Monopoly is a classic board game that challenges players to buy, trade, and develop properties to bankrupt opponents. Strategic decisions about investment and negotiation skills determine your success in dominating the game board. Discover essential tips and strategies in the rest of this article to master Monopoly.

Table of Comparison

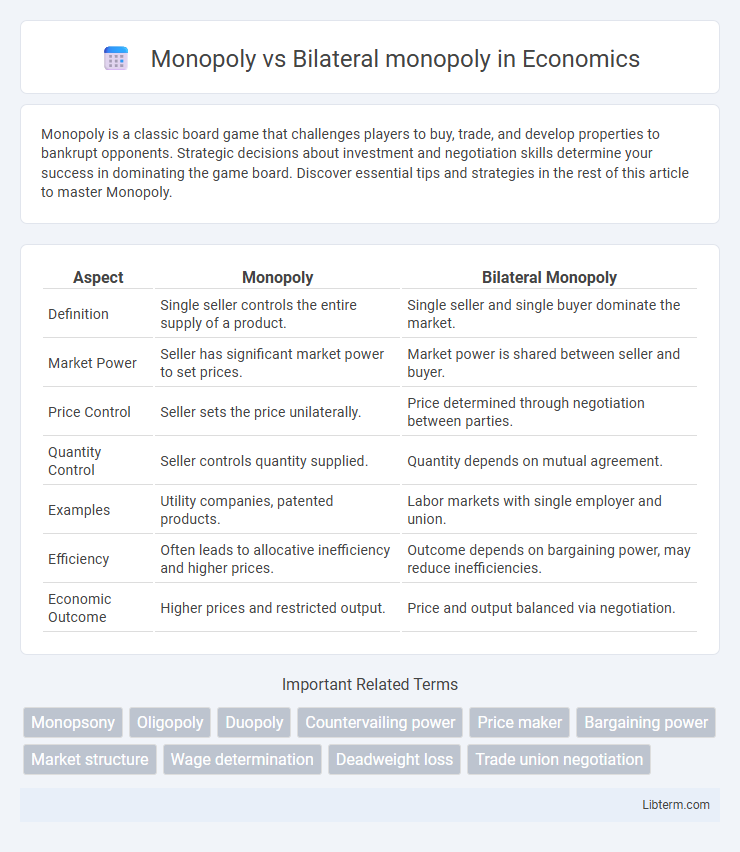

| Aspect | Monopoly | Bilateral Monopoly |

|---|---|---|

| Definition | Single seller controls the entire supply of a product. | Single seller and single buyer dominate the market. |

| Market Power | Seller has significant market power to set prices. | Market power is shared between seller and buyer. |

| Price Control | Seller sets the price unilaterally. | Price determined through negotiation between parties. |

| Quantity Control | Seller controls quantity supplied. | Quantity depends on mutual agreement. |

| Examples | Utility companies, patented products. | Labor markets with single employer and union. |

| Efficiency | Often leads to allocative inefficiency and higher prices. | Outcome depends on bargaining power, may reduce inefficiencies. |

| Economic Outcome | Higher prices and restricted output. | Price and output balanced via negotiation. |

Introduction to Monopoly and Bilateral Monopoly

A monopoly exists when a single seller dominates a market with no close substitutes, enabling price control and significant market power. In contrast, a bilateral monopoly features a single seller and a single buyer, where both parties have market power, leading to unique negotiation dynamics over price and quantity. Understanding the foundational differences between these market structures is crucial for analyzing pricing strategies and market outcomes.

Defining Monopoly: Key Features

A monopoly exists when a single firm dominates the entire market, controlling the supply and setting prices without competition. Key features include a single seller, unique product with no close substitutes, and high barriers to entry preventing other firms from entering the market. In contrast, a bilateral monopoly occurs when a single seller faces a single buyer, resulting in a unique negotiation power dynamic between the two parties.

Understanding Bilateral Monopoly: Core Concepts

A bilateral monopoly occurs when a single seller (monopolist) faces a single buyer (monopsonist), creating a unique market structure with mutual interdependence. This scenario leads to complex bargaining dynamics, where both parties influence price and output decisions, unlike a pure monopoly with a single seller controlling the market. Understanding bilateral monopoly is crucial for analyzing negotiation outcomes, wage settings in labor markets, and pricing in exclusive supply contracts.

Market Structure Differences

Monopoly features a single seller dominating the entire market with many buyers, resulting in price-setting power and lack of competition. Bilateral monopoly consists of a single seller and a single buyer, creating a strategic negotiation environment for prices and quantities. Market structure differences highlight monopolies' unilateral control versus bilateral monopolies' interdependent bargaining dynamics.

Price Determination in Monopoly

In a monopoly, price determination is solely controlled by the single seller who maximizes profit by equating marginal cost (MC) with marginal revenue (MR), leading to a price above marginal cost and restricted output. Unlike in a bilateral monopoly where a single buyer and single seller interact, the monopolist faces the entire market demand curve and sets prices accordingly without direct negotiation with buyers. The inability of consumers to influence price in a monopoly contrasts with the bargaining dynamics present in a bilateral monopoly scenario.

Wage and Price Negotiation in Bilateral Monopoly

In a bilateral monopoly, wage and price negotiations occur uniquely between a single buyer and a single seller, contrasting with a monopoly where the seller faces many buyers. The wage rate is often determined through bargaining power, with labor unions (monopsonist) negotiating against the sole employer (monopoly) to set fair wages. This negotiation dynamic leads to wage rates and prices that reflect the relative market power of each party, balancing labor supply and demand more equitably than in pure monopolies.

Economic Efficiency and Welfare Implications

Monopoly markets typically result in allocative inefficiency due to higher prices and restricted output, leading to deadweight loss and reduced consumer surplus. Bilateral monopolies, featuring a single seller and a single buyer, may achieve a more balanced price negotiation, potentially improving economic efficiency by minimizing monopoly power on both sides. Welfare implications in bilateral monopolies can be complex, as bargaining can lead to outcomes closer to competitive equilibrium, but persistent market power on either side may still distort resource allocation and reduce total welfare.

Real-World Examples of Monopoly

Real-world examples of monopoly include utility companies like American Telephone & Telegraph (AT&T) before its breakup, controlling entire markets for telephone service in certain regions. In contrast, a bilateral monopoly occurs when a single seller faces a single buyer, such as government procurement contracts with a sole defense contractor. Understanding these market structures helps analyze pricing power and negotiation dynamics between monopolists and exclusive buyers.

Real-World Examples of Bilateral Monopoly

Bilateral monopoly occurs when a single seller (monopolist) faces a single buyer (monopsonist), creating unique market dynamics seen in labor unions negotiating with a sole employer, such as the UAW with General Motors. In energy markets, regional utility companies as sole buyers negotiate with exclusive providers of power, exemplifying bilateral monopoly. This contrasts with a pure monopoly where the single seller dominates multiple buyers without the negotiation power held by a single buyer.

Conclusion: Comparing Monopoly and Bilateral Monopoly

A monopoly features a single seller dominating the market, while a bilateral monopoly involves one seller and one buyer, each with significant market power. The key difference lies in the bargaining dynamics, where price and output are determined through negotiation rather than unilateral decision-making. Bilateral monopoly situations often lead to outcomes that balance seller's pricing power with buyer's purchasing influence, creating a market environment distinct from the traditional monopoly structure.

Monopoly Infographic

libterm.com

libterm.com