Keynesian Economics focuses on total spending in the economy and its effects on output and inflation, advocating for active government intervention through fiscal policy to stabilize economic fluctuations. This theory emphasizes the role of government spending and taxation to influence demand, aiming to reduce unemployment and promote growth during recessions. Explore the rest of this article to understand how Keynesian principles can impact Your financial decisions and economic policies.

Table of Comparison

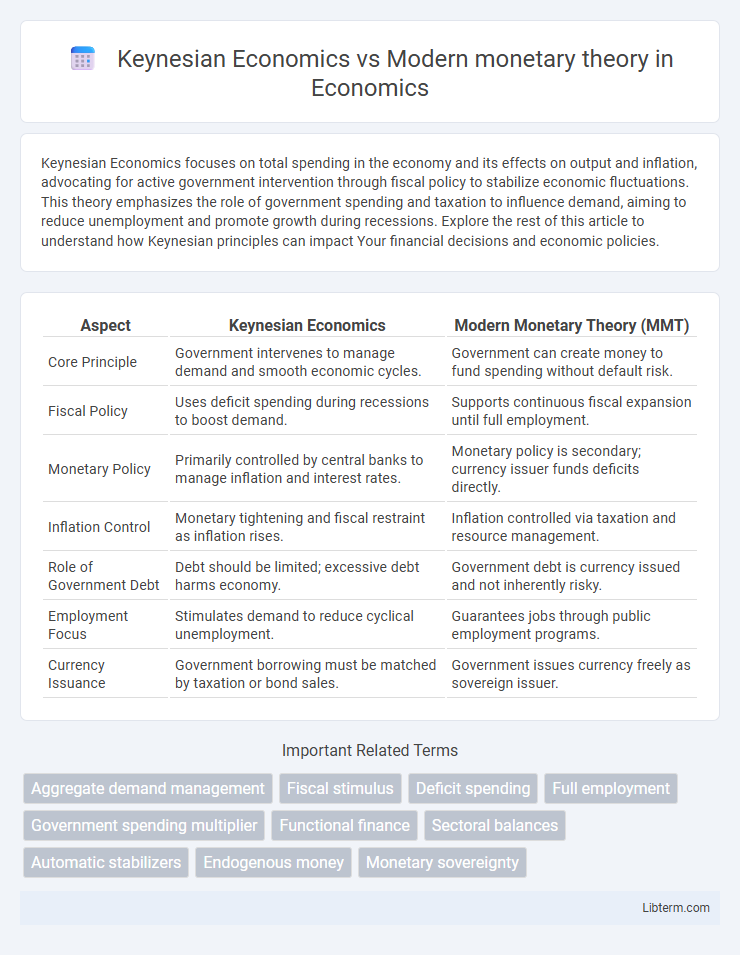

| Aspect | Keynesian Economics | Modern Monetary Theory (MMT) |

|---|---|---|

| Core Principle | Government intervenes to manage demand and smooth economic cycles. | Government can create money to fund spending without default risk. |

| Fiscal Policy | Uses deficit spending during recessions to boost demand. | Supports continuous fiscal expansion until full employment. |

| Monetary Policy | Primarily controlled by central banks to manage inflation and interest rates. | Monetary policy is secondary; currency issuer funds deficits directly. |

| Inflation Control | Monetary tightening and fiscal restraint as inflation rises. | Inflation controlled via taxation and resource management. |

| Role of Government Debt | Debt should be limited; excessive debt harms economy. | Government debt is currency issued and not inherently risky. |

| Employment Focus | Stimulates demand to reduce cyclical unemployment. | Guarantees jobs through public employment programs. |

| Currency Issuance | Government borrowing must be matched by taxation or bond sales. | Government issues currency freely as sovereign issuer. |

Overview of Keynesian Economics

Keynesian Economics emphasizes government intervention to manage economic cycles, advocating increased public spending and lower taxes during recessions to boost demand. Developed by John Maynard Keynes during the 1930s Great Depression, it challenges classical economics' belief in self-correcting markets. This framework supports fiscal policies aimed at reducing unemployment and stabilizing output through active government roles.

Fundamentals of Modern Monetary Theory

Modern Monetary Theory (MMT) asserts that sovereign governments controlling their own currency can create money to finance public spending without the risk of default, emphasizing the role of fiscal policy over monetary policy. MMT challenges traditional Keynesian Economics by arguing that inflation, rather than budget deficits, is the primary constraint on government spending. It highlights the importance of government taxing to control inflation and manage aggregate demand, rather than relying solely on interest rate adjustments.

Historical Context and Emergence

Keynesian economics emerged during the Great Depression in the 1930s, emphasizing government intervention to manage economic cycles and demand shortfalls. Modern Monetary Theory (MMT) gained prominence in the early 21st century, particularly after the 2008 financial crisis, advocating for sovereign currency issuance to finance public spending without traditional budget constraints. Both theories respond to economic crises but differ in historical context, with Keynesianism rooted in supply-demand stabilization and MMT focusing on monetary sovereignty and fiscal capacity.

Government Spending and Fiscal Policy

Keynesian economics advocates for increased government spending and fiscal stimulus during economic downturns to boost aggregate demand and reduce unemployment. Modern Monetary Theory (MMT) emphasizes that sovereign currency-issuing governments can finance deficit spending without the need for immediate tax increases, focusing on resource availability and inflation control rather than balanced budgets. Both frameworks support active fiscal policy, but MMT allows for larger and sustained government deficits as a tool for achieving full employment and economic stability.

Role of Central Banks and Monetary Policy

Keynesian economics emphasizes central banks' role in managing economic cycles through interest rate adjustments and monetary expansion to stimulate demand during recessions. Modern Monetary Theory (MMT) views central banks as facilitators of government spending, focusing less on interest rate manipulation and more on coordinating with fiscal policy to ensure full employment and price stability. While Keynesian policy relies on monetary tools for demand management, MMT prioritizes direct government spending supported by central banks' capacity to create money without the constraint of traditional debt limits.

Unemployment and Economic Stability

Keynesian Economics emphasizes government intervention through fiscal policy to reduce unemployment and stabilize economic fluctuations by managing aggregate demand. Modern Monetary Theory (MMT) argues that sovereign currency-issuing governments can sustain higher public spending without default risk, prioritizing full employment by using job guarantee programs to achieve economic stability. Both frameworks seek to minimize unemployment, but MMT uniquely highlights the role of monetary sovereignty in enabling continuous fiscal support for stable growth.

Inflation Control Mechanisms

Keynesian economics controls inflation primarily through fiscal policies that adjust government spending and taxation to influence aggregate demand, aiming to avoid excessive demand-pull inflation. Modern Monetary Theory (MMT) emphasizes the role of sovereign currency issuance and proposes inflation control through strategic taxation and resource management rather than limiting government spending. Both frameworks recognize inflation as a key concern but differ on how budget deficits and monetary sovereignty impact inflationary pressures.

Public Debt: Threat or Tool?

Keynesian economics views public debt as a manageable tool to stimulate economic growth during downturns, emphasizing government borrowing to fund deficit spending and boost aggregate demand. Modern Monetary Theory (MMT) argues that sovereign currency issuers can sustain higher public debt levels without default risk, prioritizing resource utilization and inflation control over traditional debt constraints. Both frameworks recognize public debt's role in fiscal policy but diverge on its limits and implications for long-term economic stability.

Criticisms and Debates

Keynesian economics faces criticism for its reliance on government intervention and fiscal stimulus, which some argue can lead to inefficiencies and increased public debt without guaranteeing sustained economic growth. Modern Monetary Theory (MMT) is debated for its assertion that sovereign currency issuers can finance deficits without inflation risks, a claim contested by mainstream economists who warn of potential hyperinflation and loss of investor confidence. Both theories spark ongoing debates regarding inflation control, fiscal responsibility, and the realistic limits of government spending in managing economic cycles.

Practical Applications in Today’s Economy

Keynesian Economics advocates for active government intervention through fiscal policies such as deficit spending and public works to stimulate aggregate demand during economic downturns, proven effective during recessions like the 2008 financial crisis. Modern Monetary Theory (MMT) emphasizes that sovereign currency-issuing governments can finance substantial public expenditures without immediate tax increases, prioritizing inflation control over balanced budgets, influencing policy debates on universal healthcare and green infrastructure funding. Both frameworks offer practical tools for addressing unemployment and economic stagnation, with Keynesian models emphasizing counter-cyclical spending and MMT encouraging direct monetary expansion while monitoring inflationary pressures.

Keynesian Economics Infographic

libterm.com

libterm.com