Producer surplus represents the difference between the amount producers are willing to accept for a good or service and the actual amount they receive. It reflects the economic benefit producers gain by selling at market prices higher than their minimum acceptable price. Discover how understanding producer surplus can enhance Your insights into market dynamics by reading the full article.

Table of Comparison

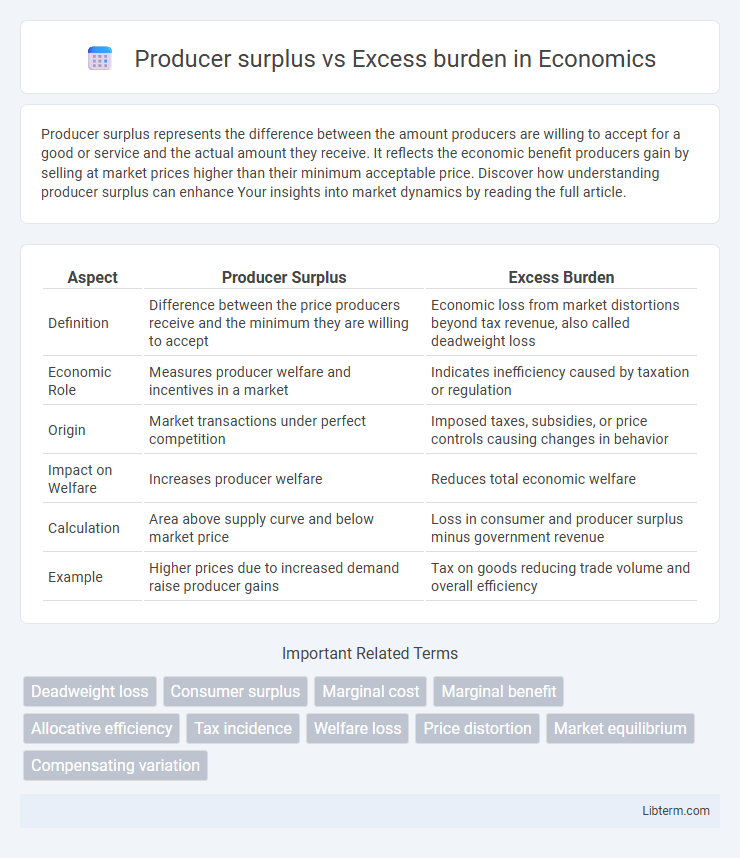

| Aspect | Producer Surplus | Excess Burden |

|---|---|---|

| Definition | Difference between the price producers receive and the minimum they are willing to accept | Economic loss from market distortions beyond tax revenue, also called deadweight loss |

| Economic Role | Measures producer welfare and incentives in a market | Indicates inefficiency caused by taxation or regulation |

| Origin | Market transactions under perfect competition | Imposed taxes, subsidies, or price controls causing changes in behavior |

| Impact on Welfare | Increases producer welfare | Reduces total economic welfare |

| Calculation | Area above supply curve and below market price | Loss in consumer and producer surplus minus government revenue |

| Example | Higher prices due to increased demand raise producer gains | Tax on goods reducing trade volume and overall efficiency |

Understanding Producer Surplus

Producer surplus represents the difference between the amount producers are willing to accept and the actual price they receive, indicating the economic benefit to sellers from market transactions. It reflects the area above the supply curve and below the market price, quantifying producer gains from trade. Understanding producer surplus is essential to evaluate the efficiency and welfare impacts of market interventions compared to excess burden, which measures the loss of total surplus due to distortionary policies.

Defining Excess Burden (Deadweight Loss)

Excess burden, also known as deadweight loss, refers to the economic inefficiency resulting from market distortions such as taxes or subsidies that cause a loss of total surplus beyond the tax revenue collected. Producer surplus measures the difference between what producers are willing to accept and the actual price received, while excess burden captures the lost gains from trade due to decreased market activity. Understanding excess burden is crucial for evaluating the true cost of taxation policies beyond mere revenue effects.

Key Differences: Producer Surplus vs Excess Burden

Producer surplus represents the difference between the price producers receive and the minimum amount they are willing to accept, reflecting producer benefits from market transactions. Excess burden, also known as deadweight loss, measures the loss of economic efficiency when market equilibrium is disrupted by taxes or subsidies, leading to a reduction in total welfare. Key differences include producer surplus indicating gains to producers, while excess burden quantifies the overall economic cost to society from market distortions.

Factors Influencing Producer Surplus

Producer surplus is influenced by factors such as market price, production costs, and the elasticity of supply, which determine the difference between what producers are willing to accept and the actual market price. Excess burden, also known as deadweight loss, arises when taxes or regulations distort market equilibrium, reducing overall welfare by decreasing producer and consumer surplus. Understanding how shifts in supply curves and tax rates affect producer surplus is essential for assessing the economic impact of policy interventions on producer profitability and market efficiency.

Causes and Sources of Excess Burden

Excess burden arises primarily from market distortions due to taxes or subsidies that shift resource allocation away from efficient equilibrium, causing deadweight loss beyond the tax revenue collected. Producer surplus declines when taxes increase production costs or reduce output, but excess burden stems from the overall loss in total welfare, including lost consumer and producer gains. Key causes include elastic supply and demand, which amplify inefficiencies as taxed goods see significant reductions in quantity traded, intensifying welfare losses beyond mere revenue effects.

Graphical Representation: Producer Surplus and Excess Burden

Producer surplus is graphically represented as the area above the supply curve and below the market price, indicating the additional benefit producers receive from selling at a higher price. Excess burden, or deadweight loss, appears as the triangular area between the supply and demand curves, beyond the equilibrium, reflecting the loss of total welfare due to market distortions such as taxes or subsidies. Visualizing both on a supply and demand graph highlights how taxes reduce producer surplus and create an excess burden by shrinking the gains from trade.

Taxation Impact on Producer Surplus and Excess Burden

Taxation reduces producer surplus by decreasing the amount producers receive after tax, leading to lower production and supply in the market. The excess burden, or deadweight loss, arises because the tax distorts producer behavior, causing a loss in total economic efficiency beyond the tax revenue collected. Optimal tax policies aim to minimize excess burden while balancing the reduction in producer surplus to maintain market equilibrium.

Real-world Examples: Producer Surplus vs Excess Burden

Producer surplus arises when producers sell goods at a price higher than their minimum acceptable price, as seen in agricultural markets where farmers benefit from government price supports. Excess burden refers to the economic inefficiency caused by taxation or regulation, illustrated by how high excise taxes on cigarettes reduce consumption but also result in lost producer and consumer welfare beyond the tax revenue collected. In real-world scenarios, balancing producer surplus and excess burden is crucial for policymakers aiming to optimize market outcomes without causing significant inefficiency.

Policy Implications: Reducing Excess Burden without Harming Producer Surplus

Policies aimed at minimizing excess burden should prioritize efficient tax structures and targeted subsidies that maintain or enhance producer surplus. Implementing shift toward consumption taxes or removing distortive subsidies can reduce economic inefficiencies while preserving producer incentives. Careful calibration of tax rates ensures reduced deadweight loss without significantly diminishing producer revenues or investment capacity.

Conclusion: Balancing Producer Surplus and Economic Efficiency

Maximizing producer surplus often leads to increased market distortions and higher excess burden, reducing overall economic efficiency. Effective policy design must carefully balance incentives for producers with minimizing deadweight loss to achieve optimal resource allocation. Striking this balance enhances sustainable economic growth while preserving welfare across stakeholders.

Producer surplus Infographic

libterm.com

libterm.com