The average tax rate reflects the portion of your total income paid in taxes, calculated by dividing total taxes by total income. It provides a clearer picture of your overall tax burden compared to marginal tax rates, helping you understand how much of your earnings go to taxes on average. Explore the rest of this article to learn how the average tax rate impacts your financial planning and tax strategy.

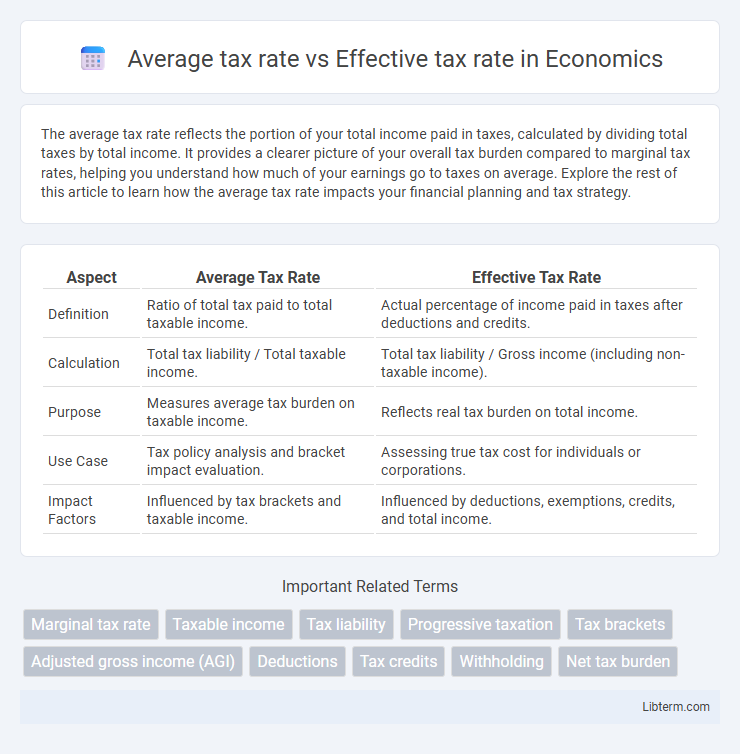

Table of Comparison

| Aspect | Average Tax Rate | Effective Tax Rate |

|---|---|---|

| Definition | Ratio of total tax paid to total taxable income. | Actual percentage of income paid in taxes after deductions and credits. |

| Calculation | Total tax liability / Total taxable income. | Total tax liability / Gross income (including non-taxable income). |

| Purpose | Measures average tax burden on taxable income. | Reflects real tax burden on total income. |

| Use Case | Tax policy analysis and bracket impact evaluation. | Assessing true tax cost for individuals or corporations. |

| Impact Factors | Influenced by tax brackets and taxable income. | Influenced by deductions, exemptions, credits, and total income. |

Understanding Average Tax Rate

The average tax rate is calculated by dividing total taxes paid by total taxable income, providing a clear percentage that reflects the overall tax burden on earnings. This rate helps taxpayers understand how much of their income is paid in taxes on average across all income brackets. Unlike the effective tax rate, which considers tax credits and deductions, the average tax rate focuses solely on the relationship between total tax liabilities and gross income.

Defining Effective Tax Rate

Effective tax rate is the percentage of total income paid in taxes after accounting for deductions, credits, and exemptions, reflecting the actual tax burden on individuals or corporations. Unlike the average tax rate, which divides total tax paid by total income, the effective tax rate provides a more accurate measure of tax liability relative to income earned. This rate is crucial for assessing real tax impact and comparing tax efficiency across different taxpayers or jurisdictions.

Key Differences Between Average and Effective Tax Rates

The average tax rate is calculated by dividing total taxes paid by total income, reflecting the overall percentage of income paid in taxes, while the effective tax rate considers the impact of deductions, credits, and varying tax brackets to show the actual tax burden on taxable income. Key differences include that the average tax rate provides a simplified, broad overview of tax liability, whereas the effective tax rate offers a more precise measure of the taxpayer's real tax cost after adjustments. Understanding these distinctions is crucial for accurate financial planning and tax strategy optimization.

Calculating the Average Tax Rate

Calculating the average tax rate involves dividing the total taxes paid by the total taxable income, providing a straightforward measure of the overall tax burden as a percentage of income. The average tax rate differs from the effective tax rate, which accounts for all income sources and deductions, reflecting the real rate paid after adjustments. Understanding how to compute the average tax rate is essential for evaluating tax policies and comparing tax liabilities across income levels.

How to Determine Effective Tax Rate

The effective tax rate is determined by dividing the total tax paid by the total taxable income, providing a comprehensive measure of the actual tax burden on an individual or business. Unlike the average tax rate, which calculates tax liability based only on marginal tax brackets, the effective tax rate accounts for deductions, credits, and other tax benefits that reduce taxable income. This calculation offers a more accurate representation of real tax obligations across varied income sources and tax situations.

Real-World Examples of Tax Rate Calculations

The average tax rate represents the total taxes paid divided by total income, providing a broad measure used in countries like the United States where a progressive tax system applies income brackets with increasing rates. The effective tax rate, often lower than the average rate, accounts for deductions, credits, and other tax benefits, reflecting the actual proportion of income paid in taxes; for instance, corporations like Apple report effective tax rates around 15% despite nominal rates near 21%. Real-world examples such as individual taxpayers with incomes distributed across multiple tax brackets and multinational companies utilizing tax credits showcase the practical differences between average and effective tax rates in tax liability calculations.

Impact on Individual and Corporate Tax Planning

Understanding the difference between average tax rate and effective tax rate is crucial for individual and corporate tax planning as the average tax rate calculates the overall percentage of income paid in taxes, while the effective tax rate reflects the actual percentage after deductions, credits, and exemptions. For individuals, optimizing deductions and credits can lower the effective tax rate, influencing decisions on income management and investment strategies. Corporations analyze effective tax rates to develop strategies for minimizing tax liabilities and maximizing after-tax profits, impacting decisions on capital expenditures and jurisdictional tax planning.

Common Misconceptions About Tax Rates

The average tax rate is often confused with the effective tax rate, but the average tax rate calculates the total taxes paid divided by total income, while the effective tax rate accounts for all applicable deductions and credits, reflecting the actual tax burden. A common misconception is that the average tax rate represents the rate applied to all income, whereas it is actually a simple ratio and may not represent marginal tax rates affecting additional income. Understanding the distinction helps taxpayers better evaluate their true tax liabilities and avoid overestimating their tax burdens based on averages alone.

Importance in Financial Decision-Making

The average tax rate, calculated as total taxes paid divided by total income, provides a broad overview of tax burden, while the effective tax rate reflects the true tax impact considering deductions and credits. Understanding these rates is crucial in financial decision-making as they influence budgeting, investment strategies, and cash flow management. Accurate assessment of effective tax rates ensures better forecasting of after-tax returns and helps optimize tax planning to enhance financial outcomes.

Choosing the Right Tax Rate Metric for Analysis

Choosing the right tax rate metric for analysis depends on the purpose and scope of the study, with the average tax rate reflecting total tax paid divided by total income and the effective tax rate measuring tax liability relative to taxable income after deductions. Analysts prioritize the effective tax rate when evaluating real tax burdens across different income levels or corporate profits, as it accounts for tax credits and incentives that lower tax liabilities. For policy comparisons and fiscal impact assessments, the average tax rate provides a more generalized view of tax obligations relative to gross earnings, essential for understanding overall taxation burden.

Average tax rate Infographic

libterm.com

libterm.com