Deadweight loss occurs when market inefficiencies lead to a loss of economic value, reducing overall welfare. It typically arises from taxes, price controls, or monopolies that prevent the optimal allocation of resources. Discover how deadweight loss impacts Your financial decisions and the broader economy in the rest of this article.

Table of Comparison

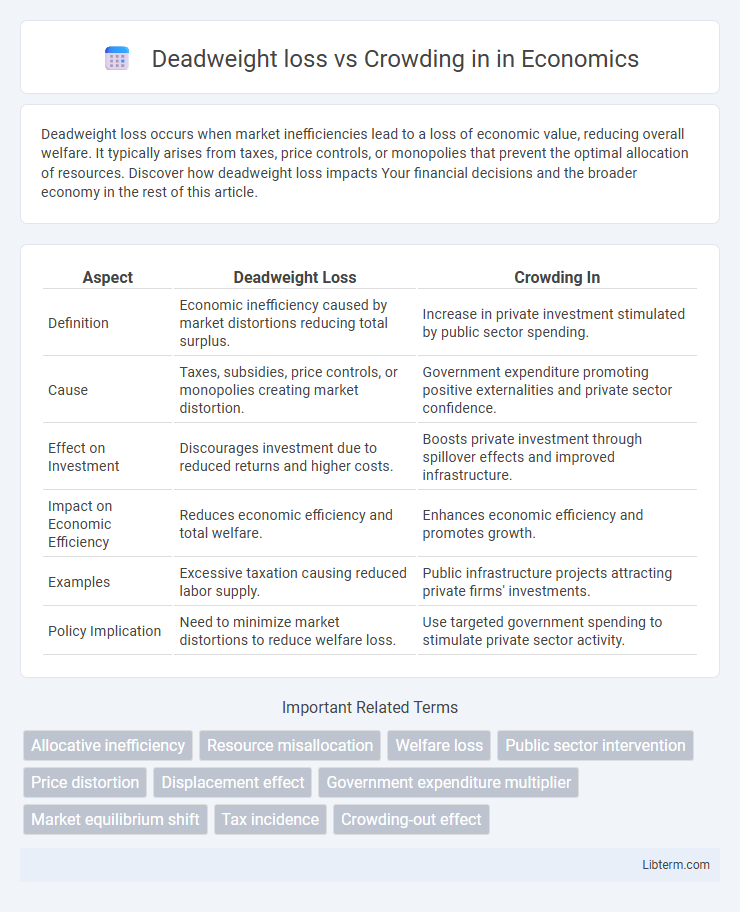

| Aspect | Deadweight Loss | Crowding In |

|---|---|---|

| Definition | Economic inefficiency caused by market distortions reducing total surplus. | Increase in private investment stimulated by public sector spending. |

| Cause | Taxes, subsidies, price controls, or monopolies creating market distortion. | Government expenditure promoting positive externalities and private sector confidence. |

| Effect on Investment | Discourages investment due to reduced returns and higher costs. | Boosts private investment through spillover effects and improved infrastructure. |

| Impact on Economic Efficiency | Reduces economic efficiency and total welfare. | Enhances economic efficiency and promotes growth. |

| Examples | Excessive taxation causing reduced labor supply. | Public infrastructure projects attracting private firms' investments. |

| Policy Implication | Need to minimize market distortions to reduce welfare loss. | Use targeted government spending to stimulate private sector activity. |

Introduction to Economic Inefficiencies

Deadweight loss represents the loss of economic efficiency when market equilibrium is not achieved, often caused by taxes, subsidies, or price controls that distort supply and demand. Crowding in occurs when increased government spending stimulates private investment, potentially reducing deadweight loss by improving resource allocation. Both concepts illustrate different mechanisms of economic inefficiencies, highlighting how market interventions can either exacerbate or mitigate losses in total welfare.

Defining Deadweight Loss: Causes and Examples

Deadweight loss refers to the loss of economic efficiency when the equilibrium outcome is not achievable due to market distortions such as taxes, price controls, or monopolies. It causes a reduction in total surplus, as resources are either underutilized or misallocated, resulting in costs that exceed benefits to society. Examples include excessive taxation leading to decreased labor supply or monopolistic pricing reducing consumer and producer welfare simultaneously.

Understanding Crowding In: Mechanisms and Impacts

Crowding in occurs when increased government spending stimulates additional private sector investment, often by improving infrastructure or reducing risks, which enhances overall economic productivity. This phenomenon contrasts with deadweight loss, which represents economic inefficiency where resources are wasted due to taxes or subsidies distorting market behavior. Understanding the mechanisms of crowding in reveals its positive impact on growth by leveraging public funds to attract private capital, thereby offsetting potential deadweight losses.

Key Differences Between Deadweight Loss and Crowding In

Deadweight loss represents the inefficiency caused when resources are not allocated optimally, often due to taxes, subsidies, or market distortions, leading to lost economic welfare. Crowding in occurs when increased government spending stimulates additional private sector investment, enhancing overall economic activity and productivity. The key difference lies in deadweight loss signaling economic inefficiency and welfare loss, while crowding in indicates positive fiscal influence boosting private investment and economic growth.

Government Intervention and Deadweight Loss

Government intervention through taxation or subsidies often leads to deadweight loss, representing inefficiency in resource allocation where total surplus is reduced. Crowding in occurs when public sector spending stimulates private investment, enhancing economic activity rather than displacing it. Understanding the balance between deadweight loss and crowding in is crucial for designing policies that minimize inefficiency while maximizing positive economic impacts.

Public Spending and the Crowding In Effect

Public spending can lead to crowding in when government investments stimulate additional private sector activity, enhancing overall economic output. Unlike deadweight loss caused by inefficiencies and market distortions from taxation or subsidies, crowding in reflects positive spillover effects that increase total demand and investment. Understanding the balance between deadweight loss and crowding in is crucial for designing fiscal policies that maximize social welfare without undermining private incentives.

Real-World Case Studies: Deadweight Loss vs. Crowding In

Deadweight loss occurs when market inefficiencies cause a reduction in total surplus, as seen in cases like rent control in New York City, which led to housing shortages. Crowding in happens when public investment stimulates additional private sector spending, exemplified by government infrastructure projects in China boosting private construction activities. Real-world case studies highlight that while deadweight loss reduces economic efficiency, crowding in can enhance overall economic growth by leveraging public funds to attract private investment.

Policy Implications for Economic Growth

Deadweight loss occurs when market inefficiencies cause a loss of economic surplus, reducing overall welfare and hindering growth by misallocating resources. Crowding in refers to increased private investment spurred by effective public spending, enhancing capital accumulation and long-term productivity. Policymakers should design interventions that minimize deadweight loss while leveraging crowding in effects to stimulate sustainable economic growth and improve resource efficiency.

Measuring Efficiency: Tools and Indicators

Deadweight loss quantifies the loss of economic efficiency when market equilibrium is disrupted, typically measured through changes in consumer and producer surplus. Crowding in refers to increased private investment stimulated by public spending, assessed by tracking shifts in investment levels relative to government expenditures. Efficiency measurement tools include cost-benefit analysis, shadow pricing, and marginal analysis to capture these effects accurately in resource allocation.

Conclusion: Balancing Efficiency and Public Investment

Deadweight loss represents the economic inefficiency arising from market distortions, while crowding in occurs when public investment stimulates additional private sector spending. Effective policy must balance minimizing deadweight loss with fostering crowding in to enhance overall economic growth. Prioritizing projects with strong multiplier effects can optimize public investment efficiency and reduce negative market impacts.

Deadweight loss Infographic

libterm.com

libterm.com