Idiosyncratic risk refers to the uncertainty inherent in a specific asset or company, independent of market-wide factors. This type of risk can be mitigated through diversification, as it affects only individual investments rather than the entire portfolio. Explore the rest of the article to understand how managing idiosyncratic risk can protect your investments.

Table of Comparison

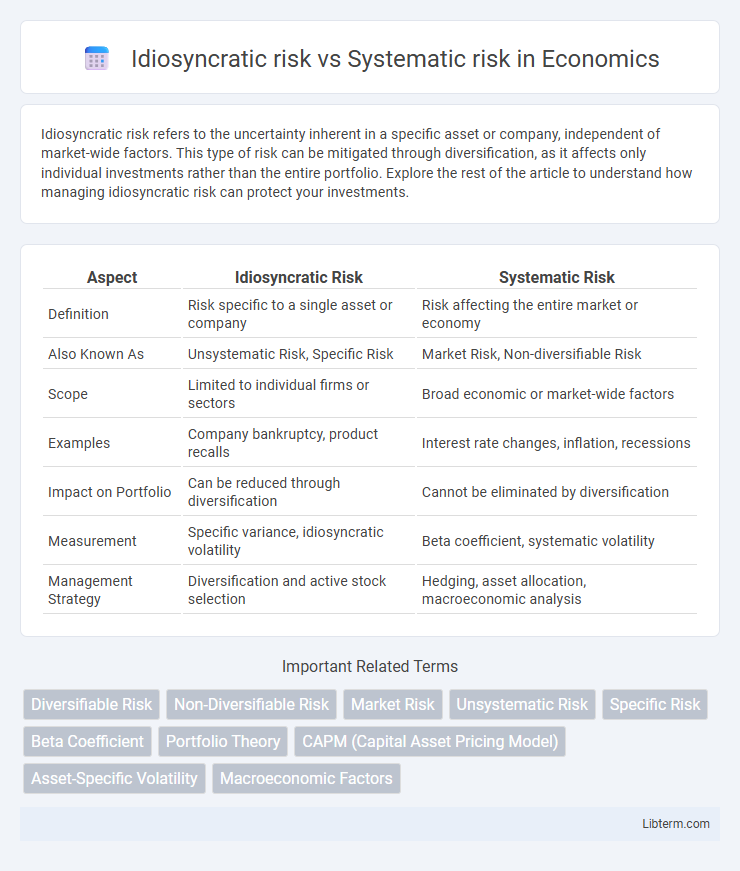

| Aspect | Idiosyncratic Risk | Systematic Risk |

|---|---|---|

| Definition | Risk specific to a single asset or company | Risk affecting the entire market or economy |

| Also Known As | Unsystematic Risk, Specific Risk | Market Risk, Non-diversifiable Risk |

| Scope | Limited to individual firms or sectors | Broad economic or market-wide factors |

| Examples | Company bankruptcy, product recalls | Interest rate changes, inflation, recessions |

| Impact on Portfolio | Can be reduced through diversification | Cannot be eliminated by diversification |

| Measurement | Specific variance, idiosyncratic volatility | Beta coefficient, systematic volatility |

| Management Strategy | Diversification and active stock selection | Hedging, asset allocation, macroeconomic analysis |

Introduction to Financial Risk

Idiosyncratic risk refers to the uncertainty inherent to a specific company or industry, affecting individual assets without impacting the entire market. Systematic risk encompasses broader economic, political, or social factors that influence the overall financial market and cannot be eliminated through diversification. Understanding these two types of financial risk is essential for portfolio management and risk mitigation strategies.

Defining Idiosyncratic Risk

Idiosyncratic risk refers to the unique, asset-specific risk that impacts a particular company or industry but does not affect the entire market. It arises from factors such as management decisions, product recalls, or regulatory changes specific to the firm. Unlike systematic risk, which encompasses broader market fluctuations, idiosyncratic risk can be mitigated through diversification in an investment portfolio.

Understanding Systematic Risk

Systematic risk refers to the inherent uncertainty affecting the entire market or a broad segment of it, driven by macroeconomic factors like interest rates, inflation, and geopolitical events. Unlike idiosyncratic risk, which impacts individual companies or industries, systematic risk cannot be eliminated through diversification. Investors assess systematic risk using metrics such as beta to gauge a security's sensitivity to market movements and to construct portfolios that align with their risk tolerance and return objectives.

Key Differences Between Idiosyncratic and Systematic Risk

Idiosyncratic risk refers to the potential loss unique to a specific asset or company, often mitigated through diversification, while systematic risk impacts entire markets or economic sectors and cannot be eliminated by diversification. Key differences include the source of risk: idiosyncratic arises from individual firm factors such as management decisions or product failures, whereas systematic risk stems from macroeconomic factors like interest rates, inflation, or geopolitical events. Understanding these distinctions guides investors in portfolio construction to balance diversifiable and non-diversifiable risks effectively.

Sources of Idiosyncratic Risk

Idiosyncratic risk arises from factors intrinsic to a specific company or industry, such as management decisions, product recalls, labor strikes, or regulatory changes impacting that entity uniquely. Unlike systematic risk, which affects the entire market or economy due to macroeconomic factors like interest rate shifts or geopolitical events, idiosyncratic risk stems from company-specific operational, financial, or competitive challenges. This risk can be mitigated through portfolio diversification by spreading investments across uncorrelated assets.

Drivers of Systematic Risk

Systematic risk is driven by macroeconomic factors such as interest rate fluctuations, inflation rates, geopolitical events, and changes in fiscal or monetary policy that affect the entire market. Market-wide phenomena like recessions, political instability, and natural disasters also contribute to systematic risk by impacting broad investor sentiment and economic stability. Unlike idiosyncratic risk, which is specific to individual companies or industries, systematic risk cannot be diversified away through asset allocation.

Impact on Investment Portfolios

Idiosyncratic risk, specific to individual assets or companies, can be mitigated through diversification by spreading investments across a variety of securities, thus reducing its impact on a portfolio. Systematic risk, also known as market risk, affects the entire market or economy and cannot be eliminated through diversification, influencing overall portfolio returns during economic downturns or market volatility. Understanding the distinction between these risks helps investors optimize portfolio construction, balancing asset allocation to manage exposure and achieve desired risk-adjusted returns.

Risk Management Strategies

Idiosyncratic risk, specific to individual assets or companies, can be mitigated through diversification strategies that spread exposure across various investments, reducing the impact of any single asset's volatility. Systematic risk, linked to broader economic or market factors, requires hedging techniques such as options, futures, or portfolio asset allocation adjustments to manage market-wide fluctuations. Effective risk management combines diversification for idiosyncratic risk with strategic hedging to protect against systematic risk, optimizing overall portfolio resilience.

Real-World Examples

Idiosyncratic risk refers to company-specific events such as Tesla's CEO Elon Musk's public statements causing stock price volatility, while systematic risk involves market-wide factors like the 2008 financial crisis impacting nearly all investments. For example, a pharmaceutical firm's drug trial failure (idiosyncratic) affects only its shares, whereas geopolitical tensions or interest rate hikes (systematic) influence the broader market. Investors diversify portfolios to mitigate idiosyncratic risk but cannot eliminate systematic risk, which affects overall market performance.

Conclusion and Takeaways

Idiosyncratic risk refers to asset-specific uncertainties that can be mitigated through diversification, while systematic risk encompasses market-wide factors that affect all investments and cannot be eliminated by diversification. Investors should focus on managing idiosyncratic risk through portfolio diversification and accept systematic risk as inherent market volatility requiring risk-adjusted returns. Understanding the distinct impacts of these risks is crucial for optimal asset allocation and informed financial decision-making.

Idiosyncratic risk Infographic

libterm.com

libterm.com