The liquidity coverage ratio (LCR) measures a bank's ability to withstand short-term financial stress by holding sufficient high-quality liquid assets to cover net cash outflows over 30 days. This crucial regulatory standard ensures financial institutions maintain resilience during liquidity crises, safeguarding the broader economy. Explore the rest of the article to understand how LCR impacts your bank's stability and the financial system at large.

Table of Comparison

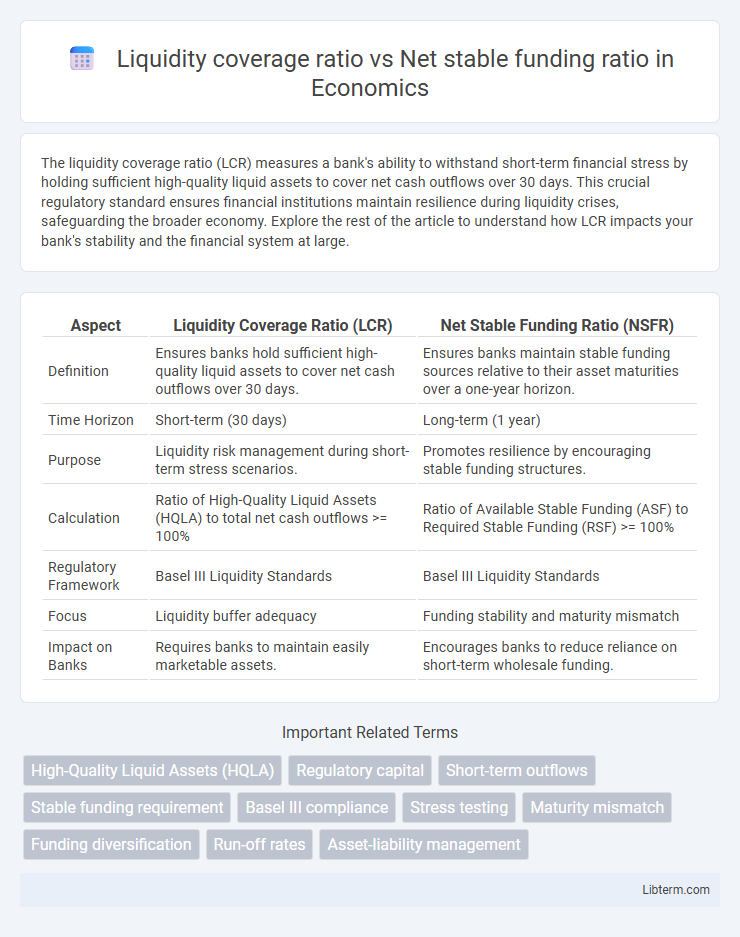

| Aspect | Liquidity Coverage Ratio (LCR) | Net Stable Funding Ratio (NSFR) |

|---|---|---|

| Definition | Ensures banks hold sufficient high-quality liquid assets to cover net cash outflows over 30 days. | Ensures banks maintain stable funding sources relative to their asset maturities over a one-year horizon. |

| Time Horizon | Short-term (30 days) | Long-term (1 year) |

| Purpose | Liquidity risk management during short-term stress scenarios. | Promotes resilience by encouraging stable funding structures. |

| Calculation | Ratio of High-Quality Liquid Assets (HQLA) to total net cash outflows >= 100% | Ratio of Available Stable Funding (ASF) to Required Stable Funding (RSF) >= 100% |

| Regulatory Framework | Basel III Liquidity Standards | Basel III Liquidity Standards |

| Focus | Liquidity buffer adequacy | Funding stability and maturity mismatch |

| Impact on Banks | Requires banks to maintain easily marketable assets. | Encourages banks to reduce reliance on short-term wholesale funding. |

Introduction to Bank Liquidity Standards

The Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand short-term liquidity disruptions by requiring high-quality liquid assets sufficient to cover net cash outflows over 30 days. In contrast, the Net Stable Funding Ratio (NSFR) assesses long-term funding stability by ensuring that available stable funding consistently exceeds required stable funding over a one-year horizon. Both standards are integral components of Basel III regulations, designed to enhance the resilience of banks against liquidity risks and promote overall financial stability.

Defining the Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand a 30-day period of financial stress by maintaining an adequate level of high-quality liquid assets (HQLA). It is calculated by dividing HQLA by total net cash outflows over the next 30 calendar days, ensuring short-term liquidity resilience. This regulatory metric supports banks in managing liquidity risk and enhancing financial stability in times of market disruptions.

Understanding the Net Stable Funding Ratio (NSFR)

The Net Stable Funding Ratio (NSFR) measures a bank's long-term liquidity by requiring stable funding sources to cover its long-term assets, promoting resilience over one year. Unlike the short-term focus of the Liquidity Coverage Ratio (LCR), NSFR ensures banks maintain a sustainable funding profile that reduces reliance on volatile liabilities. Regulatory standards set by Basel III mandate maintaining an NSFR of at least 100%, reflecting a bank's ability to withstand liquidity stress in an extended time horizon.

Key Objectives: LCR vs. NSFR

Liquidity Coverage Ratio (LCR) focuses on ensuring banks hold sufficient high-quality liquid assets to cover short-term liquidity stress over a 30-day period, promoting short-term resilience. Net Stable Funding Ratio (NSFR) mandates banks maintain a stable funding profile relative to their assets over a one-year horizon, fostering long-term funding stability. Both metrics strengthen financial institutions' liquidity management but target different time frames and risk aspects.

Components of the Liquidity Coverage Ratio

The Liquidity Coverage Ratio (LCR) focuses on maintaining high-quality liquid assets (HQLA) sufficient to cover net cash outflows over a 30-day stress period, emphasizing components such as cash inflows, cash outflows, and stock of HQLA. Net cash outflows are calculated by subtracting expected cash inflows from cash outflows, with strict caps on inflows to ensure liquidity adequacy. The LCR's components are designed to promote short-term resilience by prioritizing assets that can be quickly and reliably converted to cash under stress conditions.

Components of the Net Stable Funding Ratio

The Net Stable Funding Ratio (NSFR) measures a bank's available stable funding relative to its required stable funding over a one-year horizon, focusing on long-term liquidity resilience. Key components of the NSFR include Available Stable Funding (ASF), which comprises liabilities like retail deposits, wholesale funding with maturities beyond one year, and equity capital, while Required Stable Funding (RSF) accounts for assets weighted by liquidity risk, such as loans, securities, and other off-balance-sheet exposures. The NSFR complements the Liquidity Coverage Ratio (LCR) by emphasizing structural funding stability instead of short-term liquidity buffers.

Major Differences Between LCR and NSFR

Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand a 30-day liquidity stress scenario by holding high-quality liquid assets (HQLA) sufficient to cover net cash outflows. Net Stable Funding Ratio (NSFR) evaluates the stability of a bank's funding over a one-year horizon, ensuring the availability of stable funding sources relative to the liquidity profile of assets and off-balance sheet exposures. Major differences include LCR's short-term focus on liquidity adequacy versus NSFR's long-term emphasis on funding stability, the distinct time horizons used (30 days for LCR, 12 months for NSFR), and the specific asset and liability compositions considered under each metric.

Regulatory Importance of LCR and NSFR

The Liquidity Coverage Ratio (LCR) ensures banks maintain an adequate level of high-quality liquid assets to cover net cash outflows for 30 days, bolstering short-term resilience during financial stress. The Net Stable Funding Ratio (NSFR) promotes long-term financial stability by requiring a minimum amount of stable funding relative to the bank's assets and off-balance-sheet activities over a one-year horizon. Both LCR and NSFR are critical Basel III regulatory standards designed to strengthen liquidity risk management and reduce systemic vulnerabilities in the banking sector.

Impact on Bank Operations and Risk Management

The Liquidity Coverage Ratio (LCR) ensures banks maintain high-quality liquid assets to cover short-term obligations, directly impacting daily liquidity management by prioritizing immediate cash flow stability. The Net Stable Funding Ratio (NSFR) promotes long-term funding resilience, influencing strategic asset-liability management and fostering a stable funding structure over a one-year horizon. Both ratios complement bank risk management by mitigating liquidity risk and enhancing overall financial stability through distinct temporal focus areas.

Future Trends in Liquidity Regulation

Future trends in liquidity regulation emphasize enhanced global standards for both the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to address evolving market risks and economic uncertainties. Regulatory bodies like the Basel Committee on Banking Supervision are increasingly integrating stress-testing frameworks and digital reporting requirements to improve transparency and resilience. Advances in data analytics and artificial intelligence are expected to play a critical role in dynamically monitoring liquidity positions, enabling more proactive risk management and compliance with tightened capital adequacy norms.

Liquidity coverage ratio Infographic

libterm.com

libterm.com