Balance sheet mismatch occurs when a company's assets and liabilities have differing maturities or currency denominations, leading to potential liquidity risks and financial instability. Managing this mismatch is crucial for maintaining your organization's financial health and avoiding solvency issues. Explore the full article to understand strategies for identifying and mitigating balance sheet mismatches effectively.

Table of Comparison

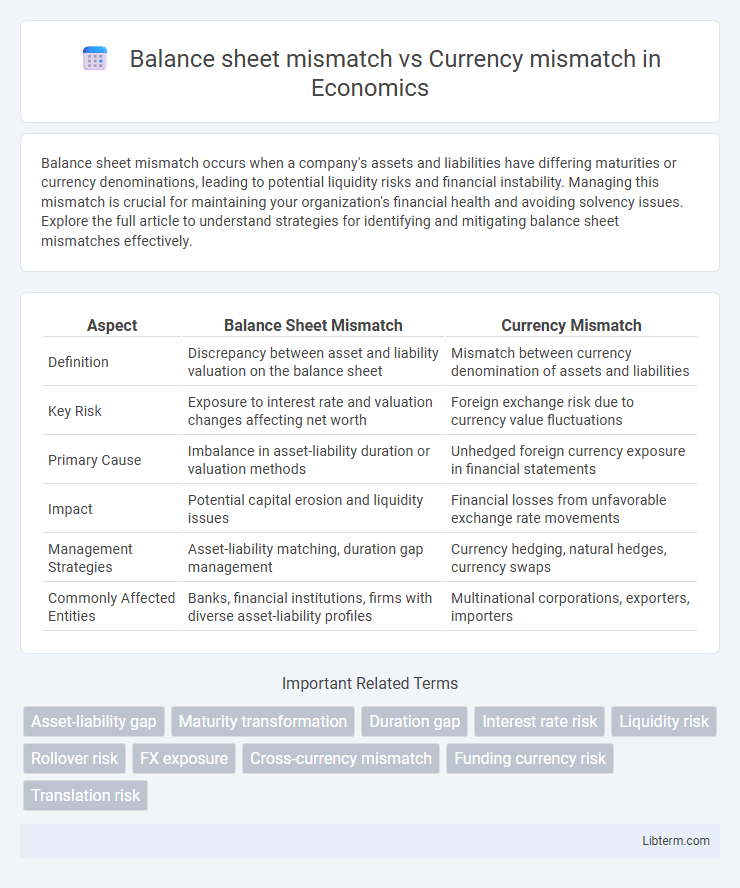

| Aspect | Balance Sheet Mismatch | Currency Mismatch |

|---|---|---|

| Definition | Discrepancy between asset and liability valuation on the balance sheet | Mismatch between currency denomination of assets and liabilities |

| Key Risk | Exposure to interest rate and valuation changes affecting net worth | Foreign exchange risk due to currency value fluctuations |

| Primary Cause | Imbalance in asset-liability duration or valuation methods | Unhedged foreign currency exposure in financial statements |

| Impact | Potential capital erosion and liquidity issues | Financial losses from unfavorable exchange rate movements |

| Management Strategies | Asset-liability matching, duration gap management | Currency hedging, natural hedges, currency swaps |

| Commonly Affected Entities | Banks, financial institutions, firms with diverse asset-liability profiles | Multinational corporations, exporters, importers |

Understanding Balance Sheet Mismatch

Balance sheet mismatch occurs when the currency composition of assets and liabilities on a company's balance sheet is not aligned, exposing the firm to exchange rate risks. Currency mismatch specifically refers to discrepancies between the currencies in which assets are held versus liabilities are owed, often resulting in potential financial losses due to currency depreciation or appreciation. Understanding balance sheet mismatch is crucial for managing foreign exchange risk and maintaining financial stability in multinational corporations and financial institutions.

Defining Currency Mismatch in Finance

Currency mismatch in finance occurs when a company's assets and liabilities are denominated in different currencies, exposing it to exchange rate risk. This imbalance can lead to valuation losses if the foreign currency depreciates against the reporting currency, impacting financial stability. Unlike balance sheet mismatch, which involves timing or nature differences between assets and liabilities, currency mismatch specifically relates to the foreign exchange exposure in the firm's financial structure.

Key Differences Between Balance Sheet and Currency Mismatch

Balance sheet mismatch occurs when a company's total assets and liabilities are unevenly distributed across different currencies, leading to financial risk due to currency fluctuations. Currency mismatch specifically refers to the situation where a company's liabilities are in a different currency than its assets or revenues, exposing it to exchange rate volatility. The key difference lies in scope: balance sheet mismatch considers the overall asset-liability structure across currencies, while currency mismatch focuses exclusively on the currency denomination discrepancy of those assets and liabilities.

Causes of Balance Sheet Mismatches

Balance sheet mismatches primarily arise from differences in the currency denomination of assets and liabilities, leading to exposure to exchange rate fluctuations. Causes include foreign currency borrowings used to finance domestic currency assets, timing gaps in asset-liability revaluation, and inadequate hedging strategies. These mismatches can amplify financial risk, especially when currency depreciation increases the local currency value of foreign-denominated liabilities without a corresponding increase in asset values.

How Currency Mismatch Occurs in Businesses

Currency mismatch in businesses occurs when assets and liabilities are denominated in different currencies, leading to exposure to exchange rate fluctuations. This typically arises when companies borrow funds in foreign currencies while generating revenues primarily in the domestic currency, causing imbalances in cash flows. Such mismatches can result in significant financial risks as currency depreciation or appreciation affects the real value of obligations and assets on the balance sheet.

Risks Associated with Balance Sheet Mismatch

Balance sheet mismatch occurs when the currency composition of a company's assets and liabilities is unaligned, leading to exposure to foreign exchange risk that can impact financial stability during currency fluctuations. Currency mismatch specifically refers to the situation where liabilities are in one currency while assets are in another, increasing the risk of insolvency if exchange rates move unfavorably. The primary risks of balance sheet mismatch include increased volatility in earnings, potential liquidity shortfalls, and heightened vulnerability to adverse macroeconomic shocks affecting currency valuations.

Implications of Currency Mismatch for Financial Stability

Currency mismatch occurs when a firm's or country's liabilities and assets are denominated in different currencies, leading to exchange rate exposure that can amplify financial risks. This mismatch undermines financial stability by increasing vulnerability to currency depreciation, causing sudden balance sheet losses and potential defaults. Such distortions can trigger systemic crises through contagion effects, highlighting the need for prudent currency risk management and regulatory oversight.

Strategies to Manage Balance Sheet Mismatches

Strategies to manage balance sheet mismatches include asset-liability matching, duration gap analysis, and dynamic hedging using derivatives such as interest rate swaps and currency forwards. Companies also employ natural hedging by aligning foreign currency revenues with liabilities in the same currency to mitigate currency risk. Regular stress testing and scenario analysis help in identifying vulnerabilities and adjusting capital structure to maintain financial stability.

Techniques to Mitigate Currency Mismatches

Techniques to mitigate currency mismatches include currency diversification, natural hedging, and the use of financial derivatives such as forwards, futures, options, and swaps to align cash flows in different currencies. Implementing currency risk management policies and regularly monitoring foreign exchange exposures help firms minimize volatility in earnings and asset values caused by currency fluctuations. Establishing multicurrency accounts and engaging in strategic currency matching of assets and liabilities further reduce the risk associated with currency mismatches.

Case Studies: Comparing Real-World Mismatches

Case studies reveal that balance sheet mismatch involves discrepancies between assets and liabilities in different categories, often affecting liquidity and solvency, while currency mismatch specifically concerns the misalignment of assets and liabilities denominated in different currencies. For instance, the Asian Financial Crisis of 1997 exemplified severe currency mismatches where firms borrowed heavily in foreign currencies but earned revenues in local currency, exacerbating financial distress. Conversely, balance sheet mismatches were prominently observed in the European debt crisis, where banks faced liquidity pressures due to mismatched maturities and asset-liability profiles, highlighting different risk origins and management challenges in real-world scenarios.

Balance sheet mismatch Infographic

libterm.com

libterm.com