Proportional tax applies a consistent tax rate to all income levels, ensuring fairness by taxing everyone equally regardless of their earnings. This system simplifies tax calculations and promotes transparency, making it easier for taxpayers to understand their obligations. Explore the rest of the article to discover how proportional tax impacts your financial planning and overall economy.

Table of Comparison

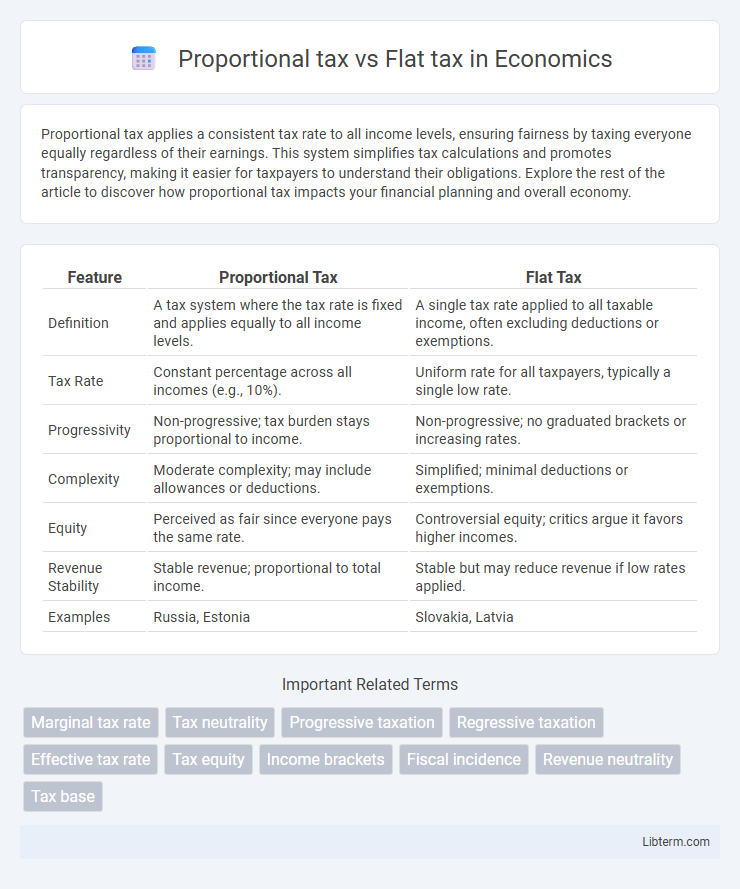

| Feature | Proportional Tax | Flat Tax |

|---|---|---|

| Definition | A tax system where the tax rate is fixed and applies equally to all income levels. | A single tax rate applied to all taxable income, often excluding deductions or exemptions. |

| Tax Rate | Constant percentage across all incomes (e.g., 10%). | Uniform rate for all taxpayers, typically a single low rate. |

| Progressivity | Non-progressive; tax burden stays proportional to income. | Non-progressive; no graduated brackets or increasing rates. |

| Complexity | Moderate complexity; may include allowances or deductions. | Simplified; minimal deductions or exemptions. |

| Equity | Perceived as fair since everyone pays the same rate. | Controversial equity; critics argue it favors higher incomes. |

| Revenue Stability | Stable revenue; proportional to total income. | Stable but may reduce revenue if low rates applied. |

| Examples | Russia, Estonia | Slovakia, Latvia |

Introduction to Taxation Systems

Proportional tax systems impose a constant tax rate on all income levels, ensuring uniform taxation regardless of earnings, while flat tax systems apply a single fixed rate primarily on personal or corporate income. Proportional taxes simplify administration by maintaining consistent rates, contrasting with progressive tax systems that increase rates with income. Understanding these tax structures is essential for evaluating their impacts on equity, efficiency, and government revenue generation.

What is a Proportional Tax?

A proportional tax, also known as a flat-rate tax, imposes the same percentage rate on all taxpayers regardless of their income level, ensuring tax liability scales directly with earnings. This tax system maintains equity by taxing high and low earners at an identical proportion, simplifying administration and compliance. Proportional taxes contrast with progressive systems, where the tax rate increases as income rises, affecting the distribution of tax burdens across income groups.

What is a Flat Tax?

A flat tax is a taxation system where a single constant rate is applied to all levels of income, eliminating graduated brackets and simplifying tax calculations. Unlike proportional taxes that may adjust rates based on income brackets, a flat tax ensures uniform tax liability regardless of earnings. This system aims to increase transparency, reduce administrative costs, and encourage economic growth by applying one fixed percentage to every taxpayer.

Key Differences Between Proportional and Flat Tax

Proportional tax and flat tax systems both apply a constant tax rate regardless of income level, but proportional tax typically refers to a consistent rate applied across all taxable income brackets within a progressive framework, while flat tax implies a single uniform rate with minimal deductions or exemptions. In proportional tax, the rate remains fixed but the tax base may vary due to different income categories or credits, whereas flat tax simplifies taxation by eliminating most loopholes and providing a streamlined ledger. Key differences include the impact on income equality, with proportional tax partially balancing equity and efficiency, while flat tax prioritizes simplicity and predictability at the potential cost of regressive effects on lower-income earners.

Advantages of Proportional Tax

Proportional tax offers simplicity and fairness by taxing all income levels at a consistent rate, eliminating complexities and reducing administrative costs. This system encourages compliance and transparency, as taxpayers easily understand their obligations without progressive brackets. By maintaining a stable revenue stream, proportional tax supports government budgeting while fostering economic efficiency and growth.

Advantages of Flat Tax

Flat tax systems offer simplicity by applying a single fixed rate to all income levels, reducing complexity in tax calculations and compliance. This uniform rate encourages economic growth by providing consistent incentives for earning and investment, avoiding the disincentives associated with higher marginal tax rates. Administrative efficiency improves with flat taxes, as tax authorities benefit from streamlined processes and lower enforcement costs compared to progressive or proportional tax systems.

Drawbacks of Proportional Tax

Proportional tax imposes the same tax rate on all income levels, but it disproportionately affects lower-income earners by taking a larger share of their disposable income, reducing their ability to cover essential expenses. This flat rate structure lacks progressivity, which limits government revenue potential for funding social programs aimed at reducing inequality. Critics also argue that it fails to account for taxpayers' varying abilities to pay, potentially exacerbating economic disparities and reducing overall social welfare.

Drawbacks of Flat Tax

Flat tax systems can disproportionately burden low-income earners by applying a single tax rate to all income levels, reducing the progressivity seen in proportional tax models. This lack of graduated rates may lead to increased income inequality and limit the government's ability to implement redistributive fiscal policies. Critics argue that flat taxes often result in lower revenue generation, potentially reducing funds for essential public services and social programs.

Impact on Economic Equality and Fairness

Proportional tax systems charge a consistent tax rate across all income levels, which can limit government revenue for redistributive programs and often maintain existing economic inequalities. Flat tax systems impose a single tax rate on all taxpayers regardless of income, simplifying tax administration but potentially placing a higher relative burden on lower-income individuals, thereby raising concerns about fairness. Both tax structures impact economic equality differently, with progressive tax models generally seen as more effective in reducing income disparities.

Choosing the Right Tax System

Choosing the right tax system depends on economic goals such as equity, simplicity, and revenue generation. Proportional tax imposes a uniform rate on all income levels, promoting fairness and administrative ease but may not address income inequality adequately. Flat tax offers predictability and encourages compliance, yet it risks disproportionately burdening lower-income earners compared to progressive structures.

Proportional tax Infographic

libterm.com

libterm.com