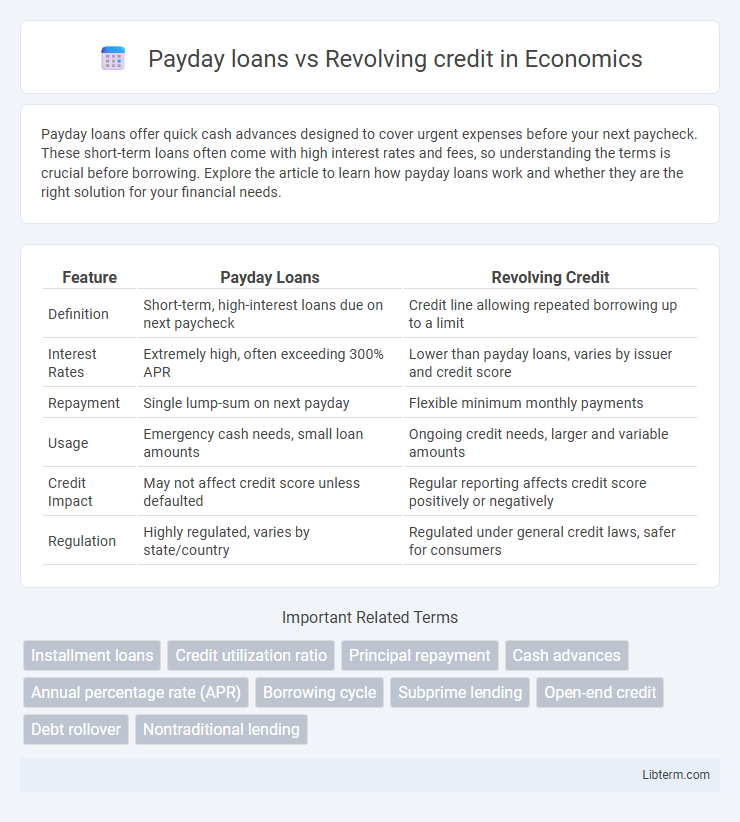

Payday loans offer quick cash advances designed to cover urgent expenses before your next paycheck. These short-term loans often come with high interest rates and fees, so understanding the terms is crucial before borrowing. Explore the article to learn how payday loans work and whether they are the right solution for your financial needs.

Table of Comparison

| Feature | Payday Loans | Revolving Credit |

|---|---|---|

| Definition | Short-term, high-interest loans due on next paycheck | Credit line allowing repeated borrowing up to a limit |

| Interest Rates | Extremely high, often exceeding 300% APR | Lower than payday loans, varies by issuer and credit score |

| Repayment | Single lump-sum on next payday | Flexible minimum monthly payments |

| Usage | Emergency cash needs, small loan amounts | Ongoing credit needs, larger and variable amounts |

| Credit Impact | May not affect credit score unless defaulted | Regular reporting affects credit score positively or negatively |

| Regulation | Highly regulated, varies by state/country | Regulated under general credit laws, safer for consumers |

Introduction to Payday Loans and Revolving Credit

Payday loans are short-term, high-interest loans designed to be repaid by the borrower's next paycheck, often used to cover immediate financial emergencies. Revolving credit, such as credit cards or lines of credit, provides ongoing access to funds up to a set limit, allowing borrowers to carry balances and make minimum payments over time. Both financial products offer quick access to cash but differ significantly in terms of interest rates, repayment flexibility, and risk factors.

Key Differences Between Payday Loans and Revolving Credit

Payday loans are short-term, high-interest loans designed for immediate cash needs, typically requiring repayment on the borrower's next payday, while revolving credit provides a flexible borrowing limit that can be used and repaid repeatedly over time. Payday loans often carry significantly higher annual percentage rates (APRs) and pose a greater risk of debt cycles due to their stringent repayment terms, whereas revolving credit offers lower interest rates and more manageable repayment options. Unlike payday loans that focus on rapid, one-time borrowing, revolving credit supports ongoing credit access with periodic minimum payments and interest applied only to outstanding balances.

How Payday Loans Work

Payday loans provide short-term, high-interest cash advances typically due on the borrower's next payday, relying on proof of income and a postdated check or electronic access to the borrower's bank account for repayment. These loans often have fixed fees that translate into extremely high annual percentage rates (APRs), making them costly forms of credit compared to revolving credit options like credit cards, which offer ongoing access to a credit line with variable APRs. The borrower's ability to repay the full amount quickly is critical, as failure to do so usually results in rollovers or additional fees increasing the debt burden.

How Revolving Credit Works

Revolving credit provides a flexible borrowing option where individuals can access a predetermined credit limit, repay the borrowed amount, and borrow again without reapplying. Interest accrues only on the outstanding balance, making it cost-efficient for managing ongoing expenses. Common examples include credit cards and lines of credit, which differ from payday loans that require lump-sum repayment by the next paycheck.

Qualification Requirements for Each Option

Payday loans require minimal qualification, often including proof of income, a valid ID, and an active checking account, making them accessible to borrowers with poor credit. Revolving credit, such as credit cards or lines of credit, requires a credit check and typically higher credit scores, demonstrating repayment capability and financial stability. Lenders assess debt-to-income ratios and credit history for revolving credit approval, while payday loans prioritize immediate cash flow over creditworthiness.

Interest Rates and Fees Comparison

Payday loans typically feature extremely high interest rates, often exceeding 300% APR, along with upfront fees that can significantly increase the total repayment amount. Revolving credit, such as credit cards and lines of credit, usually offers lower interest rates, averaging between 10% and 25% APR, and charges fees based on usage patterns, including annual fees or balance transfer fees. The cost disparity makes revolving credit a more cost-effective borrowing option over payday loans, which can lead to debt cycles due to their predatory pricing structures.

Repayment Terms and Flexibility

Payday loans typically require full repayment on the borrower's next payday, often within two to four weeks, offering little flexibility and higher risk of rollover fees. Revolving credit, such as credit cards or lines of credit, allows borrowers to carry balances with minimum monthly payments and flexible repayment schedules, adapting to individual financial situations. The contrast in repayment terms and flexibility makes revolving credit more manageable for long-term financial planning, while payday loans serve immediate short-term cash needs despite higher costs.

Impact on Credit Score

Payday loans typically have a negative impact on credit scores because they are often not reported to credit bureaus, yet failure to repay can result in collections that harm credit standing. Revolving credit, such as credit cards, affects credit scores through credit utilization and payment history, with timely payments and low balances improving credit ratings. Responsible management of revolving credit boosts credit scores, while mismanagement of payday loans can lead to significant credit damage.

Pros and Cons: Payday Loans vs Revolving Credit

Payday loans offer quick access to cash with minimal qualification requirements but come with extremely high interest rates and fees, leading to potential debt cycles. Revolving credit, such as credit cards, provides flexible borrowing with variable interest rates and credit limits, promoting better debt management if payments are made timely. However, mismanagement of revolving credit can result in accumulating interest and credit score damage, while payday loans pose a higher risk of financial strain due to their short repayment periods.

Choosing the Best Option for Your Financial Situation

Payday loans offer quick cash for urgent expenses but come with high interest rates and short repayment terms, often leading to debt cycles. Revolving credit, such as credit cards or lines of credit, provides flexible borrowing with variable interest rates and the ability to carry balances over time. Choosing the best option depends on your repayment ability, interest tolerance, and long-term financial goals, making revolving credit generally more sustainable for managing ongoing expenses.

Payday loans Infographic

libterm.com

libterm.com