Market Timing Theory suggests that investors can predict market movements and adjust their portfolios to buy low and sell high, aiming to maximize returns. This approach relies heavily on accurately forecasting economic trends, interest rates, and market cycles, a challenging task even for seasoned professionals. Explore the rest of this article to understand the feasibility and risks involved in attempting to time the market effectively.

Table of Comparison

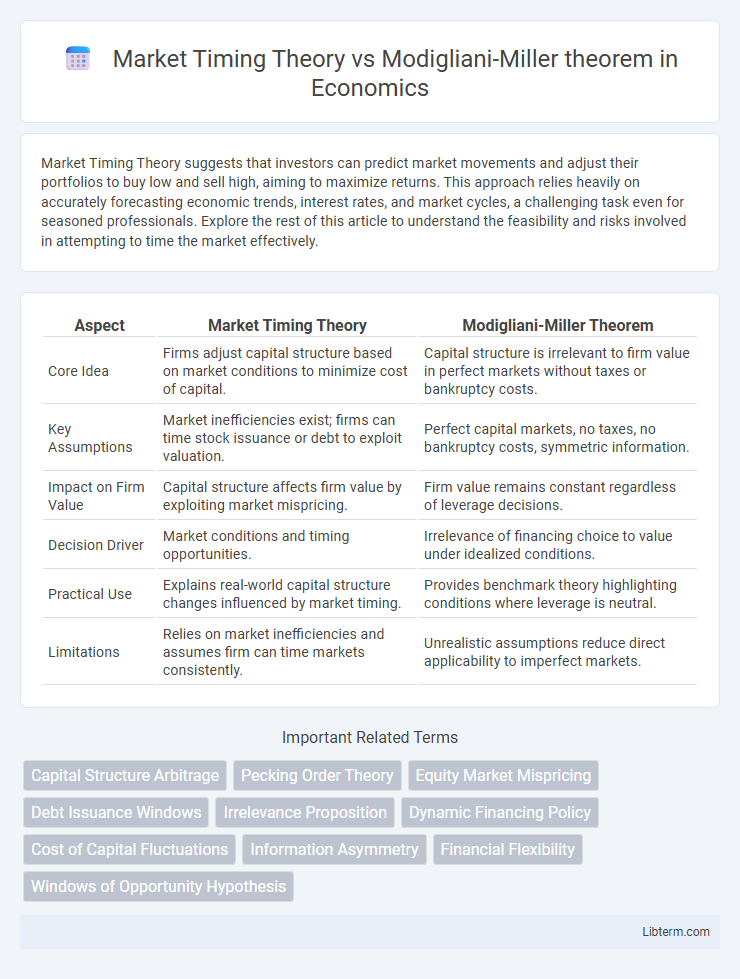

| Aspect | Market Timing Theory | Modigliani-Miller Theorem |

|---|---|---|

| Core Idea | Firms adjust capital structure based on market conditions to minimize cost of capital. | Capital structure is irrelevant to firm value in perfect markets without taxes or bankruptcy costs. |

| Key Assumptions | Market inefficiencies exist; firms can time stock issuance or debt to exploit valuation. | Perfect capital markets, no taxes, no bankruptcy costs, symmetric information. |

| Impact on Firm Value | Capital structure affects firm value by exploiting market mispricing. | Firm value remains constant regardless of leverage decisions. |

| Decision Driver | Market conditions and timing opportunities. | Irrelevance of financing choice to value under idealized conditions. |

| Practical Use | Explains real-world capital structure changes influenced by market timing. | Provides benchmark theory highlighting conditions where leverage is neutral. |

| Limitations | Relies on market inefficiencies and assumes firm can time markets consistently. | Unrealistic assumptions reduce direct applicability to imperfect markets. |

Introduction to Market Timing Theory and Modigliani-Miller Theorem

Market Timing Theory posits that firms capitalize on market conditions by issuing equity when stock prices are high and repurchasing shares or issuing debt when prices are low, aiming to minimize capital costs and maximize firm value. The Modigliani-Miller theorem establishes that, in perfect markets without taxes or bankruptcy costs, a firm's capital structure is irrelevant to its overall value, emphasizing that financing decisions do not affect firm valuation. These foundational theories contrast by highlighting market conditions' role in financing strategies versus the irrelevance of capital structure in idealized financial environments.

Historical Background and Development

Market Timing Theory emerged in the 1980s, emphasizing that firms capitalize on market conditions by issuing equity when stock prices are high and repurchasing shares when prices are low, a concept supported by empirical evidence from firms' financing behavior. The Modigliani-Miller theorem, formulated in the 1950s by Franco Modigliani and Merton Miller, established the foundational principle that in perfect markets without taxes or bankruptcy costs, a firm's value is unaffected by its capital structure, forming the basis for modern capital structure theories. Both theories represent critical developments in corporate finance, with Market Timing Theory challenging and extending the Modigliani-Miller framework by incorporating market imperfections and timing strategies into capital structure decisions.

Key Principles of Market Timing Theory

Market Timing Theory posits that firms strategically issue equity when stock prices are overvalued and repurchase shares or issue debt when stock prices are undervalued, aiming to minimize the cost of capital. This theory contrasts with the Modigliani-Miller theorem, which assumes capital structure irrelevance in perfect markets, emphasizing no advantage in timing equity or debt issuance. Key principles include the firm's ability to assess market conditions accurately and the persistence of market inefficiencies that create opportunities for value-enhancing capital structure adjustments.

Core Concepts of the Modigliani-Miller Theorem

The Modigliani-Miller theorem posits that in perfect capital markets, a firm's value is unaffected by its capital structure, emphasizing the irrelevance of debt-equity mix for firm valuation. Core concepts include the assumptions of no taxes, bankruptcy costs, or asymmetric information, enabling the theory to isolate the impact of capital structure from firm value. This theorem contrasts with Market Timing Theory, which suggests firms strategically choose financing based on market conditions to maximize firm value.

Assumptions Underlying Each Theory

Market Timing Theory assumes that investors can successfully predict market conditions and issue equity or debt based on favorable market prices, relying on timing advantages and market inefficiencies. The Modigliani-Miller theorem operates under assumptions of perfect capital markets, no taxes, no bankruptcy costs, and symmetric information, asserting that a firm's value is unaffected by its capital structure. These contrasting assumptions highlight that Market Timing Theory depends on market imperfections and investor foresight, while Modigliani-Miller assumes idealized, frictionless markets.

How Market Timing Theory Challenges MM Theorem

Market Timing Theory challenges the Modigliani-Miller theorem by asserting that firms capitalize on prevailing market conditions to time their equity issuance and debt financing, thereby influencing capital structure dynamically rather than adhering to a fixed optimal mix. Unlike the MM theorem's assumption of market efficiency and irrelevance of capital structure, Market Timing Theory emphasizes investor sentiment and market mispricing as key drivers in managerial financing decisions. Empirical evidence shows firms tend to issue equity when stock prices are overvalued and repurchase shares or issue debt when undervalued, contradicting MM's proposition of capital structure neutrality.

Empirical Evidence: Market Timing vs. MM in Practice

Empirical evidence reveals that Market Timing Theory, which posits firms capitalize on market conditions to issue equity when valuations are high, shows mixed results with some studies confirming temporary stock price effects but limited long-term impact on firm value. In contrast, the Modigliani-Miller theorem asserts capital structure irrelevance under perfect market conditions, supported by empirical findings that highlight the minimal influence of leverage changes on firm valuation absent taxes, bankruptcy costs, or asymmetric information. Practical data suggests firms often deviate from MM's assumptions, using market timing strategically despite its imperfect outcomes, indicating real-world capital structure decisions blend theoretical insights with observed market behavior.

Practical Implications for Corporate Finance

Market Timing Theory suggests firms capitalize on market conditions by issuing equity when stock prices are high and repurchasing shares when undervalued, influencing capital structure dynamically. In contrast, the Modigliani-Miller theorem posits that under perfect market conditions, a firm's value is unaffected by its capital structure, implying financing decisions do not affect firm value. Practically, firms often blend insights from both theories, using market timing to optimize financing costs while recognizing that real-world frictions like taxes and bankruptcy risk validate deviations from Modigliani-Miller's propositions.

Criticisms and Limitations of Both Theories

Market Timing Theory faces criticism for its reliance on investors' ability to predict market conditions accurately, which empirical evidence often disputes, leading to inconsistent capital structure outcomes. The Modigliani-Miller theorem assumes perfect capital markets without taxes, bankruptcy costs, or asymmetric information, limiting its practical applicability and failing to capture real-world financial frictions. Both theories are constrained by their idealized assumptions, with Market Timing Theory's empirical support being weak and Modigliani-Miller's framework being largely theoretical, reducing their effectiveness in guiding corporate financing decisions.

Conclusion: Reconciling Market Timing and MM Theorem

Market Timing Theory emphasizes that firms strategically issue equity when stock prices are high and repurchase shares when prices are low, influencing capital structure based on market conditions. The Modigliani-Miller theorem posits capital structure irrelevance under perfect markets, asserting firm value is unaffected by financing decisions. Reconciling these views recognizes market imperfections where market timing impacts observed capital structure, but long-term firm value aligns with MM's theoretical framework under efficient market assumptions.

Market Timing Theory Infographic

libterm.com

libterm.com