Comparative advantage is an economic principle explaining how individuals or countries gain by specializing in producing goods with the lowest opportunity cost. This concept drives global trade efficiency and helps allocate resources optimally to maximize overall production. Explore the rest of this article to understand how leveraging your comparative advantage can benefit your decisions and strategies.

Table of Comparison

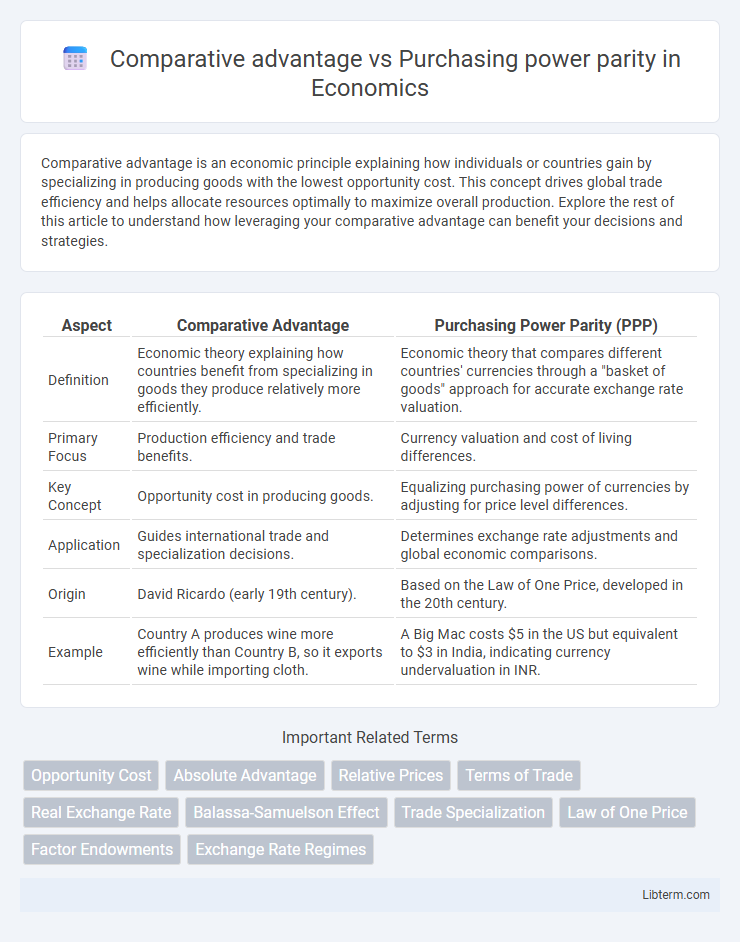

| Aspect | Comparative Advantage | Purchasing Power Parity (PPP) |

|---|---|---|

| Definition | Economic theory explaining how countries benefit from specializing in goods they produce relatively more efficiently. | Economic theory that compares different countries' currencies through a "basket of goods" approach for accurate exchange rate valuation. |

| Primary Focus | Production efficiency and trade benefits. | Currency valuation and cost of living differences. |

| Key Concept | Opportunity cost in producing goods. | Equalizing purchasing power of currencies by adjusting for price level differences. |

| Application | Guides international trade and specialization decisions. | Determines exchange rate adjustments and global economic comparisons. |

| Origin | David Ricardo (early 19th century). | Based on the Law of One Price, developed in the 20th century. |

| Example | Country A produces wine more efficiently than Country B, so it exports wine while importing cloth. | A Big Mac costs $5 in the US but equivalent to $3 in India, indicating currency undervaluation in INR. |

Understanding Comparative Advantage: Key Concepts

Comparative advantage explains how countries benefit from specializing in producing goods where they have the lowest opportunity cost, increasing overall economic efficiency and trade gains. It differs from Purchasing Power Parity (PPP), which measures currency value adjustments to equalize the purchasing power across nations. Understanding comparative advantage is essential for analyzing international trade patterns and optimal resource allocation among countries.

Defining Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" approach, ensuring that identical goods have the same price when expressed in a common currency. It serves as a method for determining the relative value of currencies, reflecting the cost of living and inflation rates across countries. PPP is crucial for making accurate international economic comparisons, adjusting exchange rates to reflect the true purchasing power rather than nominal currency values.

Historical Background of Comparative Advantage

The historical background of comparative advantage traces back to the early 19th century with economist David Ricardo's theory, which explained how countries benefit from specializing in goods where they have a lower opportunity cost. This principle became foundational in international trade, emphasizing efficiency and mutual gains even when one country holds an absolute advantage. Unlike Purchasing Power Parity, which emerged later to compare price levels across countries, comparative advantage centers on production capabilities and trade benefits.

Theoretical Foundations of PPP

The theoretical foundations of Purchasing Power Parity (PPP) stem from the Law of One Price, which asserts that identical goods should have the same price in different countries when expressed in a common currency. PPP is fundamentally grounded in the idea that exchange rates adjust to equalize the purchasing power of different currencies by offsetting price level differences. Unlike comparative advantage, which explains trade patterns based on relative productivity differences, PPP focuses on price level equalization as the primary determinant of exchange rate movements.

Comparative Advantage vs PPP: Major Differences

Comparative advantage emphasizes the efficiency of producing goods at lower opportunity costs, guiding international trade by specialization, whereas Purchasing Power Parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods across countries. Comparative advantage drives competitive exports and import patterns, while PPP provides a metric for assessing currency valuation and inflation-adjusted income levels. The fundamental difference lies in comparative advantage focusing on production efficiency and trade benefits, contrasted with PPP's focus on currency equivalence and cost of living comparisons.

How Each Theory Impacts International Trade

Comparative advantage drives international trade by encouraging countries to specialize in producing goods where they have lower opportunity costs, leading to increased efficiency and mutually beneficial exchanges. Purchasing power parity (PPP) influences trade by providing a method to compare the relative value of currencies, affecting pricing, competitiveness, and market decisions across borders. Together, these theories shape trade patterns, with comparative advantage determining production focus and PPP adjusting for real purchasing power in global markets.

Real-World Examples: Comparative Advantage in Action

Comparative advantage is demonstrated by countries like China specializing in manufacturing electronics due to lower production costs, while the United States focuses on aerospace technology where it holds expertise and innovation capacity. Purchasing power parity (PPP) adjusts exchange rates to reflect the relative value of currencies by comparing the cost of identical goods, such as the Big Mac Index, which highlights the differences in living costs and currency valuation between countries. Real-world trade patterns show that nations leverage comparative advantage to optimize production and trade efficiency, which can sometimes diverge from PPP expectations based on market dynamics and labor productivity.

Case Studies Demonstrating PPP

Case studies demonstrating Purchasing Power Parity (PPP) include comparing the cost of identical goods like the Big Mac Index across countries, revealing true currency value without exchange rate distortions. Unlike comparative advantage, which emphasizes specialization and trade benefits based on production efficiency, PPP focuses on price level equilibrium for consistent currency valuation. Empirical evidence from studies of the Eurozone and emerging markets highlights PPP's role in assessing currency misvaluations and guiding economic policy decisions.

Advantages and Limitations of Both Approaches

Comparative advantage emphasizes specialization based on relative efficiency, allowing countries to maximize total output and trade benefits, but it assumes factors like constant opportunity costs and ignores transportation costs and market imperfections. Purchasing power parity (PPP) offers a realistic measure of price level differences and living standards across countries, improving exchange rate comparisons, yet it is limited by data quality, non-tradable goods, and short-term market fluctuations. Both frameworks provide valuable insights for international trade analysis, but their assumptions and applicable contexts define their practical advantages and constraints.

Choosing the Right Framework for Economic Analysis

Comparative advantage emphasizes the efficiency of producing goods relative to other countries, guiding decisions on trade specialization to maximize overall economic gains. Purchasing power parity (PPP) focuses on the relative value of currencies by comparing the cost of identical baskets of goods across nations, providing insight into currency valuation and living standards. Selecting the right framework depends on whether the analysis aims to understand trade benefits and resource allocation (comparative advantage) or to assess currency value and international price level differences (PPP).

Comparative advantage Infographic

libterm.com

libterm.com