Inter-temporal trade involves exchanging goods, services, or resources across different time periods to optimize consumption and investment decisions. This concept allows consumers and firms to shift resources from the present to the future or vice versa, balancing immediate needs with long-term benefits. Explore the full article to understand how inter-temporal trade impacts economic growth and personal financial planning.

Table of Comparison

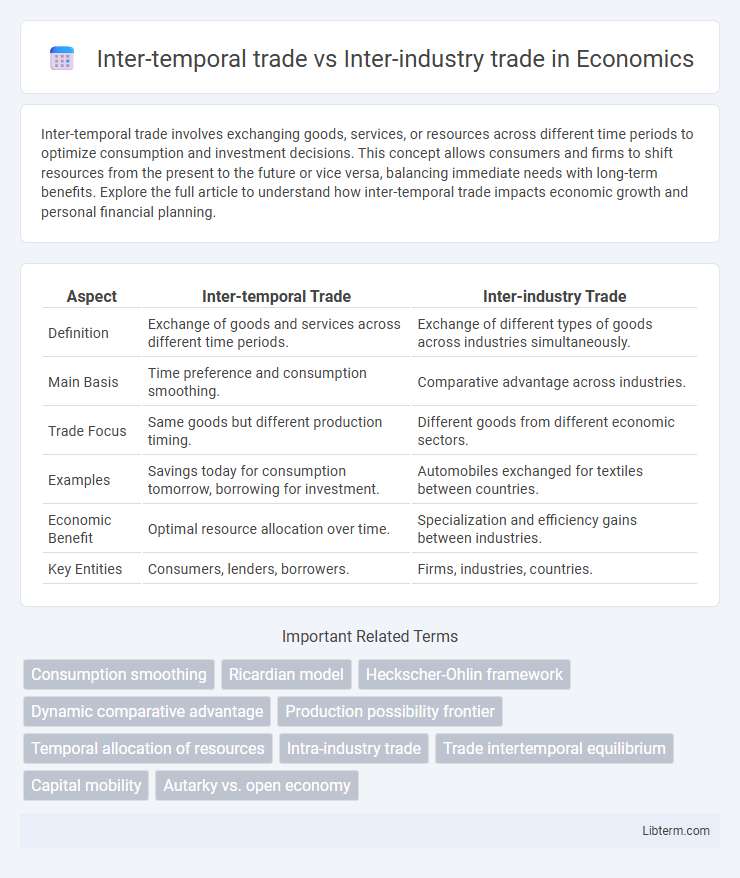

| Aspect | Inter-temporal Trade | Inter-industry Trade |

|---|---|---|

| Definition | Exchange of goods and services across different time periods. | Exchange of different types of goods across industries simultaneously. |

| Main Basis | Time preference and consumption smoothing. | Comparative advantage across industries. |

| Trade Focus | Same goods but different production timing. | Different goods from different economic sectors. |

| Examples | Savings today for consumption tomorrow, borrowing for investment. | Automobiles exchanged for textiles between countries. |

| Economic Benefit | Optimal resource allocation over time. | Specialization and efficiency gains between industries. |

| Key Entities | Consumers, lenders, borrowers. | Firms, industries, countries. |

Introduction to Inter-temporal and Inter-industry Trade

Inter-temporal trade involves exchanging goods or services across different time periods, allowing countries to optimize resource allocation by shifting consumption or production between the present and future. Inter-industry trade, on the other hand, occurs between countries specializing in different industries or sectors, driven by comparative advantage and differing factor endowments. Understanding these trade types clarifies how temporal shifts and industry specialization each influence international trade patterns and economic growth.

Defining Inter-temporal Trade

Inter-temporal trade refers to the exchange of goods and services across different time periods, allowing countries to specialize in producing certain products when it is most efficient or resource-advantageous. This type of trade enables nations to transfer consumption and production over time, optimizing resource use despite temporal constraints. Unlike inter-industry trade, which involves trading different types of goods simultaneously, inter-temporal trade emphasizes the timing and scheduling of production and consumption.

Understanding Inter-industry Trade

Inter-industry trade involves the exchange of different goods between countries, reflecting comparative advantages based on resource endowments or technological differences. This trade type typically occurs between countries at different stages of economic development, where one specializes in agriculture or raw materials, while the other produces manufactured goods. Understanding inter-industry trade highlights how international specialization promotes global efficiency and economic growth by leveraging distinct sectoral strengths.

Key Theoretical Frameworks

Inter-temporal trade theory emphasizes the role of time and capital accumulation in shaping comparative advantage, focusing on consumption smoothing and investment across different periods. Inter-industry trade theory, rooted in classical Ricardian and Heckscher-Ohlin models, explains trade patterns based on differences in factor endowments and technology across industries. Key frameworks include the Life-Cycle/Permanent Income Hypothesis for inter-temporal trade and the Factor Proportions Theory for inter-industry trade, highlighting distinct mechanisms driving trade flows.

Major Differences Between the Two Trade Types

Inter-temporal trade involves exchanging goods or services across different time periods, typically to take advantage of varying production capabilities or consumption needs over time, whereas inter-industry trade encompasses the exchange of different types of goods between countries, reflecting their comparative advantages in distinct industries. Inter-temporal trade often relates to savings and investment decisions influencing future consumption, while inter-industry trade is driven by differences in factor endowments and technology between countries. The major difference lies in the temporal aspect of inter-temporal trade versus the sectoral or industrial focus of inter-industry trade.

Economic Implications of Inter-temporal Trade

Inter-temporal trade allows economies to optimize consumption and production by trading goods across different time periods, leading to improved resource allocation and enhanced welfare through smoothing consumption patterns. Unlike inter-industry trade, which focuses on exchanging different types of goods simultaneously, inter-temporal trade significantly impacts savings, investment rates, and capital accumulation by altering temporal preferences and interest rates. This dynamic trade form influences economic growth by enabling countries to leverage comparative advantages over time and mitigate short-term shocks.

Economic Impacts of Inter-industry Trade

Inter-industry trade involves the exchange of different goods between industries, enhancing economic specialization and efficiency by allowing countries to exploit comparative advantages in distinct sectors such as manufacturing and agriculture. This type of trade stimulates economic growth by promoting industrial diversification, technological innovation, and employment generation across various industries. The expansion of inter-industry trade leads to improved resource allocation, higher productivity, and increased consumer welfare through a broader variety of goods and competitive pricing.

Real-world Examples and Case Studies

Inter-temporal trade involves countries exchanging goods or services across different time periods to optimize resource use, as seen in the energy sector where nations trade electricity based on peak demand times, exemplified by the U.S.-Canada power grid cooperation. Inter-industry trade occurs when countries specialize in different industries and exchange distinct products, such as Germany exporting automobiles to the United States while importing agricultural products in return. Case studies like the North American Free Trade Agreement (NAFTA) illustrate inter-industry trade with Mexico exporting manufactured goods and the U.S. exporting technology-intensive products, highlighting specialization benefits.

Policy Considerations and Trade Strategies

Inter-temporal trade emphasizes the benefits of shifting consumption and production over time, requiring policies that support savings, investment, and stable interest rates to optimize future resource allocation. Inter-industry trade involves exchanging different goods across sectors, necessitating strategic trade policies that foster comparative advantage, sector-specific subsidies, and tariff adjustments to enhance competitive positioning. Effective trade strategies balance these approaches by integrating dynamic temporal planning with industry-specific support to maximize long-term economic growth and trade diversification.

Conclusion: Comparative Insights and Future Trends

Inter-temporal trade leverages time-based comparative advantages by optimizing resource allocation across different periods, while inter-industry trade relies on industry-specific comparative advantages rooted in diverse factor endowments. Future trends suggest increasing integration of digital technologies and supply chain innovations will enhance the efficiency and scope of both trade types, promoting global economic resilience. Understanding the dynamic interplay between temporal factors and industry specialization remains crucial for policymakers aiming to maximize trade benefits in evolving markets.

Inter-temporal trade Infographic

libterm.com

libterm.com