Diseconomies of scale occur when a company grows so large that the costs per unit increase, reducing overall efficiency and profitability. Factors such as management inefficiencies, communication breakdowns, and increased complexity can lead to higher operational costs. Explore the rest of the article to understand how these challenges can impact your business and strategies to manage them effectively.

Table of Comparison

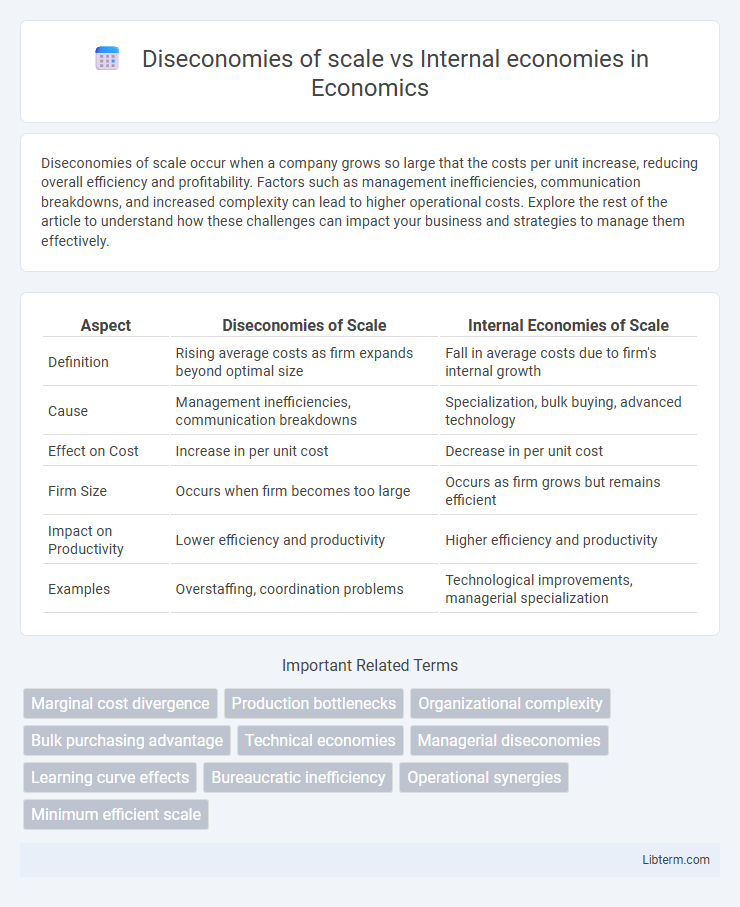

| Aspect | Diseconomies of Scale | Internal Economies of Scale |

|---|---|---|

| Definition | Rising average costs as firm expands beyond optimal size | Fall in average costs due to firm's internal growth |

| Cause | Management inefficiencies, communication breakdowns | Specialization, bulk buying, advanced technology |

| Effect on Cost | Increase in per unit cost | Decrease in per unit cost |

| Firm Size | Occurs when firm becomes too large | Occurs as firm grows but remains efficient |

| Impact on Productivity | Lower efficiency and productivity | Higher efficiency and productivity |

| Examples | Overstaffing, coordination problems | Technological improvements, managerial specialization |

Understanding Economies and Diseconomies of Scale

Economies of scale occur when increasing production leads to lower average costs due to factors such as specialization, bulk purchasing, and operational efficiencies within a firm. Diseconomies of scale arise when a company grows too large, causing inefficiencies like communication breakdowns, coordination problems, and increased bureaucracy. Understanding these concepts helps businesses optimize size and production to balance cost advantages against potential operational challenges.

Defining Internal Economies of Scale

Internal economies of scale refer to cost advantages that a firm experiences as it increases production, leading to lower average costs per unit. These benefits arise from factors such as improved operational efficiency, specialization of labor, and better utilization of capital equipment within the company. In contrast, diseconomies of scale occur when a company's expansion causes average costs to rise due to management inefficiencies or resource limitations.

Major Types of Internal Economies

Internal economies of scale refer to cost advantages that a firm gains as it increases production within its own operations, including technical economies from advanced machinery, managerial economies through specialized management, and marketing economies achieved by bulk buying and efficient advertising. Diseconomies of scale occur when a company grows so large that inefficiencies arise, causing average costs per unit to increase due to factors like coordination difficulties and communication breakdowns. Understanding these major types of internal economies helps firms optimize growth by maximizing cost savings before diseconomies of scale set in.

Sources of Internal Economies in Firms

Sources of internal economies in firms include technical economies, arising from improved production techniques and specialized machinery, and managerial economies, stemming from the division of labor and expertise in administration. Financial economies occur when larger firms secure lower interest rates and better credit terms due to their size and lower risk profile. Marketing economies arise from bulk buying and advertising, reducing per-unit costs, while network economies result from an expanded customer base and enhanced brand recognition.

Concept of Diseconomies of Scale

Diseconomies of scale occur when a firm's expansion leads to increased per-unit costs due to factors like management inefficiencies, communication breakdowns, and coordination challenges. These inefficiencies counteract the cost advantages of internal economies, which arise from factors such as specialized labor, bulk purchasing, and technological improvements resulting in lower average costs. Understanding the threshold at which growth shifts from economies to diseconomies of scale is crucial for optimizing organizational size and operational efficiency.

Causes of Diseconomies of Scale

Diseconomies of scale occur when a firm's long-run average costs increase as output expands, often caused by factors such as management inefficiencies, communication breakdowns, and coordination challenges within large organizations. Internal causes include bureaucratic delays, worker alienation, and difficulties in maintaining quality control across extensive operations. These inefficiencies counteract the cost advantages gained from internal economies of scale, such as specialization and bulk purchasing, leading to higher per-unit costs at larger production levels.

Key Differences: Internal Economies vs Diseconomies of Scale

Internal economies of scale refer to cost advantages a firm gains as it increases production, such as improved labor efficiency, bulk purchasing, and advanced technology adoption. Diseconomies of scale occur when a firm's growth leads to inefficiencies, such as communication breakdowns, increased bureaucracy, and management challenges, causing average costs to rise. The key difference lies in internal economies reducing average costs through growth, while diseconomies of scale increase average costs due to operational inefficiencies at larger scales.

Impact on Business Efficiency and Cost Structure

Diseconomies of scale increase a firm's average costs as production expands beyond optimal capacity, leading to reduced operational efficiency due to factors like management complexity and communication breakdowns. Internal economies of scale, conversely, lower average costs through improved efficiencies such as bulk purchasing, specialized labor, and advanced technology within the organization. The interplay between these forces directly influences a business's cost structure, determining whether growth enhances profitability or incurs inefficiencies that erode cost advantages.

Real-World Examples and Case Studies

Internal economies refer to cost advantages gained by firms as they increase production scale, exemplified by Amazon's investment in automation and logistics, which lowered per-unit costs and enhanced efficiency. Diseconomies of scale occur when a company grows too large, leading to inefficiencies such as communication breakdowns and bureaucracy; a notable case is General Motors in the 1980s, which faced coordination problems and rising costs despite its size. Real-world examples highlight how firms must balance growth to leverage internal economies while avoiding the pitfalls of diseconomies, optimizing operational and managerial strategies to sustain profitability.

Strategic Implications for Business Growth

Diseconomies of scale occur when a firm's expansion leads to rising per-unit costs due to inefficiencies, while internal economies of scale enable cost reductions through optimized operations and resource management. Businesses must strategically balance growth to maximize internal economies such as enhanced labor specialization and technology use, avoiding overexpansion that triggers managerial challenges and communication breakdowns causing diseconomies. Effective growth strategies hinge on scalable organizational structures and controlled complexity to sustain competitive advantage and long-term profitability.

Diseconomies of scale Infographic

libterm.com

libterm.com