Clean surplus accounting ensures that all changes in equity, except those arising from transactions with shareholders, are reflected in the income statement, providing a clearer and more accurate picture of a company's financial performance. This method adjusts the traditional accounting approach by excluding unrealized gains and losses from equity calculations, which improves the comparability of financial statements. Explore the full article to understand how clean surplus accounting can enhance your financial analysis and decision-making.

Table of Comparison

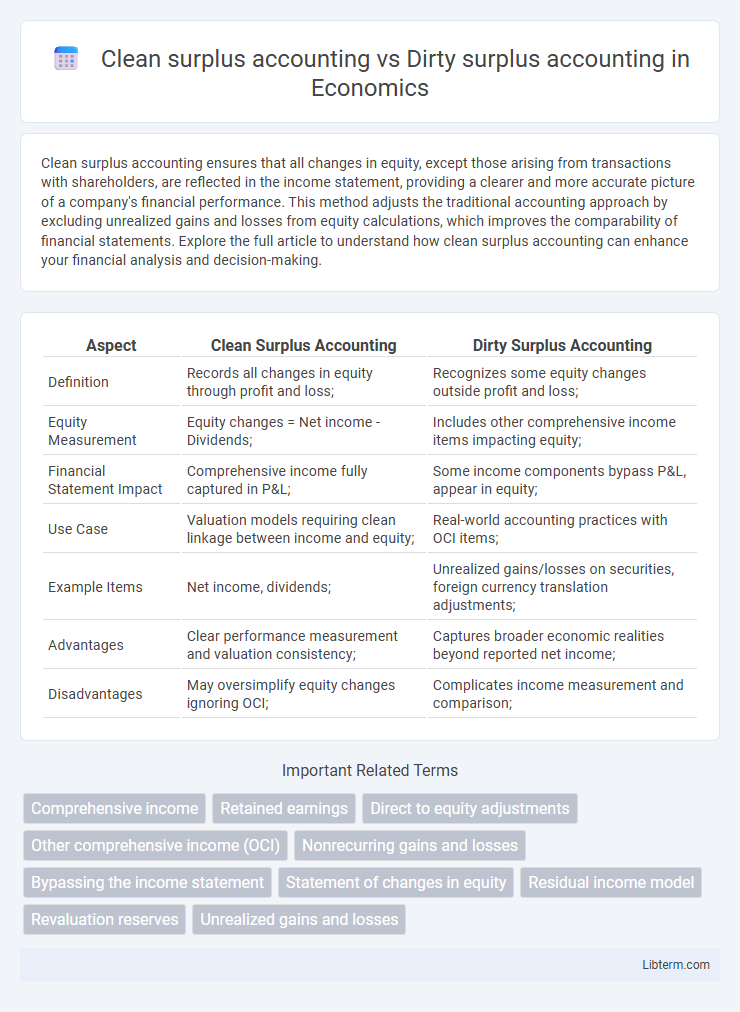

| Aspect | Clean Surplus Accounting | Dirty Surplus Accounting |

|---|---|---|

| Definition | Records all changes in equity through profit and loss; | Recognizes some equity changes outside profit and loss; |

| Equity Measurement | Equity changes = Net income - Dividends; | Includes other comprehensive income items impacting equity; |

| Financial Statement Impact | Comprehensive income fully captured in P&L; | Some income components bypass P&L, appear in equity; |

| Use Case | Valuation models requiring clean linkage between income and equity; | Real-world accounting practices with OCI items; |

| Example Items | Net income, dividends; | Unrealized gains/losses on securities, foreign currency translation adjustments; |

| Advantages | Clear performance measurement and valuation consistency; | Captures broader economic realities beyond reported net income; |

| Disadvantages | May oversimplify equity changes ignoring OCI; | Complicates income measurement and comparison; |

Introduction to Clean Surplus and Dirty Surplus Accounting

Clean surplus accounting records all changes in equity directly through net income, excluding transactions with shareholders such as dividends and share buybacks, providing a transparent view of a firm's performance. Dirty surplus accounting, by contrast, allows certain gains and losses to bypass the income statement and flow directly through equity, often reflecting items like foreign currency adjustments or unrealized gains on securities. Understanding the distinction is crucial for accurate financial analysis and valuation, as clean surplus supports the clean surplus relation used in advanced equity valuation models.

Defining Clean Surplus Accounting

Clean surplus accounting defines comprehensive income by excluding transactions with equity holders such as dividends and share repurchases, ensuring net income reconciles with changes in book equity without involving equity transactions. This method facilitates accurate valuation models like the residual income model by maintaining a clear separation between operating performance and equity financing activities. In contrast, dirty surplus accounting includes these equity transactions in the income statement, potentially distorting performance measurement and valuation consistency.

Defining Dirty Surplus Accounting

Dirty surplus accounting refers to the practice of recognizing certain gains and losses directly in equity without passing through the profit and loss statement, leading to less transparent financial performance reporting. It contrasts with clean surplus accounting, where all income and expenses are recorded in the income statement, ensuring that changes in equity arise solely from profits, losses, and dividends. This distinction affects financial analysis and valuation models by influencing how comprehensive income and equity changes are reported.

Key Principles of Clean Surplus Accounting

Clean surplus accounting emphasizes that all changes in equity, other than transactions with owners, should be recognized through the income statement, ensuring a clear and consistent link between net income and equity changes. It excludes items like unrealized gains and losses from equity, which are instead recorded in other comprehensive income under dirty surplus accounting. This approach enhances the reliability of residual income valuation models by ensuring comprehensive income accurately reflects all economic events affecting equity.

Key Principles of Dirty Surplus Accounting

Dirty surplus accounting recognizes changes in equity that bypass the income statement, recording them directly in the equity section of the balance sheet. Key principles include capturing comprehensive income items such as unrealized gains and losses, revaluations, and foreign currency translation adjustments outside net income. This method enhances the transparency of financial performance by reflecting economic events not captured in traditional profit measures.

Major Differences Between Clean and Dirty Surplus Accounting

Clean surplus accounting excludes gains and losses from equity that bypass the income statement, ensuring net income fully reconciles with changes in equity. Dirty surplus accounting includes comprehensive income components, such as unrealized gains and losses, directly in equity without affecting net income. The major difference lies in the treatment of these items, impacting performance measurement and equity valuation accuracy.

Impact on Financial Statement Analysis

Clean surplus accounting ensures that all changes in equity, except for transactions with owners, are recorded through the income statement, enhancing the transparency and comparability of financial ratios such as return on equity and earnings per share. Dirty surplus accounting allows certain gains and losses to bypass the income statement and directly affect equity, which can obscure true earnings performance and complicate the assessment of a company's profitability and financial health. This distinction significantly impacts financial statement analysis by influencing the accuracy of valuation metrics and the reliability of predicting future cash flows.

Effects on Shareholder Equity Calculations

Clean surplus accounting excludes gains and losses not recognized in the income statement, ensuring that changes in shareholder equity reflect only transactions directly related to net income and dividends, which facilitates clearer equity valuation. Dirty surplus accounting includes items like unrealized gains or losses bypassing the income statement and recorded in equity, causing shareholder equity calculations to incorporate comprehensive income components that may introduce volatility and reduce comparability. This distinction affects the accuracy and transparency of equity measurement, influencing investment decisions and financial analysis by altering perceived company performance.

Advantages and Disadvantages of Each Approach

Clean surplus accounting enhances transparency by excluding items bypassing the income statement, facilitating more accurate equity valuation and performance measurement. However, its limitation lies in potentially omitting real economic gains or losses recorded directly in equity, which can distort the full financial picture. Dirty surplus accounting captures all changes in equity, including those not passing through net income, providing a comprehensive view but complicating earnings analysis and comparability across firms.

Conclusion: Choosing Between Clean and Dirty Surplus Accounting

Choosing between clean surplus accounting and dirty surplus accounting depends on the desired level of transparency and the complexity of financial reporting. Clean surplus accounting offers a clearer view of comprehensive income by excluding certain items from profit and loss, enhancing comparability across firms. Dirty surplus accounting captures all changes in equity, including unrealized gains and losses, providing a more inclusive but potentially less clear picture of financial performance.

Clean surplus accounting Infographic

libterm.com

libterm.com