A market economy relies on supply and demand to allocate resources efficiently, encouraging competition and innovation. Prices are determined by how much consumers are willing to pay and how much producers are willing to supply, fostering economic growth and consumer choice. Discover how understanding market economy dynamics can benefit Your financial decisions in the rest of this article.

Table of Comparison

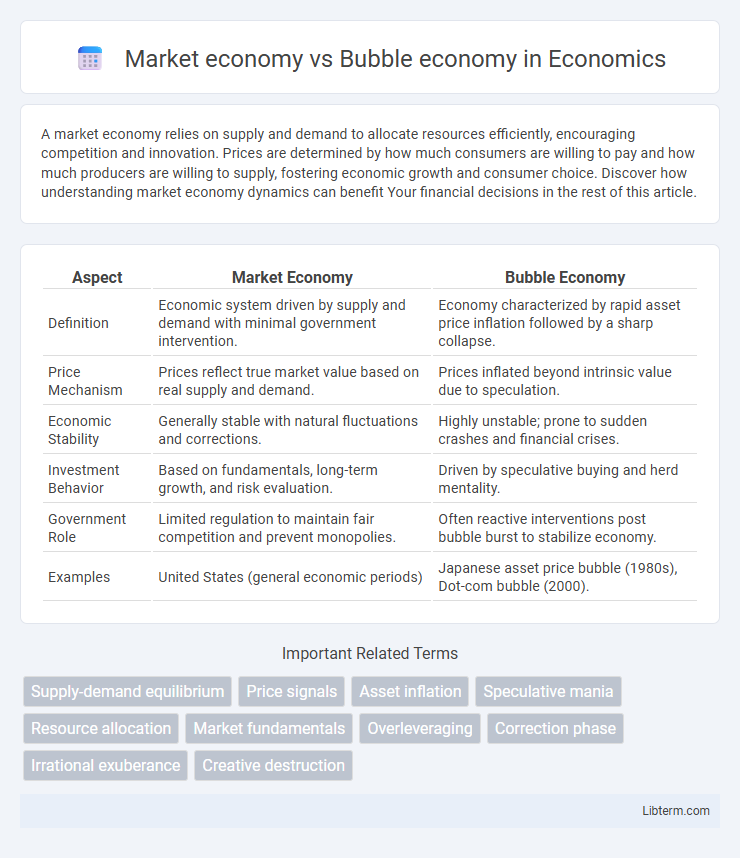

| Aspect | Market Economy | Bubble Economy |

|---|---|---|

| Definition | Economic system driven by supply and demand with minimal government intervention. | Economy characterized by rapid asset price inflation followed by a sharp collapse. |

| Price Mechanism | Prices reflect true market value based on real supply and demand. | Prices inflated beyond intrinsic value due to speculation. |

| Economic Stability | Generally stable with natural fluctuations and corrections. | Highly unstable; prone to sudden crashes and financial crises. |

| Investment Behavior | Based on fundamentals, long-term growth, and risk evaluation. | Driven by speculative buying and herd mentality. |

| Government Role | Limited regulation to maintain fair competition and prevent monopolies. | Often reactive interventions post bubble burst to stabilize economy. |

| Examples | United States (general economic periods) | Japanese asset price bubble (1980s), Dot-com bubble (2000). |

Introduction to Market Economy and Bubble Economy

Market economy operates through decentralized decision-making where supply and demand determine prices, production, and distribution of goods, fostering innovation and efficient resource allocation. Bubble economy occurs when asset prices inflate rapidly beyond intrinsic values due to speculative behavior, leading to market distortions and eventual crashes. Understanding the dynamics of market economy versus bubble economy highlights the importance of sustainable growth and the risks of speculative excesses.

Key Principles of a Market Economy

A market economy operates on the principles of supply and demand, private property rights, and minimal government intervention, fostering efficient allocation of resources through competitive markets. Prices in a market economy reflect real value based on consumer preferences and production costs, promoting sustainable economic growth. In contrast, a bubble economy is characterized by asset prices inflated beyond intrinsic values due to speculative behavior, risking abrupt market corrections and economic instability.

Characteristics of a Bubble Economy

A bubble economy is characterized by rapidly escalating asset prices driven by speculative investment rather than fundamental value, often leading to unsustainable market growth. Excessive credit expansion, investor overconfidence, and a disconnect between market prices and underlying economic indicators are typical features. Such economies face heightened risk of sharp market corrections when the bubble bursts, causing significant financial instability.

Historical Examples of Market Economies

Historical examples of market economies include the United States during the post-World War II era, characterized by sustained economic growth driven by supply and demand forces, private property, and competitive markets. The British Industrial Revolution also exemplifies a market economy, where technological innovation and entrepreneurship led to increased production and urbanization. In contrast, bubble economies, such as Japan's asset price bubble in the late 1980s, are marked by unsustainable price increases driven by speculation rather than fundamental market principles.

Notable Financial Bubbles in History

Notable financial bubbles in history highlight the contrast between stable market economies and volatile bubble economies, with the Tulip Mania of the 1630s demonstrating extreme speculative frenzy followed by a dramatic collapse. The South Sea Bubble in 1720 exemplified excessive investor speculation in stock markets, leading to widespread economic fallout. More recently, the Housing Bubble of the mid-2000s precipitated the global financial crisis, underscoring the dangers of over-leveraged credit and asset price inflation in bubble economies.

Causes and Triggers of Economic Bubbles

Economic bubbles arise when asset prices significantly exceed their intrinsic values, driven by speculative demand and irrational exuberance. Key causes include excessive credit expansion, low interest rates, and herd behavior that inflates valuations beyond sustainable levels. Triggers often involve shifts like tightening monetary policy, negative economic news, or changes in investor sentiment that provoke rapid sell-offs and bubble bursts.

Impacts of Market Economies on Growth and Stability

Market economies promote growth through efficient allocation of resources driven by supply, demand, and competition, enabling innovation and productivity improvements. These economies tend to achieve long-term stability by adjusting to market signals, reducing the risk of persistent imbalances and fostering sustainable development. Conversely, bubble economies experience rapid, unsustainable asset price increases that distort investment and eventually lead to sharp market corrections, undermining economic stability and growth.

Consequences of Bubble Economies: Risks and Downfalls

Bubble economies generate unsustainable asset price inflation, leading to severe market corrections and widespread financial losses. The collapse of bubble economies disrupts investor confidence, triggers liquidity crises, and undermines economic stability across sectors. Prolonged exposure to bubble-driven volatility increases systemic risk, potentially causing recessions and long-term damage to employment and capital markets.

Preventing and Managing Economic Bubbles

Effective prevention and management of economic bubbles in a market economy rely on robust regulatory frameworks and timely monetary policies to control excessive credit growth and speculative behavior. Implementing transparent financial disclosures and strengthening market surveillance help detect early warning signs, enabling preemptive intervention to stabilize asset prices. Coordination among central banks, financial institutions, and policymakers ensures resilience against bubble-induced market volatility and long-term economic disruptions.

Market Economy vs Bubble Economy: Comparative Analysis

Market economies operate on supply and demand principles, with prices determined by free competition and consumer choices, fostering sustainable economic growth. Bubble economies, driven by speculative investment and inflated asset prices, often experience rapid expansions followed by sharp contractions that destabilize markets. Comparative analysis shows market economies emphasize long-term value creation and resource allocation efficiency, whereas bubble economies prioritize short-term gains, leading to increased volatility and economic risk.

Market economy Infographic

libterm.com

libterm.com