Unleveraged financial positions involve investing without borrowed funds, reducing risk exposure while potentially limiting returns. This strategy appeals to conservative investors focused on preserving capital and avoiding debt-related obligations. Explore the rest of the article to understand how unleveraged strategies can impact your investment portfolio.

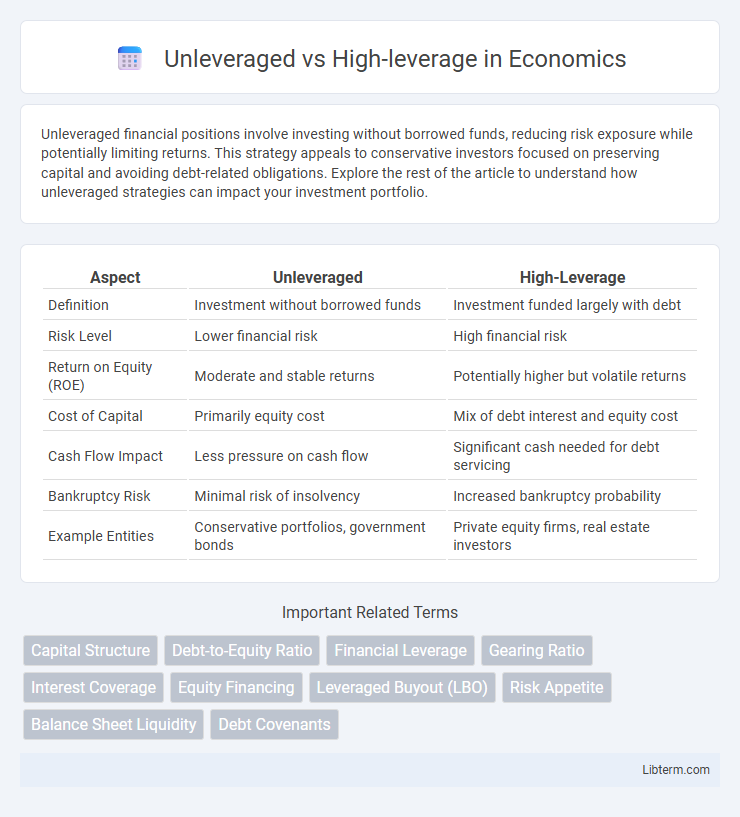

Table of Comparison

| Aspect | Unleveraged | High-Leverage |

|---|---|---|

| Definition | Investment without borrowed funds | Investment funded largely with debt |

| Risk Level | Lower financial risk | High financial risk |

| Return on Equity (ROE) | Moderate and stable returns | Potentially higher but volatile returns |

| Cost of Capital | Primarily equity cost | Mix of debt interest and equity cost |

| Cash Flow Impact | Less pressure on cash flow | Significant cash needed for debt servicing |

| Bankruptcy Risk | Minimal risk of insolvency | Increased bankruptcy probability |

| Example Entities | Conservative portfolios, government bonds | Private equity firms, real estate investors |

Introduction to Leverage in Finance

Leverage in finance refers to using borrowed capital to increase the potential return on investment, distinguishing between unleveraged investments that rely solely on owned funds and high-leverage strategies that amplify exposure through significant debt. High-leverage positions can enhance profitability but also magnify risks, including increased vulnerability to market volatility and potential insolvency. Understanding leverage ratios, debt-to-equity metrics, and their impact on financial performance is essential for managing risk and optimizing capital structure.

Defining Unleveraged and High-Leverage Strategies

Unleveraged strategies involve investments made without borrowed funds, relying solely on equity to minimize financial risk and potential losses. High-leverage strategies use significant debt to amplify returns, increasing both potential gains and exposure to market volatility. Understanding the balance between these approaches is crucial for managing investment risk and optimizing portfolio performance.

Key Differences Between Unleveraged and High-Leverage

Unleveraged assets involve no debt financing, resulting in lower financial risk and stable returns, while high-leverage investments use significant borrowed funds to amplify potential gains and losses. Key differences include risk exposure, cash flow variability, and return profiles, with unleveraged positions offering more predictable outcomes compared to the volatility associated with high-leverage strategies. Understanding debt-to-equity ratios and interest obligations is crucial when evaluating financial performance between these two investment approaches.

Risk Profiles: Unleveraged vs High-Leverage

Unleveraged investments carry significantly lower risk as they do not involve borrowed capital, reducing exposure to market volatility and potential losses. High-leverage strategies amplify potential returns but substantially increase risk due to debt obligations, which can lead to large losses if asset values decline. Investors must carefully assess their risk tolerance, as high-leverage positions can result in margin calls or bankruptcy during adverse market conditions.

Potential Returns: Comparing Profitability

Unleveraged investments typically offer lower potential returns due to the reliance solely on owned capital, minimizing exposure to market volatility. High-leverage strategies amplify potential profitability by using borrowed funds to increase investment size, which can lead to significantly enhanced gains during favorable market conditions. However, the increased return potential also carries heightened risk, as losses are magnified proportionally to the leverage applied.

Impact on Cash Flow and Liquidity

Unleveraged firms maintain stable cash flow and liquidity by avoiding debt-related interest payments, reducing financial risk and ensuring operational flexibility. High-leverage companies face increased pressure on cash flow due to mandatory debt servicing, which can constrain liquidity and elevate the risk of insolvency during economic downturns. Effective cash flow management in high-leverage scenarios is crucial to prevent liquidity shortages and maintain business continuity.

Suitability for Different Investor Types

Unleveraged investments suit conservative investors seeking stable returns without exposure to debt-related risks, typically favoring blue-chip stocks or bonds. High-leverage strategies appeal to aggressive investors willing to accept amplified volatility and potential losses in pursuit of higher gains, often involving margin trading or derivatives. Understanding risk tolerance and investment horizon is essential for selecting the appropriate leverage level aligned with individual financial goals.

Market Conditions Favoring Each Strategy

Unleveraged strategies perform well in volatile or uncertain market conditions by minimizing risk exposure and preserving capital stability, ideal for conservative investors or bear markets. High-leverage strategies excel in bullish or stable market environments by maximizing potential returns through amplified exposure, suitable for aggressive investors seeking rapid growth. Understanding market trends, volatility indexes, and economic indicators helps in selecting the right leverage approach to optimize risk-adjusted performance.

Common Misconceptions About Leverage

Common misconceptions about leverage often confuse its impact on investment risk, assuming high leverage always leads to greater losses, while it actually amplifies both gains and losses proportionally. Many investors believe unleveraged positions are risk-free, overlooking the opportunity cost and the limitations they impose on capital efficiency. Understanding that leverage is a strategic tool requiring careful management is essential to effectively balance potential returns against the inherent financial risks.

Conclusion: Choosing the Right Approach

Selecting between unleveraged and high-leverage financing depends on a company's risk tolerance, growth objectives, and market conditions. Unleveraged strategies minimize financial risk and preserve equity, ideal for stable cash flow businesses seeking long-term sustainability. High-leverage approaches can amplify returns and accelerate expansion but require careful management of debt obligations to avoid solvency issues.

Unleveraged Infographic

libterm.com

libterm.com