The marginal tax rate determines the percentage of tax applied to each additional dollar of income earned, directly impacting your take-home pay and financial decisions. Understanding how this rate changes with income levels helps optimize tax planning and maximize after-tax income. Explore the rest of the article to learn how adjusting your income can influence your marginal tax rate and overall tax strategy.

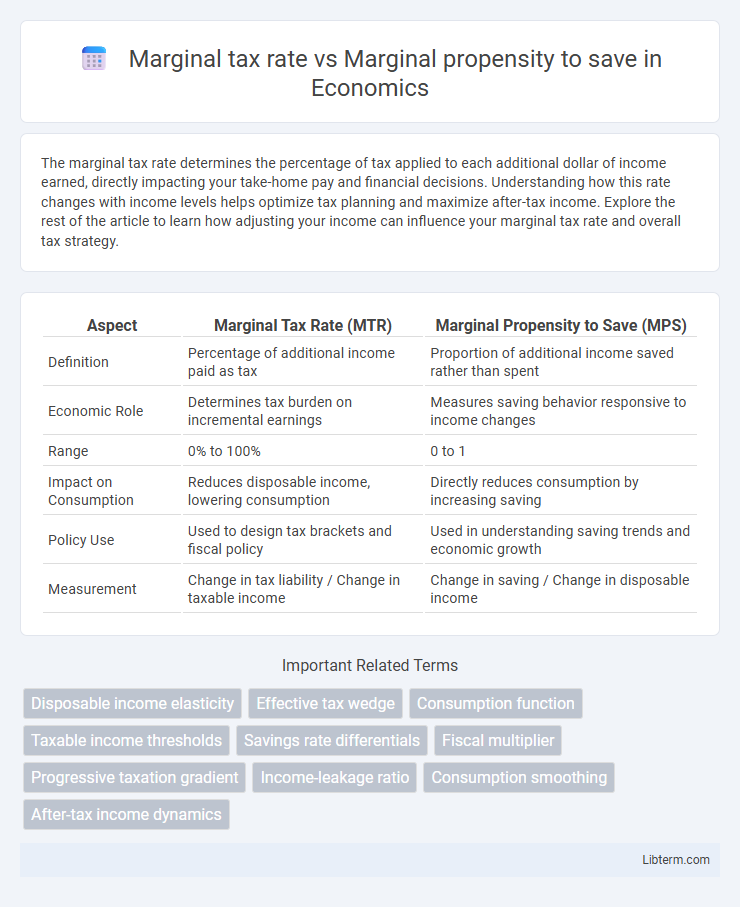

Table of Comparison

| Aspect | Marginal Tax Rate (MTR) | Marginal Propensity to Save (MPS) |

|---|---|---|

| Definition | Percentage of additional income paid as tax | Proportion of additional income saved rather than spent |

| Economic Role | Determines tax burden on incremental earnings | Measures saving behavior responsive to income changes |

| Range | 0% to 100% | 0 to 1 |

| Impact on Consumption | Reduces disposable income, lowering consumption | Directly reduces consumption by increasing saving |

| Policy Use | Used to design tax brackets and fiscal policy | Used in understanding saving trends and economic growth |

| Measurement | Change in tax liability / Change in taxable income | Change in saving / Change in disposable income |

Introduction to Marginal Tax Rate and Marginal Propensity to Save

The marginal tax rate measures the percentage of tax applied to each additional dollar of income, influencing disposable income and work incentives. The marginal propensity to save (MPS) represents the fraction of additional income that households save rather than consume, affecting overall savings and investment levels. Understanding the interaction between marginal tax rate and MPS is critical for analyzing economic behavior and fiscal policy impact on saving patterns.

Defining Marginal Tax Rate

Marginal tax rate refers to the percentage of tax applied to an additional dollar of income earned, directly impacting an individual's take-home pay and disposable income. This rate influences economic decisions, notably the marginal propensity to save, which measures the fraction of additional income that is saved rather than spent. Higher marginal tax rates can reduce the incentive to save by decreasing the net benefit of earning extra income.

Understanding Marginal Propensity to Save

Marginal Propensity to Save (MPS) represents the fraction of additional income that a household saves rather than spends, typically ranging between 0 and 1. Unlike the marginal tax rate, which denotes the percentage of additional income taxed by the government, MPS directly influences consumer saving behavior and overall economic growth through its impact on aggregate demand. Understanding MPS is essential for analyzing how fiscal policies affect savings rates, consumption patterns, and investment in an economy.

Key Differences: Taxation vs. Saving Behavior

Marginal tax rate measures the percentage of tax applied to each additional dollar of income, directly affecting disposable income and government revenue. Marginal propensity to save quantifies the portion of additional income that a household saves rather than spends, reflecting individual saving behavior. The key difference lies in taxation being a policy-driven deduction from income, while saving behavior is a personal economic choice influenced by factors like income levels and future expectations.

How Marginal Tax Rates Influence Consumption

Marginal tax rates directly impact disposable income by reducing the amount of additional earnings individuals keep, which in turn affects their consumption patterns. Higher marginal tax rates decrease the marginal propensity to consume because with less after-tax income, savers tend to allocate a larger portion toward savings rather than immediate spending. Empirical studies show that an increase in marginal tax rates often leads to a lower consumption rate as households adjust their budget constraints, prioritizing saving to maintain future financial stability.

The Role of Marginal Propensity to Save in Economic Models

Marginal propensity to save (MPS) measures the portion of additional income that households save rather than spend, playing a crucial role in economic models by influencing the multiplier effect and overall consumption patterns. Unlike the marginal tax rate, which directly reduces disposable income through taxation, MPS determines the velocity of money circulation and savings accumulation, impacting long-term economic growth and investment. Understanding MPS helps economists predict how changes in income affect saving behavior, aggregate demand, and fiscal policy outcomes within macroeconomic frameworks.

Policy Implications: Taxation and Saving Patterns

Marginal tax rates directly influence individuals' marginal propensity to save by altering after-tax income and incentives to defer consumption. Higher marginal tax rates on income can reduce saving rates as disposable income decreases, discouraging long-term financial accumulation. Policymakers must balance tax structures to maintain efficient saving behaviors, fostering economic growth while ensuring adequate revenue.

Interaction Between Marginal Tax Rate and Savings

The interaction between the marginal tax rate and the marginal propensity to save critically influences personal saving behavior and overall economic growth. Higher marginal tax rates reduce disposable income, thereby decreasing the marginal propensity to save as individuals allocate more of their after-tax income to immediate consumption rather than future savings. Empirical studies indicate that lowering marginal tax rates can enhance savings rates by increasing the incentive to retain income, which supports greater capital accumulation and long-term investment.

Real-World Examples and Case Studies

Marginal tax rate affects individuals' disposable income, influencing their marginal propensity to save (MPS), as seen in the 2018 U.S. Tax Cuts and Jobs Act where reduced tax rates led to an increase in consumer spending and a mixed impact on savings behavior. In contrast, Scandinavian countries with higher marginal tax rates, such as Sweden, exhibit a higher MPS due to strong social safety nets promoting savings for future security. Case studies in developing economies like India reveal that moderate marginal tax rates combined with financial literacy programs significantly elevate the MPS among middle-class households.

Conclusion: Economic Impact and Practical Insights

Marginal tax rate directly affects disposable income, influencing consumers' spending and saving behavior, while marginal propensity to save (MPS) measures the proportion of additional income saved rather than spent. A higher marginal tax rate typically reduces disposable income, potentially lowering the MPS as taxpayers adjust consumption and saving patterns. Understanding the interplay between marginal tax rates and MPS provides valuable insights for fiscal policy, enabling governments to fine-tune tax structures and stimulus measures to optimize economic growth and savings rates.

Marginal tax rate Infographic

libterm.com

libterm.com