Classical economics focuses on how free markets, competition, and self-interest drive economic growth and resource allocation efficiently. It emphasizes long-term growth through factors like labor, capital, and production without much government intervention. Explore the article to understand how classical economics shapes modern economic policies and impacts Your financial decisions.

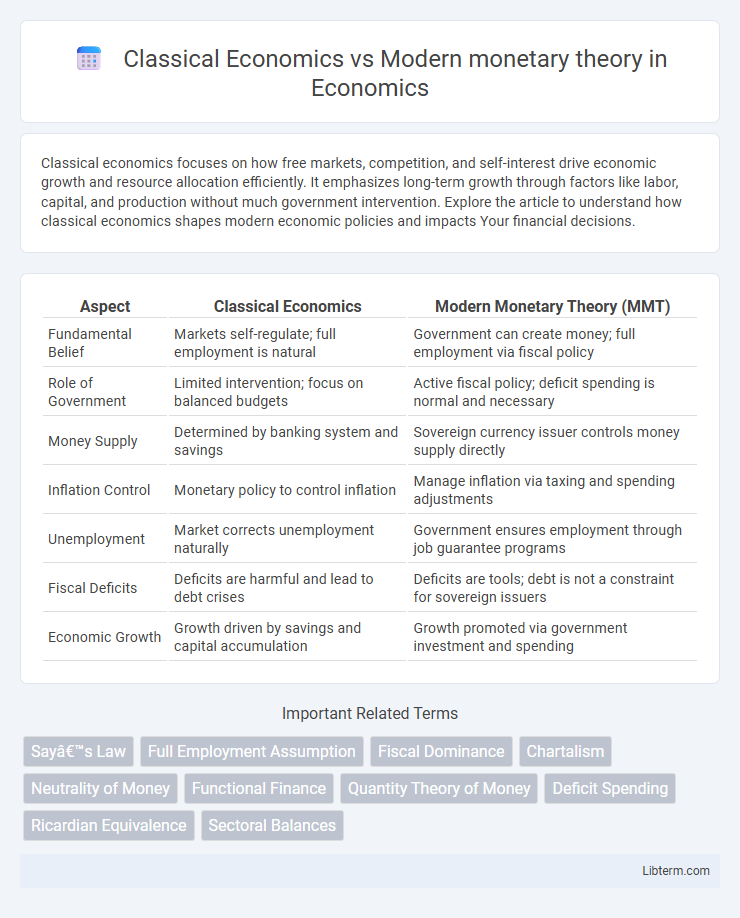

Table of Comparison

| Aspect | Classical Economics | Modern Monetary Theory (MMT) |

|---|---|---|

| Fundamental Belief | Markets self-regulate; full employment is natural | Government can create money; full employment via fiscal policy |

| Role of Government | Limited intervention; focus on balanced budgets | Active fiscal policy; deficit spending is normal and necessary |

| Money Supply | Determined by banking system and savings | Sovereign currency issuer controls money supply directly |

| Inflation Control | Monetary policy to control inflation | Manage inflation via taxing and spending adjustments |

| Unemployment | Market corrects unemployment naturally | Government ensures employment through job guarantee programs |

| Fiscal Deficits | Deficits are harmful and lead to debt crises | Deficits are tools; debt is not a constraint for sovereign issuers |

| Economic Growth | Growth driven by savings and capital accumulation | Growth promoted via government investment and spending |

Overview of Classical Economics

Classical economics, rooted in the works of Adam Smith and David Ricardo, emphasizes free markets, the invisible hand, and the self-regulating nature of the economy through supply and demand. It asserts that economies naturally achieve full employment in the long run without government intervention, relying on flexible prices and wages. Key principles include the labor theory of value and Say's Law, which states that supply creates its own demand.

Foundations of Modern Monetary Theory (MMT)

Modern Monetary Theory (MMT) is founded on the premise that sovereign currency issuers, unlike households or businesses, cannot run out of money because they create currency through spending. This framework emphasizes the role of government deficits in maintaining full employment and advocates for fiscal policy as the primary tool for economic stability, rather than monetary policy. MMT challenges traditional Classical Economics by rejecting the idea that government budgets must be balanced and by viewing inflation as the main constraint on public spending instead of the availability of revenue.

Key Differences Between Classical Economics and MMT

Classical economics emphasizes balanced budgets, limited government intervention, and the self-regulating nature of markets, while Modern Monetary Theory (MMT) argues that sovereign governments with their own currency can finance deficits without default risk and should prioritize full employment over budget balance. Classical economists advocate for monetary policy to control inflation, whereas MMT views inflation as primarily manageable through fiscal policy and resource constraints. The differing assumptions about government spending capabilities and inflation control highlight the fundamental divide between Classical Economics and MMT frameworks.

Historical Context and Evolution

Classical economics emerged in the late 18th century, emphasizing free markets, limited government intervention, and the self-regulating nature of supply and demand, with foundational figures like Adam Smith and David Ricardo shaping its principles during the Industrial Revolution. Modern Monetary Theory (MMT), developing primarily in the late 20th and early 21st centuries, challenges classical assumptions by highlighting sovereign currency issuance, fiscal policy's role in managing economic activity, and the capacity of governments to fund public spending without relying solely on taxes or borrowing. The evolution from classical economics to MMT reflects significant shifts in economic understanding driven by historical events such as the Great Depression, World War II, and subsequent financial crises that exposed limitations of classical theories in addressing unemployment and inflation.

Government Role in Economic Policy

Classical Economics advocates for limited government intervention, emphasizing free markets and the self-regulating nature of supply and demand to achieve economic equilibrium. In contrast, Modern Monetary Theory (MMT) asserts that governments with sovereign currency can and should actively use fiscal policy, including deficit spending, to manage economic stability and achieve full employment. MMT challenges traditional views by emphasizing the government's role as a currency issuer, which removes financial constraints on public spending to support economic growth.

Money Creation and Fiscal Policy Approaches

Classical economics views money creation as primarily controlled by central banks through monetary policy, emphasizing limited government intervention and fiscal discipline to maintain economic stability. Modern Monetary Theory (MMT) argues that sovereign governments with their own fiat currency can create money freely to fund fiscal policy without the risk of default, focusing on managing inflation rather than balancing budgets. Fiscal policy in classical economics prioritizes reducing deficits and debt, while MMT advocates using government spending strategically to achieve full employment and economic growth.

Inflation and Unemployment Perspectives

Classical Economics views inflation primarily as a result of excessive money supply growth and considers unemployment a temporary mismatch corrected by flexible wages and prices. Modern Monetary Theory (MMT) argues that inflation emerges when government spending surpasses real resource capacity, emphasizing that unemployment can be reduced to a buffer level by using fiscal policy to achieve full employment without necessarily triggering inflation. While Classical Economics prioritizes monetary policy to control inflation, MMT advocates for proactive fiscal policy to manage both inflation and unemployment dynamically.

Policy Implications and Real-World Applications

Classical economics emphasizes balanced budgets and limited government intervention, advocating for monetary policy focused on controlling inflation and maintaining currency stability. Modern Monetary Theory (MMT) supports active fiscal policies with expansive government spending financed by sovereign currency issuance to achieve full employment and economic growth. In real-world applications, classical policies often lead to austerity measures during downturns, while MMT-inspired approaches encourage deficit spending to stimulate demand and reduce unemployment without immediate concern for debt levels.

Criticisms and Limitations of Each Theory

Classical Economics faces criticism for its assumption of flexible prices and wages, which often fails to account for real-world market rigidities and the persistence of unemployment during economic downturns. Modern Monetary Theory (MMT) is frequently challenged for underestimating inflation risks and the potential long-term consequences of excessive government spending financed by money creation. Both theories have limitations: Classical Economics struggles with explaining demand-driven recessions, while MMT's reliance on sovereign currency control may not be applicable to countries with significant foreign debt or currency constraints.

Future Outlook: Bridging Classical and Modern Approaches

Classical economics emphasizes fiscal discipline and market self-regulation, while Modern Monetary Theory (MMT) advocates for active government spending to achieve full employment and economic stability. Future economic policies may increasingly integrate classical principles of sound money with MMT's flexible fiscal tools to address complex challenges such as inflation control and public investment. This hybrid approach aims to balance economic growth with sustainable debt management, leveraging data on government deficits and inflation expectations for informed decision-making.

Classical Economics Infographic

libterm.com

libterm.com