Cross-border investment allows you to diversify your portfolio by allocating assets across different countries, reducing risks associated with a single economy. Understanding currency fluctuations, political stability, and regulatory environments is crucial for optimizing returns in international markets. Explore the full article to discover strategies for successful global investing and enhancing your financial growth.

Table of Comparison

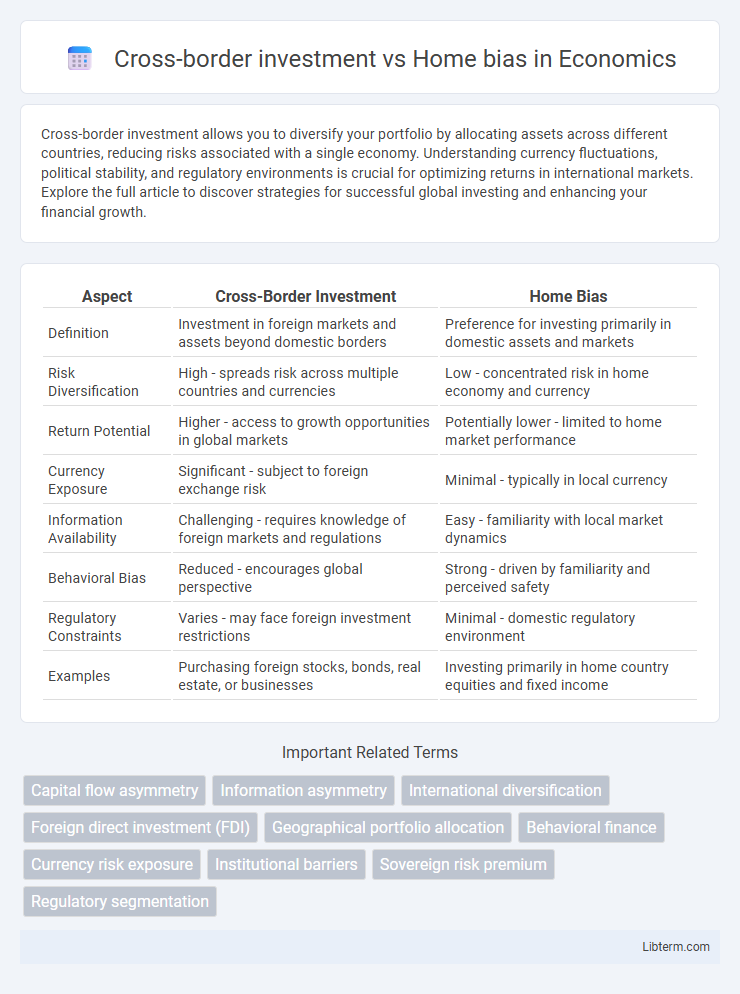

| Aspect | Cross-Border Investment | Home Bias |

|---|---|---|

| Definition | Investment in foreign markets and assets beyond domestic borders | Preference for investing primarily in domestic assets and markets |

| Risk Diversification | High - spreads risk across multiple countries and currencies | Low - concentrated risk in home economy and currency |

| Return Potential | Higher - access to growth opportunities in global markets | Potentially lower - limited to home market performance |

| Currency Exposure | Significant - subject to foreign exchange risk | Minimal - typically in local currency |

| Information Availability | Challenging - requires knowledge of foreign markets and regulations | Easy - familiarity with local market dynamics |

| Behavioral Bias | Reduced - encourages global perspective | Strong - driven by familiarity and perceived safety |

| Regulatory Constraints | Varies - may face foreign investment restrictions | Minimal - domestic regulatory environment |

| Examples | Purchasing foreign stocks, bonds, real estate, or businesses | Investing primarily in home country equities and fixed income |

Introduction to Cross-Border Investment

Cross-border investment involves allocating capital in foreign markets to diversify portfolios and seek higher returns beyond domestic boundaries. Investors encounter varying regulatory environments, currency risks, and market dynamics, which distinguish these opportunities from home bias preferences. Understanding global economic trends and geopolitical factors is crucial for optimizing cross-border investment strategies.

Understanding Home Bias in Investments

Home bias in investments refers to the tendency of investors to allocate a disproportionately large share of their portfolios to domestic assets, often ignoring potentially higher returns and diversification benefits offered by foreign markets. Research shows that despite globalization and easier access to international markets, investors still hold 60-80% of their portfolios in domestic equities, revealing a strong preference driven by familiarity, perceived lower risk, and information asymmetry. Understanding this bias is crucial for investors aiming to optimize portfolio performance through strategic cross-border investments that mitigate home bias and enhance global diversification.

Key Drivers of Cross-Border Investment

Cross-border investment is primarily driven by factors such as market diversification, higher returns, and risk reduction compared to home bias, where investors prefer domestic assets due to familiarity and perceived lower information costs. Economic globalization and technological advancements facilitate access to international markets, increasing the appeal of foreign investments. Regulatory environments, trade agreements, and currency stability also play critical roles in influencing cross-border capital flows.

Causes and Implications of Home Bias

Home bias in investment arises from factors such as information asymmetry, perceived currency risk, and familiarity with domestic markets, leading investors to prefer local assets over foreign ones. This preference restricts portfolio diversification, potentially increasing risk and reducing returns compared to more globally diversified investments. As a result, home bias can lead to suboptimal capital allocation and limit exposure to growth opportunities available in international markets.

Risk and Return: Global Diversification vs. Domestic Focus

Cross-border investment offers enhanced risk diversification by spreading assets across multiple countries, reducing exposure to domestic economic downturns and political risks. Home bias concentrates portfolios in domestic markets, potentially increasing vulnerability to localized market shocks but benefiting from familiarity and lower transaction costs. Global diversification typically yields higher risk-adjusted returns due to exposure to broader growth opportunities and currency diversification, whereas domestic focus may limit return potential but simplifies risk assessment and management.

Barriers to International Investing

Cross-border investment faces significant barriers such as currency risk, regulatory differences, and political instability that contribute to investors' home bias, favoring domestic assets despite lower diversification benefits. Information asymmetry and higher transaction costs in foreign markets limit international portfolio diversification and reinforce preference for familiar markets. Studies indicate home bias persists due to these constraints, impacting global capital allocation efficiency and portfolio risk optimization.

Benefits of Overcoming Home Bias

Overcoming home bias in cross-border investment enhances portfolio diversification by reducing country-specific risks and increasing exposure to high-growth markets. It enables investors to capitalize on global opportunities, improving potential returns through access to a broader range of asset classes and industries. Furthermore, global investment strategies can lead to better risk-adjusted performance by mitigating the impact of domestic economic downturns.

Trends in Global vs. Domestic Portfolio Allocation

Global portfolio allocation has increased significantly as investors seek diversification beyond home markets, reducing the home bias effect traditionally favoring domestic assets. Cross-border investment trends reveal growing capital flows into emerging markets and international equities, driven by globalization and improved access to foreign markets. Despite this shift, many investors still exhibit home bias, allocating a disproportionate share to local securities, influenced by familiarity, regulatory advantages, and currency considerations.

Policy and Regulatory Influences on Investment Decisions

Policy and regulatory frameworks significantly impact cross-border investment by shaping risk perceptions and compliance costs for investors. Home bias often persists due to investors' preference for familiar legal systems and tax regimes that reduce uncertainty and facilitate portfolio management. Regulatory incentives such as tax treaties, investor protections, and capital controls can either encourage or restrict the flow of capital across borders, influencing the balance between domestic and international asset allocation.

Strategies for Balancing Cross-Border and Home Investments

Investors can balance cross-border and home investments by diversifying portfolios to mitigate country-specific risks while capitalizing on global growth opportunities. Employing a strategy that allocates a core portion to domestic assets with stable returns, combined with targeted international investments in emerging markets, enhances risk-adjusted returns. Utilizing geographic allocation models and periodic portfolio rebalancing helps maintain optimal exposure consistent with evolving economic conditions and investor risk tolerance.

Cross-border investment Infographic

libterm.com

libterm.com