Social bonds play a crucial role in shaping your emotional well-being and overall mental health by fostering trust, support, and a sense of belonging. Strong connections with family, friends, and community members enhance resilience against stress and contribute to a happier, more fulfilling life. Explore the rest of the article to learn how to nurture and maintain meaningful social relationships.

Table of Comparison

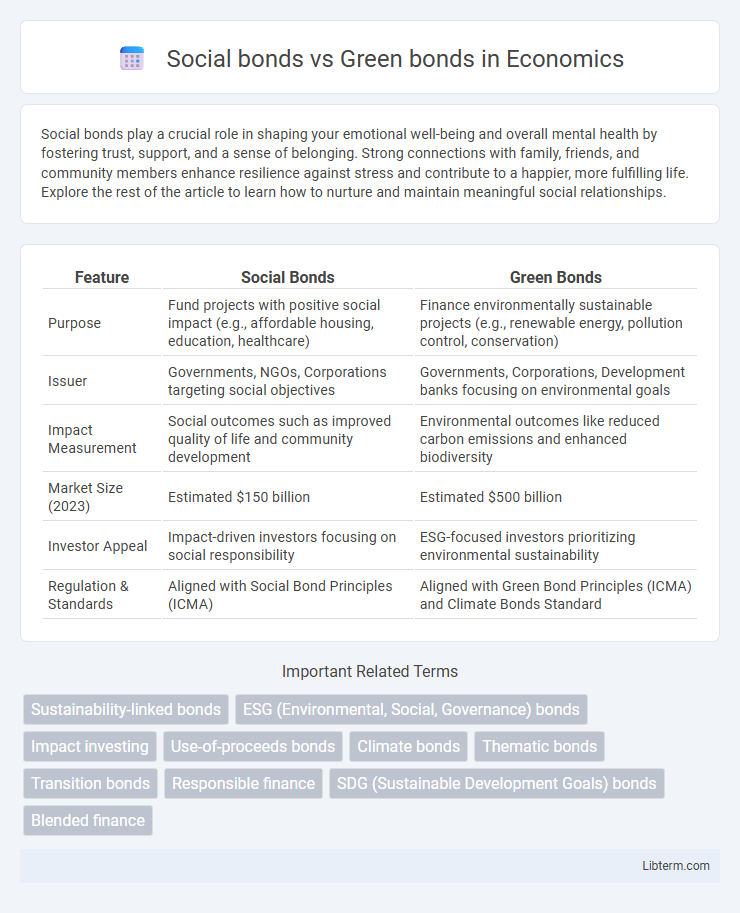

| Feature | Social Bonds | Green Bonds |

|---|---|---|

| Purpose | Fund projects with positive social impact (e.g., affordable housing, education, healthcare) | Finance environmentally sustainable projects (e.g., renewable energy, pollution control, conservation) |

| Issuer | Governments, NGOs, Corporations targeting social objectives | Governments, Corporations, Development banks focusing on environmental goals |

| Impact Measurement | Social outcomes such as improved quality of life and community development | Environmental outcomes like reduced carbon emissions and enhanced biodiversity |

| Market Size (2023) | Estimated $150 billion | Estimated $500 billion |

| Investor Appeal | Impact-driven investors focusing on social responsibility | ESG-focused investors prioritizing environmental sustainability |

| Regulation & Standards | Aligned with Social Bond Principles (ICMA) | Aligned with Green Bond Principles (ICMA) and Climate Bonds Standard |

Introduction to Social Bonds and Green Bonds

Social bonds and green bonds are instrumental financial instruments designed to fund projects with positive societal and environmental impacts, respectively. Social bonds focus on financing initiatives that address social issues such as affordable housing, education, and healthcare, aiming to improve community well-being and social equity. Green bonds specifically support projects related to environmental sustainability, including renewable energy, pollution reduction, and climate change mitigation, aligning with global efforts to combat ecological challenges.

Definitions and Core Objectives

Social bonds are debt instruments designed to fund projects that generate positive social outcomes, such as affordable housing, education, and healthcare access. Green bonds specifically finance environmental initiatives aimed at mitigating climate change, conserving natural resources, and promoting renewable energy projects. Both bond types prioritize sustainable development but differ in their core objectives, with social bonds targeting social welfare improvements and green bonds focusing on ecological sustainability.

Key Differences Between Social and Green Bonds

Social bonds primarily finance projects that address social issues such as affordable housing and healthcare, while green bonds fund environmentally sustainable initiatives like renewable energy and pollution reduction. The key difference lies in their impact focus: social bonds target social welfare improvements, whereas green bonds aim to mitigate environmental challenges. Both bond types attract investors interested in sustainable development but cater to distinct sectors and outcome metrics.

Historical Development and Global Trends

Social bonds emerged in the early 2010s as part of the growing impact investing movement, addressing issues like affordable housing, healthcare, and education, while green bonds originated in 2007 with the World Bank to finance environmentally sustainable projects such as renewable energy and pollution reduction. Global trends show a rapid expansion of both markets, with green bonds dominating issuance volume due to heightened climate action commitments, whereas social bonds are gaining traction amid increased focus on social equity and pandemic recovery efforts. Regional variations exist, with Europe leading in green bond issuance and Asia-Pacific showing strong growth in social bonds, driven by evolving regulatory frameworks and investor demand.

Major Issuers and Markets

Major issuers of social bonds include governments, supranational organizations, and financial institutions focusing on funding social projects such as affordable housing and healthcare, with significant markets in the United States and Europe. Green bonds predominantly attract issuance from corporate entities, municipalities, and development banks targeting environmental projects like renewable energy and climate change mitigation, with China, the EU, and the US leading market volumes. Both bond types benefit from growing investor demand for ESG-compliant assets, but green bonds currently dominate in issuance size and market breadth.

Impact Measurement and Reporting

Social bonds focus on funding projects that generate measurable social benefits, using impact measurement frameworks such as the Social Return on Investment (SROI) and the Global Impact Investing Network (GIIN) metrics to evaluate outcomes. Green bonds prioritize environmental projects, employing standardized reporting aligned with the Climate Bonds Initiative (CBI) criteria and the Green Bond Principles (GBP) to ensure transparency and track reductions in carbon emissions or improvements in biodiversity. Both bond types require rigorous impact reporting, but social bonds emphasize social metrics like improved community health or education access, while green bonds center on quantifiable environmental performance indicators.

Regulatory Frameworks and Standards

Social bonds and green bonds operate under distinct regulatory frameworks and standards designed to ensure transparency, accountability, and impact measurement. Social bonds adhere to the Social Bond Principles (SBP) established by the International Capital Market Association (ICMA), emphasizing projects that address social issues such as affordable housing, education, and healthcare. Green bonds are governed by the Green Bond Principles (GBP) and often align with environmental regulations and taxonomies like the EU Green Bond Standard, focusing on financing projects with positive environmental benefits, including renewable energy and climate change mitigation.

Investor Perspectives and Motivations

Investor perspectives on social bonds emphasize funding projects that generate positive social outcomes such as affordable housing, education, and healthcare access, appealing to those prioritizing social impact alongside financial returns. Green bonds attract investors focused on financing environmentally sustainable initiatives like renewable energy, energy efficiency, and climate resilience, driven by increasing regulatory support and growing demand for climate-conscious portfolios. Both bond types cater to impact investors motivated by aligning investments with Environmental, Social, and Governance (ESG) criteria, though green bonds often benefit from clearer quantifiable environmental metrics.

Challenges and Opportunities in Adoption

Social bonds face challenges in standardized impact measurement and risk assessment due to diverse social outcomes, while green bonds benefit from clearer environmental benchmarks but struggle with greenwashing concerns. Opportunities for social bonds lie in growing investor demand for social impact and integration with Environmental, Social, and Governance (ESG) frameworks, whereas green bonds can leverage regulatory support and technological innovation for verification. Both bond types require enhanced transparency and robust reporting to boost market confidence and scale adoption effectively.

The Future Outlook of Social and Green Bonds

The future outlook for social bonds and green bonds highlights rapid growth driven by increasing investor demand for sustainable and impact-focused investments. Social bonds target social welfare projects such as affordable housing and healthcare, while green bonds finance environmentally beneficial projects like renewable energy and carbon reduction. Emerging regulatory frameworks and enhanced reporting standards are expected to boost transparency, fostering greater market confidence and expanding issuance volumes globally.

Social bonds Infographic

libterm.com

libterm.com