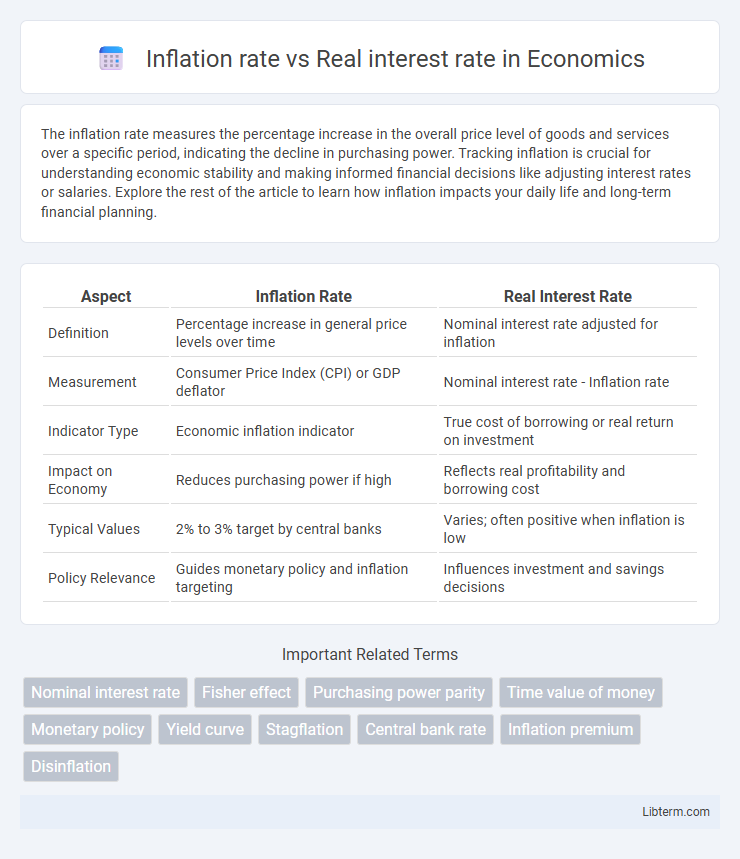

The inflation rate measures the percentage increase in the overall price level of goods and services over a specific period, indicating the decline in purchasing power. Tracking inflation is crucial for understanding economic stability and making informed financial decisions like adjusting interest rates or salaries. Explore the rest of the article to learn how inflation impacts your daily life and long-term financial planning.

Table of Comparison

| Aspect | Inflation Rate | Real Interest Rate |

|---|---|---|

| Definition | Percentage increase in general price levels over time | Nominal interest rate adjusted for inflation |

| Measurement | Consumer Price Index (CPI) or GDP deflator | Nominal interest rate - Inflation rate |

| Indicator Type | Economic inflation indicator | True cost of borrowing or real return on investment |

| Impact on Economy | Reduces purchasing power if high | Reflects real profitability and borrowing cost |

| Typical Values | 2% to 3% target by central banks | Varies; often positive when inflation is low |

| Policy Relevance | Guides monetary policy and inflation targeting | Influences investment and savings decisions |

Understanding Inflation Rate and Real Interest Rate

The inflation rate measures the percentage increase in the general price level of goods and services over a period, reflecting the loss of purchasing power. Real interest rate is calculated by subtracting the inflation rate from the nominal interest rate, representing the true cost of borrowing or the real yield on savings. Understanding the relationship between inflation rate and real interest rate is crucial for making informed financial decisions and evaluating investment returns accurately.

Key Differences Between Inflation Rate and Real Interest Rate

The inflation rate measures the percentage increase in the general price level of goods and services over a specific period, reflecting the decrease in purchasing power. The real interest rate is the nominal interest rate adjusted for inflation, representing the true cost of borrowing or the real yield on savings. Key differences include that inflation rate indicates overall economic price changes, while real interest rate reveals the effective return after accounting for inflation's impact.

How Inflation Influences Real Interest Rates

Inflation directly impacts real interest rates by reducing the purchasing power of the returns on savings and investments, causing lenders to demand higher nominal interest rates to maintain real returns. When inflation rises, real interest rates often decrease if nominal rates fail to adjust proportionally, leading to lower incentives for saving and potential increases in borrowing. Central banks, such as the Federal Reserve, monitor inflation to adjust nominal interest rates accordingly, aiming to stabilize real interest rates and support economic growth.

The Economic Impact of Inflation Rate vs Real Interest Rate

The inflation rate directly erodes purchasing power, diminishing the real value of money and influencing consumer behavior and business investment decisions. Real interest rates, adjusted for inflation, reflect the true cost of borrowing and the real yield to savers, thereby affecting capital allocation and economic growth. When inflation outpaces nominal interest rates, real interest rates can turn negative, discouraging savings and potentially fueling further inflation, while positive real rates promote financial stability and investment.

Calculating Real Interest Rate: Formula and Examples

The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate, expressed as Real Interest Rate = Nominal Interest Rate - Inflation Rate. For example, if a savings account offers a nominal interest rate of 6% and the inflation rate is 3%, the real interest rate is 3%, indicating the true purchasing power gain. This calculation helps investors and policymakers understand the actual earning or cost of borrowing after adjusting for inflation.

Inflation Rate Trends and Their Effects on Borrowing

Rising inflation rates reduce the real interest rate, which is nominal interest rate minus inflation, thereby affecting borrowing costs by lowering the effective cost of loans. Inflation trends directly influence lenders' willingness to lend, as higher inflation erodes the real returns on fixed-rate debt. Borrowers benefit during periods of accelerating inflation because the real value of debt decreases over time, encouraging increased borrowing and spending.

Real Interest Rate: Importance for Investors and Savers

The real interest rate, defined as the nominal interest rate minus the inflation rate, is crucial for investors and savers because it reflects the true purchasing power of returns on investments or savings. Positive real interest rates ensure that the value of invested capital grows after adjusting for inflation, preserving wealth over time. Monitoring real interest rates helps investors make informed decisions about asset allocation and helps savers maintain financial goals in inflationary environments.

Policy Implications: Central Banks and Interest Rate Decisions

Inflation rate directly influences the real interest rate, calculated by subtracting inflation from nominal interest rates, shaping central bank policy decisions. Central banks adjust nominal interest rates to control inflation, aiming to maintain a positive real interest rate that encourages investment and economic growth while curbing excessive inflation. Effective interest rate policies balance inflation targets and economic stability, impacting borrowing costs, consumer spending, and overall financial market conditions.

Historical Comparison: Inflation Rate vs Real Interest Rate

Historical comparisons reveal that periods of high inflation rates often correspond with low or negative real interest rates, as nominal interest rates lag behind rising prices. During the 1970s and early 1980s, inflation rates exceeded 10%, while real interest rates frequently dipped below zero, eroding purchasing power and discouraging savings. Conversely, in low inflation environments of the 1990s and early 2000s, real interest rates remained positive, supporting economic growth and investment.

Strategies to Protect Wealth During High Inflation Periods

During high inflation periods, prioritizing investments with real interest rates that exceed inflation is essential for preserving purchasing power. Strategies include allocating funds to Treasury Inflation-Protected Securities (TIPS), real estate assets, and commodities like gold, which historically outperform during inflationary phases. Diversifying portfolios with inflation-hedged assets reduces risk and enhances wealth protection when nominal interest rates fail to offset rising price levels.

Inflation rate Infographic

libterm.com

libterm.com