Book value represents the net asset value of a company, calculated as total assets minus total liabilities, reflecting the company's accounting value on its balance sheet. It serves as a crucial metric for investors to assess whether a stock is undervalued or overvalued relative to its market price. Explore the rest of this article to understand how book value can impact your investment decisions.

Table of Comparison

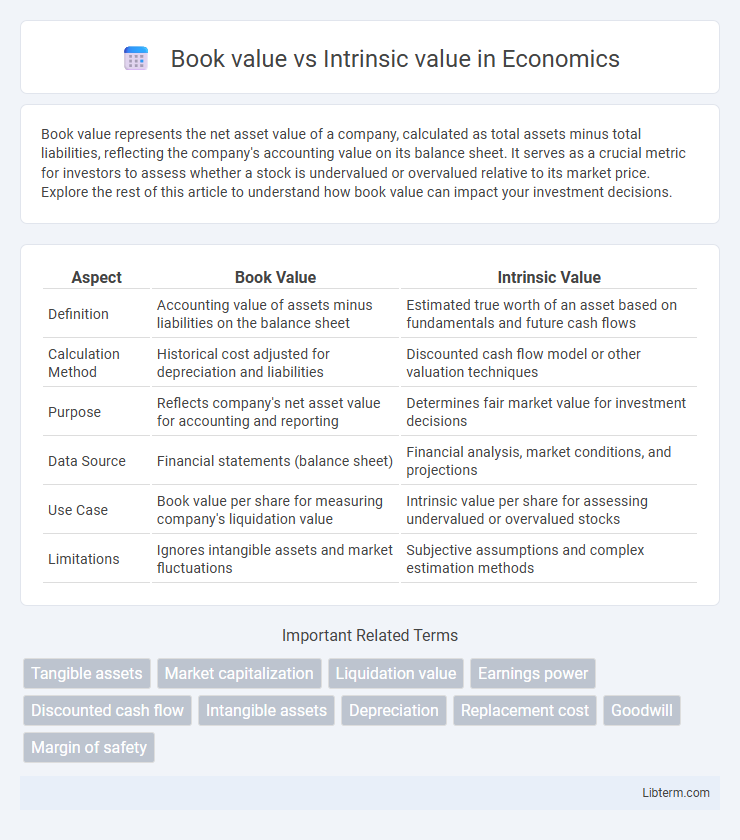

| Aspect | Book Value | Intrinsic Value |

|---|---|---|

| Definition | Accounting value of assets minus liabilities on the balance sheet | Estimated true worth of an asset based on fundamentals and future cash flows |

| Calculation Method | Historical cost adjusted for depreciation and liabilities | Discounted cash flow model or other valuation techniques |

| Purpose | Reflects company's net asset value for accounting and reporting | Determines fair market value for investment decisions |

| Data Source | Financial statements (balance sheet) | Financial analysis, market conditions, and projections |

| Use Case | Book value per share for measuring company's liquidation value | Intrinsic value per share for assessing undervalued or overvalued stocks |

| Limitations | Ignores intangible assets and market fluctuations | Subjective assumptions and complex estimation methods |

Understanding Book Value: Definition and Calculation

Book value represents a company's net asset value calculated as total assets minus total liabilities, reflecting the accounting value recorded on the balance sheet. It is determined using historical cost and does not account for market fluctuations or intangible assets such as brand reputation. Investors use book value to assess whether a stock is undervalued by comparing it with market price, though it may differ significantly from intrinsic value, which estimates the true economic worth based on future cash flows.

What is Intrinsic Value? Key Concepts Explained

Intrinsic value represents the true, inherent worth of an asset based on fundamental analysis, factoring in qualitative and quantitative elements like cash flow, growth potential, and risk. Unlike book value, which reflects historical cost minus depreciation, intrinsic value captures the present and future earning capacity of the asset. Investors use discounted cash flow (DCF) models and other valuation techniques to estimate intrinsic value, aiming to identify undervalued opportunities in the market.

Differences Between Book Value and Intrinsic Value

Book value represents a company's net asset value calculated from its balance sheet, reflecting historical costs minus liabilities. Intrinsic value estimates the true worth of an asset based on discounted cash flows, future earnings, and market conditions, providing a forward-looking valuation. The key difference lies in book value's reliance on accounting data, while intrinsic value incorporates qualitative factors and growth potential for a comprehensive assessment.

Factors Influencing Book Value

Book value is primarily influenced by a company's asset purchases, depreciation methods, and liabilities recorded on the balance sheet. Changes in accounting policies, write-downs, and impairments of assets can significantly alter the book value over time. Market conditions generally do not affect book value directly, as it reflects historical costs rather than current market prices.

Determinants of Intrinsic Value in Investments

Intrinsic value in investments is primarily determined by an asset's expected future cash flows, discounted to their present value using an appropriate discount rate. Factors influencing intrinsic value include the company's earnings growth potential, risk profile, dividend policy, and macroeconomic conditions impacting market stability. Unlike book value, which reflects historical cost accounting, intrinsic value captures the true economic worth based on fundamental analysis and market expectations.

Book Value in Financial Statements: A Closer Look

Book value in financial statements represents a company's net asset value calculated as total assets minus total liabilities, reflecting the accounting value of equity. It serves as a fundamental metric for investors to assess a firm's baseline worth using historical cost rather than market fluctuations. Book value contrasts with intrinsic value, which estimates true economic worth based on future cash flows and qualitative factors beyond raw financial data.

Calculating Intrinsic Value: Popular Methods

Intrinsic value is calculated using methods such as discounted cash flow (DCF) analysis, which estimates the present value of expected future cash flows, and the dividend discount model (DDM), which values stocks based on projected dividends. Another popular approach is the residual income model, which considers net income minus a charge for the cost of capital. These methods rely on detailed financial data and assumptions about growth rates, discount rates, and risk to provide a more accurate assessment of a company's true worth compared to book value.

Practical Examples: Book Value vs Intrinsic Value

Book value represents a company's net asset value calculated from its balance sheet, such as when a company reports $500 million in total assets minus $300 million in liabilities, resulting in a book value of $200 million. Intrinsic value considers a broader range of factors including future cash flows, growth potential, and market conditions, exemplified by an investor valuing the same company at $350 million based on discounted future earnings. Practical applications reveal discrepancies where companies with high book value may be undervalued if their intrinsic value is significantly higher due to strong growth prospects or intangible assets like brand value.

Importance for Investors: When to Use Each Metric

Book value represents a company's net asset value based on its balance sheet, providing a clear snapshot of tangible assets minus liabilities, and is crucial for value investors seeking a conservative estimate of company worth. Intrinsic value estimates the true underlying worth of a company by incorporating future cash flows, growth prospects, and risk factors, making it essential for long-term investors focused on fundamental analysis and potential profitability. Investors rely on book value for assessing liquidation scenarios and intrinsic value for evaluating investment quality and price justification.

Common Misconceptions About Book and Intrinsic Value

Many investors mistakenly assume that book value represents the true worth of a company, overlooking its basis in historical cost accounting rather than current market conditions. Intrinsic value is often confused with market price, yet it requires comprehensive analysis of future cash flows, growth potential, and risk factors, making it a more accurate measure of a company's true economic value. Misunderstanding these concepts can lead to flawed investment decisions, as book value ignores intangible assets and intrinsic value depends heavily on subjective assumptions.

Book value Infographic

libterm.com

libterm.com