Return on assets (ROA) is a key financial metric that measures a company's ability to generate profit from its total assets, indicating operational efficiency. It is calculated by dividing net income by average total assets, providing insight into how effectively management is utilizing resources to produce earnings. Discover how understanding your ROA can help improve business performance by exploring the details in the rest of the article.

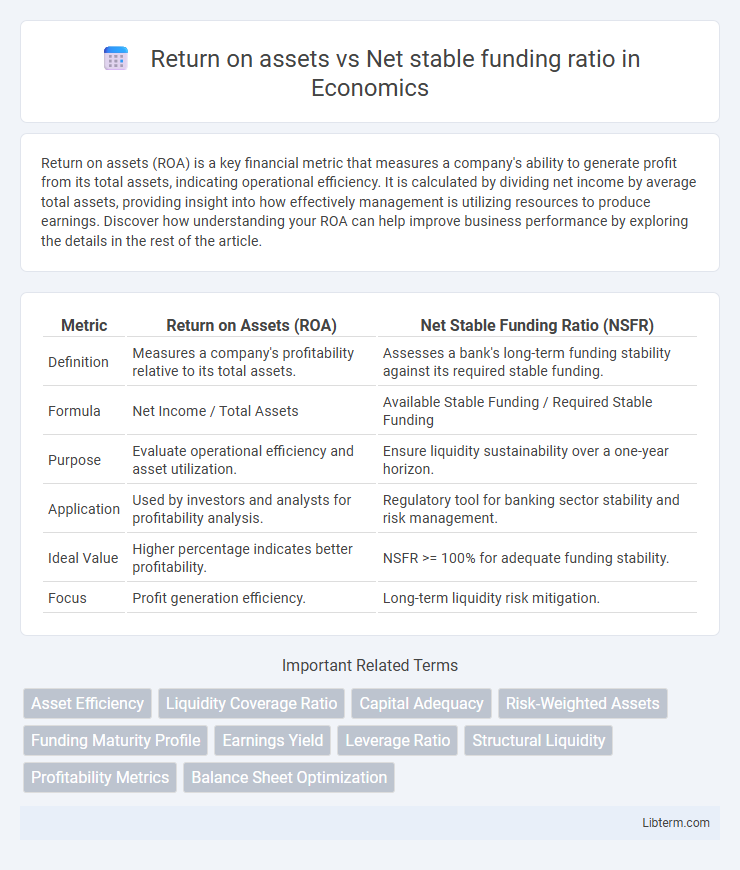

Table of Comparison

| Metric | Return on Assets (ROA) | Net Stable Funding Ratio (NSFR) |

|---|---|---|

| Definition | Measures a company's profitability relative to its total assets. | Assesses a bank's long-term funding stability against its required stable funding. |

| Formula | Net Income / Total Assets | Available Stable Funding / Required Stable Funding |

| Purpose | Evaluate operational efficiency and asset utilization. | Ensure liquidity sustainability over a one-year horizon. |

| Application | Used by investors and analysts for profitability analysis. | Regulatory tool for banking sector stability and risk management. |

| Ideal Value | Higher percentage indicates better profitability. | NSFR >= 100% for adequate funding stability. |

| Focus | Profit generation efficiency. | Long-term liquidity risk mitigation. |

Introduction to Return on Assets (ROA) and Net Stable Funding Ratio (NSFR)

Return on Assets (ROA) measures a company's profitability by indicating how efficiently its assets generate net income, expressed as a percentage. The Net Stable Funding Ratio (NSFR) is a liquidity standard used by banks to ensure long-term stability by comparing available stable funding to required stable funding over a one-year horizon. Both ROA and NSFR are critical financial metrics, with ROA assessing asset efficiency and NSFR evaluating funding structure resilience.

Defining Return on Assets (ROA)

Return on Assets (ROA) measures a company's profitability relative to its total assets by calculating net income divided by average total assets, indicating how efficiently management uses assets to generate earnings. It is a key financial ratio used for assessing operational performance and asset utilization in industries ranging from banking to manufacturing. Unlike the Net Stable Funding Ratio (NSFR), which evaluates funding stability and liquidity risks over a one-year horizon, ROA focuses exclusively on profitability and asset efficiency.

Understanding Net Stable Funding Ratio (NSFR)

The Net Stable Funding Ratio (NSFR) measures a bank's ability to fund its activities with stable sources over a one-year horizon, ensuring long-term liquidity resilience. Unlike Return on Assets (ROA), which evaluates profitability by relating net income to total assets, NSFR focuses on matching available stable funding with the required stable funding for assets and off-balance sheet exposures. Understanding NSFR is critical for assessing a bank's liquidity risk and regulatory compliance under Basel III standards.

Key Differences Between ROA and NSFR

Return on Assets (ROA) measures a bank's profitability by indicating how efficiently it uses its assets to generate earnings, expressed as a percentage of net income over total assets. In contrast, the Net Stable Funding Ratio (NSFR) assesses liquidity risk by ensuring that long-term assets are funded with stable liabilities, calculated as the ratio of Available Stable Funding to Required Stable Funding over a one-year period. The key difference lies in ROA focusing on profitability and asset efficiency, whereas NSFR emphasizes funding stability and liquidity management within regulatory frameworks.

Importance of ROA in Financial Performance Analysis

Return on Assets (ROA) is a critical metric in financial performance analysis as it measures a company's ability to efficiently utilize its assets to generate profits, providing insights into operational effectiveness and asset management. Unlike the Net Stable Funding Ratio (NSFR), which primarily assesses liquidity and funding stability in banking institutions, ROA directly reflects profitability and overall business efficiency across industries. Investors and analysts prioritize ROA to evaluate management's effectiveness in leveraging assets to maximize returns and drive sustainable growth.

Significance of NSFR in Banking Stability

Net Stable Funding Ratio (NSFR) is a crucial regulatory metric ensuring banks maintain a stable funding profile relative to their assets, mitigating liquidity risk and promoting long-term financial stability. Return on Assets (ROA) measures profitability by indicating how efficiently a bank utilizes its assets to generate earnings, but it does not address liquidity or funding stability. The significance of NSFR lies in its ability to complement profitability metrics like ROA by safeguarding banks against short-term funding mismatches, thereby enhancing overall banking sector resilience.

Impact of ROA and NSFR on Risk Management

Return on assets (ROA) directly measures a bank's profitability relative to its assets, providing insight into asset efficiency and potential credit risk exposure. The net stable funding ratio (NSFR) assesses the stability of a bank's funding sources, promoting long-term liquidity resilience and reducing funding risk. Together, ROA and NSFR influence risk management by balancing profitability targets against liquidity stability, ensuring sustainable financial performance under regulatory frameworks like Basel III.

How ROA and NSFR Influence Strategic Decision-Making

Return on Assets (ROA) quantifies a firm's profitability by measuring net income relative to total assets, guiding strategic decisions on asset utilization and investment efficiency. The Net Stable Funding Ratio (NSFR) assesses a bank's long-term liquidity stability, influencing funding strategies and risk management priorities. Together, ROA and NSFR impact strategic decision-making by balancing profitability goals with regulatory liquidity requirements, ensuring sustainable financial performance and resilience.

Regulatory Requirements for ROA and NSFR

Return on assets (ROA) measures a company's profitability relative to its total assets, primarily governed by accounting standards and internal financial performance metrics rather than direct regulatory mandates. The Net Stable Funding Ratio (NSFR) is a critical regulatory requirement introduced by Basel III to ensure banks maintain a stable funding profile relative to their assets over a one-year horizon, promoting long-term resilience. Regulatory frameworks emphasize maintaining NSFR above 100% to mitigate liquidity risks, whereas ROA is monitored for efficiency and profitability but not directly regulated by capital adequacy or liquidity standards.

Conclusion: Balancing Profitability and Stability

Return on Assets (ROA) measures a firm's profitability by indicating how efficiently assets generate earnings, while the Net Stable Funding Ratio (NSFR) assesses long-term liquidity and financial stability by ensuring available stable funding covers asset maturities. Balancing ROA and NSFR enables institutions to maintain robust profitability without compromising financial resilience, mitigating risks associated with excessive leverage or illiquid asset structures. Optimal financial management integrates these metrics to achieve sustainable growth and regulatory compliance.

Return on assets Infographic

libterm.com

libterm.com