Storage cost directly impacts your overall budget, influencing decisions on inventory levels and warehouse space. Efficient cost management ensures optimized resource allocation and improved profitability. Explore the article to discover practical strategies for reducing your storage expenses.

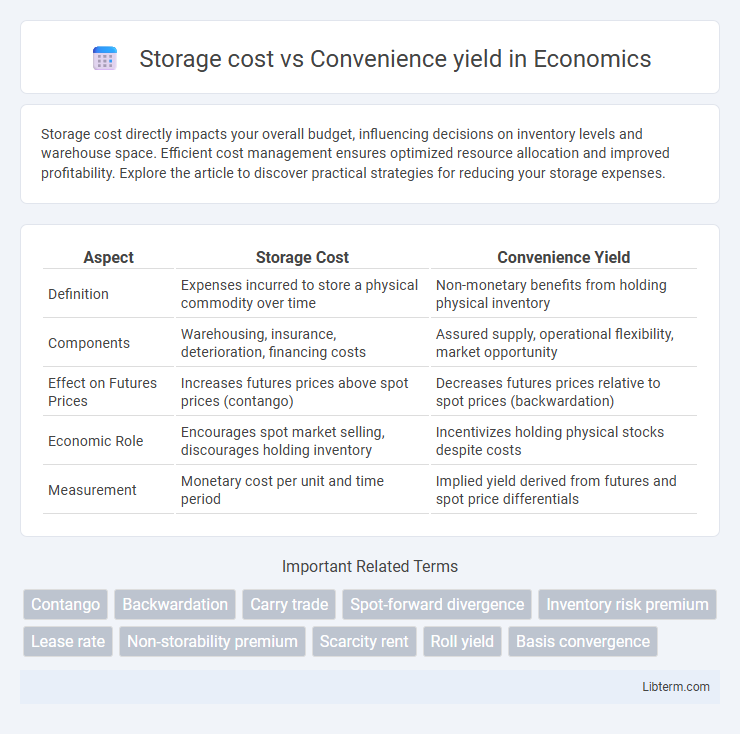

Table of Comparison

| Aspect | Storage Cost | Convenience Yield |

|---|---|---|

| Definition | Expenses incurred to store a physical commodity over time | Non-monetary benefits from holding physical inventory |

| Components | Warehousing, insurance, deterioration, financing costs | Assured supply, operational flexibility, market opportunity |

| Effect on Futures Prices | Increases futures prices above spot prices (contango) | Decreases futures prices relative to spot prices (backwardation) |

| Economic Role | Encourages spot market selling, discourages holding inventory | Incentivizes holding physical stocks despite costs |

| Measurement | Monetary cost per unit and time period | Implied yield derived from futures and spot price differentials |

Introduction to Storage Cost and Convenience Yield

Storage cost represents the expenses incurred from holding physical commodities, including warehousing, insurance, and deterioration risks. Convenience yield reflects the non-monetary benefits of possessing the physical asset, such as ensuring supply continuity and flexibility in response to market fluctuations. Understanding the balance between storage cost and convenience yield is crucial for accurate commodity pricing and managing inventory strategies.

Defining Storage Cost in Commodity Markets

Storage cost in commodity markets refers to the expenses incurred for holding physical goods over time, including warehousing fees, insurance, and capital costs tied up in inventory. This cost impacts commodity pricing as it influences the decision to store commodities for future sale or immediate consumption. Understanding storage cost is crucial for calculating the convenience yield, which represents the non-monetary benefits of physically holding a commodity versus holding a contract.

Understanding the Concept of Convenience Yield

Convenience yield represents the non-monetary benefits or premiums derived from holding a physical commodity rather than a futures contract, influencing the relationship between storage costs and futures prices. Higher convenience yield often offsets storage costs, reflecting advantages like immediate availability, reduced supply risk, and operational flexibility. This concept is critical in commodity markets to explain pricing discrepancies and investment decisions between holding physical assets versus futures positions.

Factors Influencing Storage Cost

Storage cost is primarily influenced by factors such as warehousing fees, insurance premiums, and spoilage or depreciation risks associated with the stored goods. Seasonal fluctuations and interest rates affect the capital tied up in inventory, further impacting storage expenses. Efficient inventory management and technology adoption can reduce these costs, optimizing the balance between storage cost and convenience yield.

Factors Affecting Convenience Yield

Convenience yield is influenced by factors such as inventory levels, market demand volatility, and the perishability of the stored commodity. Higher storage costs typically reduce inventory holdings, which can increase convenience yield due to scarcity and immediate availability benefits. Seasonal variations and geopolitical risks also affect convenience yield by impacting the ease of access and security of supply for market participants.

Relationship Between Storage Cost and Convenience Yield

The storage cost represents the expenses incurred to hold a physical commodity over time, including warehousing, insurance, and financing fees. Convenience yield reflects the non-monetary benefits of physically holding the commodity, such as ensuring supply availability or meeting unexpected demand. An inverse relationship typically exists where higher storage costs reduce the convenience yield, as the financial burden of holding inventory outweighs the immediate benefits of access to the physical asset.

Impact on Commodity Futures Pricing

Storage cost directly increases the cost of holding a physical commodity, leading to higher futures prices as producers and traders seek compensation for warehousing expenses. Convenience yield reflects the non-monetary benefits of physically holding the commodity, often reducing futures prices when supply shortages or immediate demand drive up the value of on-hand inventory. The interplay between storage cost and convenience yield creates the basis for futures pricing, where high storage costs coupled with low convenience yield typically result in contango, while high convenience yield relative to storage costs can cause backwardation.

Real-World Examples: Storage Cost vs Convenience Yield

The oil markets illustrate the dynamic between storage cost and convenience yield, where high storage expenses during supply gluts drive prices down despite available inventory. In contrast, during geopolitical tensions or seasonal demand spikes, the convenience yield increases as immediate access to oil becomes more valuable than the cost of storage, pushing spot prices above futures prices. Similar patterns appear in agricultural commodities like wheat, where perishability raises storage costs, but harvest-time scarcity boosts convenience yield significantly.

Strategies for Balancing Storage Cost and Convenience Yield

Effective strategies for balancing storage cost and convenience yield involve optimizing inventory levels to minimize holding expenses while ensuring product availability. Firms often use just-in-time inventory systems and demand forecasting models to reduce excess storage costs without sacrificing the convenience of immediate supply. Leveraging real-time data analytics enables dynamic adjustment of stock, enhancing the trade-off between storage costs and the intrinsic value of convenience yield.

Conclusion: Optimizing Returns in Commodity Investments

Balancing storage costs against convenience yield is critical for maximizing returns in commodity investments, as high storage costs can erode profits while substantial convenience yields add intrinsic value by ensuring supply security. Investors should evaluate market conditions, including demand volatility and inventory levels, to determine when the convenience yield justifies carrying inventory despite storage expenses. Optimizing strategies that leverage favorable convenience yields while minimizing unnecessary storage costs enable more efficient commodity portfolio performance and risk management.

Storage cost Infographic

libterm.com

libterm.com