Emerging markets offer vast opportunities for growth due to rapid industrialization, increasing consumer bases, and evolving regulatory environments. These economies often present higher returns but come with increased risks such as political instability and currency fluctuations. Explore the article to understand how your investments can benefit from the potential of emerging markets.

Table of Comparison

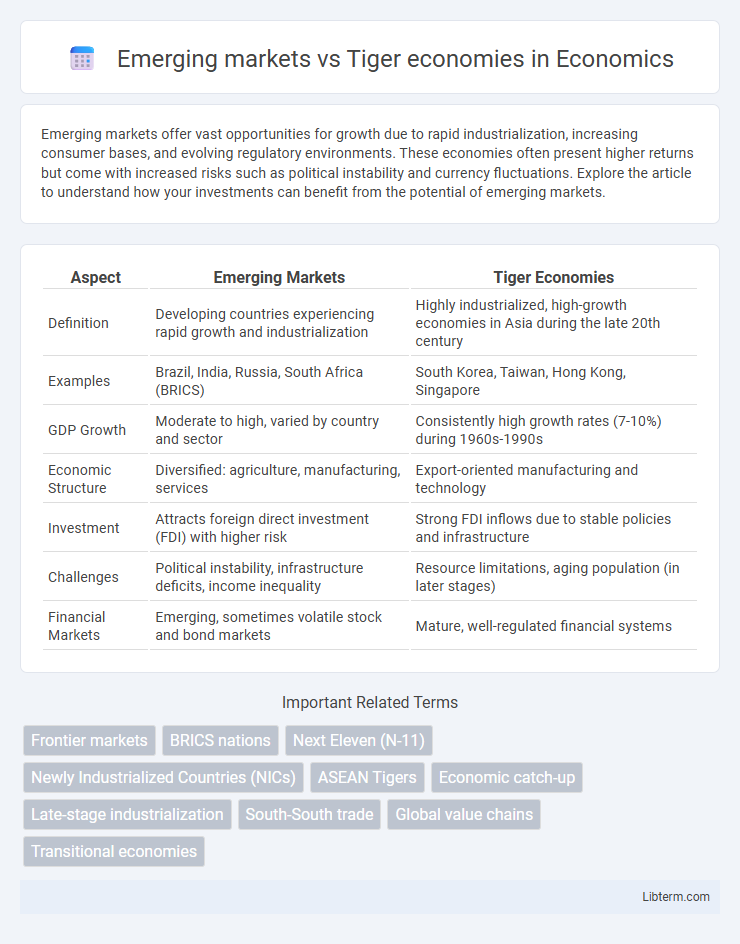

| Aspect | Emerging Markets | Tiger Economies |

|---|---|---|

| Definition | Developing countries experiencing rapid growth and industrialization | Highly industrialized, high-growth economies in Asia during the late 20th century |

| Examples | Brazil, India, Russia, South Africa (BRICS) | South Korea, Taiwan, Hong Kong, Singapore |

| GDP Growth | Moderate to high, varied by country and sector | Consistently high growth rates (7-10%) during 1960s-1990s |

| Economic Structure | Diversified: agriculture, manufacturing, services | Export-oriented manufacturing and technology |

| Investment | Attracts foreign direct investment (FDI) with higher risk | Strong FDI inflows due to stable policies and infrastructure |

| Challenges | Political instability, infrastructure deficits, income inequality | Resource limitations, aging population (in later stages) |

| Financial Markets | Emerging, sometimes volatile stock and bond markets | Mature, well-regulated financial systems |

Introduction to Emerging Markets and Tiger Economies

Emerging markets are nations experiencing rapid industrialization and economic growth, characterized by expanding middle classes and increasing foreign investment. Tiger economies, a subset of emerging markets primarily in Asia, such as South Korea, Taiwan, Hong Kong, and Singapore, demonstrate exceptionally fast growth rates driven by export-oriented industrialization and high savings rates. Understanding these distinctions aids investors in evaluating risk and growth potential in dynamic global markets.

Defining Emerging Markets

Emerging markets are nations experiencing rapid economic growth and industrialization, characterized by increasing GDP, improving infrastructure, and expanding middle-class populations. These markets often feature volatile financial systems but present significant investment opportunities due to untapped consumer bases and natural resources. Tiger economies, such as South Korea, Taiwan, Hong Kong, and Singapore, represent a subset of emerging markets distinguished by their exceptional growth rates, export-driven strategies, and advanced technological development during their rapid development phases.

Understanding Tiger Economies

Tiger economies, primarily Hong Kong, Singapore, South Korea, and Taiwan, are characterized by rapid industrialization, high growth rates, and export-driven economic models during the late 20th century. These economies leveraged strong government policies, investment in education, and technological innovation to transition from low-income to high-income status within a few decades. Understanding tiger economies involves analyzing their strategic focus on manufacturing, global trade integration, and infrastructure development that differentiated them from broader emerging markets.

Key Characteristics: Emerging Markets vs Tiger Economies

Emerging markets are characterized by rapid industrialization, improving infrastructure, and growing consumer bases with moderate risk and volatility. Tiger economies, often found in East Asia, exhibit exceptionally high growth rates, advanced industrialization, export-driven markets, and strong government policies fostering economic stability and innovation. Key distinctions include tiger economies' superior GDP growth, higher foreign direct investment inflows, and more developed financial systems compared to broader emerging markets.

Historical Development and Economic Growth

Emerging markets, characterized by rapid industrialization and increasing integration into the global economy, have shown variable growth patterns influenced by diverse political and economic reforms since the late 20th century. Tiger economies, specifically the original Four Tigers--Hong Kong, Singapore, South Korea, and Taiwan--achieved extraordinary economic growth from the 1960s to the 1990s through export-oriented industrialization, high savings rates, and investments in human capital. Their historical development showcases a model of sustained GDP growth, technological advancement, and rising living standards that many emerging markets aspire to replicate.

Investment Opportunities and Risks

Emerging markets such as Brazil, India, and South Africa offer vast investment opportunities due to rapid economic growth, expanding middle classes, and abundant natural resources, but face risks from political instability, currency volatility, and regulatory challenges. Tiger economies like South Korea, Singapore, Hong Kong, and Taiwan demonstrate more mature economic structures with advanced infrastructure, stable governance, and strong export-oriented industries, presenting comparatively lower investment risks alongside opportunities in technology, manufacturing, and finance. Investors must balance potential high returns in emerging markets against greater uncertainties, while tiger economies provide more predictable growth environments with stable institutional frameworks.

Trade Patterns and Global Integration

Emerging markets exhibit diverse trade patterns characterized by increased exports of raw materials and manufactured goods, driven by expanding domestic industries and regional trade agreements. Tiger economies, such as South Korea, Taiwan, Singapore, and Hong Kong, demonstrate advanced global integration with high export-to-GDP ratios, emphasizing technology-intensive and high-value-added products in global supply chains. These differences underscore how tiger economies leverage sophisticated trade networks and innovation-focused exports to achieve rapid industrialization and global economic influence.

Government Policies and Economic Reforms

Emerging markets often implement broad government policies aimed at liberalizing trade, encouraging foreign investment, and improving infrastructure, leading to moderate yet widespread economic growth. Tiger economies, such as South Korea and Singapore, have historically pursued aggressive economic reforms including export-driven industrialization, rigorous education systems, and significant state-led investments in technology and innovation. These targeted policies foster rapid industrialization, higher productivity, and accelerated economic development compared to typical emerging market trajectories.

Case Studies: Notable Examples

Emerging markets such as Brazil and South Africa demonstrate rapid industrial growth and increasing integration into global trade, driven by abundant natural resources and expanding middle classes. Tiger economies including South Korea, Taiwan, Hong Kong, and Singapore showcase strategic export-led growth, high investment in education, and technological innovation leading to sustained high GDP growth rates. Case studies reveal that while emerging markets benefit from commodity booms and demographic dividends, tiger economies excel through institutional reforms and targeted economic policies fostering competitiveness.

Future Outlook: Challenges and Prospects

Emerging markets face challenges such as political instability, infrastructure deficits, and fluctuating commodity prices that can hinder sustained growth, but they also benefit from expanding middle classes and rapid urbanization driving demand. Tiger economies, known for high growth rates and export-driven industrialization, must navigate pressures from rising labor costs and technological disruption while leveraging innovation and regional trade agreements to maintain competitiveness. The future outlook depends on adaptive economic policies, investment in human capital, and integration into global value chains to sustain long-term development and resilience.

Emerging markets Infographic

libterm.com

libterm.com