Anchoring bias occurs when individuals rely too heavily on the first piece of information encountered, skewing subsequent judgments and decisions. This cognitive shortcut can impact your ability to make objective assessments by unduly influencing your perception of value, probability, or outcomes. Discover how understanding and overcoming anchoring bias can enhance your decision-making process in the rest of this article.

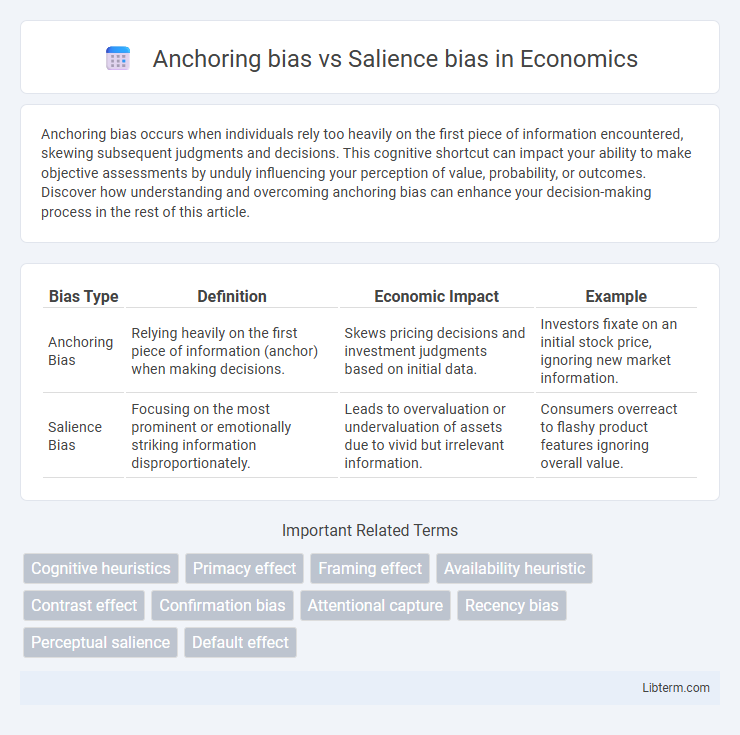

Table of Comparison

| Bias Type | Definition | Economic Impact | Example |

|---|---|---|---|

| Anchoring Bias | Relying heavily on the first piece of information (anchor) when making decisions. | Skews pricing decisions and investment judgments based on initial data. | Investors fixate on an initial stock price, ignoring new market information. |

| Salience Bias | Focusing on the most prominent or emotionally striking information disproportionately. | Leads to overvaluation or undervaluation of assets due to vivid but irrelevant information. | Consumers overreact to flashy product features ignoring overall value. |

Understanding Anchoring Bias

Anchoring bias occurs when individuals rely heavily on the first piece of information they encounter, known as the anchor, to make subsequent judgments or decisions. This cognitive bias impacts various fields such as finance, marketing, and negotiations, where initial data disproportionately influences outcomes despite the presence of additional relevant information. Understanding anchoring bias helps in developing strategies to mitigate its effects by encouraging consideration of multiple reference points and more flexible thinking.

Defining Salience Bias

Salience bias occurs when individuals focus disproportionately on the most prominent or emotionally striking information, overlooking other relevant details. Unlike anchoring bias, which relies heavily on an initial piece of information to make decisions, salience bias is driven by the vividness or standout features of specific data. This cognitive bias can lead to distorted judgment, as attention skews towards what is most noticeable rather than what is most important.

Key Differences Between Anchoring and Salience Bias

Anchoring bias occurs when individuals rely too heavily on an initial piece of information (the "anchor") when making decisions, causing subsequent judgments to be biased toward that anchor. Salience bias, however, influences decisions based on information that stands out or is most prominent, often ignoring less noticeable but relevant data. The key difference lies in anchoring bias being tied to initial information fixation, while salience bias depends on the striking or vivid nature of information that captures attention.

How Anchoring Bias Influences Decision-Making

Anchoring bias influences decision-making by causing individuals to rely heavily on the initial piece of information (the "anchor") when making subsequent judgments, often ignoring contradictory evidence. This cognitive bias skews objectivity and can lead to systematic errors in estimating value, risk, or probabilities. Unlike salience bias, which focuses attention on the most noticeable or emotionally striking information, anchoring bias fixes decision-making on arbitrary reference points, significantly affecting outcomes in negotiations, pricing, and forecasting.

The Impact of Salience Bias on Perception

Salience bias significantly alters perception by causing individuals to focus disproportionately on striking or memorable features of information while ignoring less obvious but equally important data. This cognitive distortion leads to overestimating the importance of vivid events, often resulting in skewed judgments and decision-making errors. Understanding salience bias is crucial for improving accuracy in areas such as marketing, risk assessment, and media consumption.

Anchoring Bias in Real-Life Scenarios

Anchoring bias occurs when individuals rely heavily on the first piece of information encountered when making decisions, which can skew judgments even in critical real-life scenarios such as financial negotiations or medical diagnoses. For example, an initial price offer in a car sale often sets a psychological reference point, causing buyers to perceive subsequent prices relative to that anchor rather than the item's true value. This cognitive bias can lead to suboptimal choices by limiting objective evaluation and reinforcing early impressions despite contradictory evidence.

Salience Bias Examples and Applications

Salience bias occurs when individuals focus disproportionately on the most noticeable or emotionally striking information, leading to skewed judgments and decisions. For example, in marketing, advertisers use vivid colors and compelling images to make products stand out, exploiting salience bias to capture consumer attention and drive purchases. In finance, investors may overemphasize recent or prominent news events, such as a company's high-profile scandal, resulting in irrational stock market behaviors influenced by salience bias.

Psychological Mechanisms Behind Anchoring Bias

Anchoring bias occurs when individuals rely heavily on an initial piece of information, or "anchor," influencing their subsequent judgments and decisions. This bias stems from cognitive mechanisms such as insufficient adjustment from the anchor and selective accessibility, where the anchor activates related information in memory, shaping perception. Unlike salience bias, which focuses attention on prominent or emotionally striking stimuli, anchoring bias is primarily driven by the subconscious weight assigned to the initial reference point during decision-making.

Reducing Anchoring and Salience Bias in Judgments

Reducing anchoring bias involves actively seeking diverse perspectives and considering alternative reference points to prevent reliance on initial information. To mitigate salience bias, emphasize evaluating less obvious but relevant data by broadening attention beyond prominent or emotionally striking details. Implementing structured decision-making processes and critical thinking techniques enhances objectivity by minimizing the influence of these cognitive biases on judgments.

Implications for Business and Everyday Choices

Anchoring bias leads decision-makers to rely heavily on initial information, causing skewed pricing strategies and flawed budget forecasts in business. Salience bias causes individuals to overemphasize prominent or recent events, impacting marketing effectiveness and risk assessment in everyday choices. Recognizing these biases helps companies optimize product positioning and improve consumer decision-making by presenting balanced, relevant data.

Anchoring bias Infographic

libterm.com

libterm.com