Sovereign risk refers to the possibility that a government may default on its debt obligations or take actions that negatively impact investors, such as currency devaluation or expropriation. Evaluating sovereign risk is crucial for investors and businesses engaged in international trade to protect Your assets and forecast potential financial losses. Discover how understanding sovereign risk can enhance Your global investment strategy by reading the rest of this article.

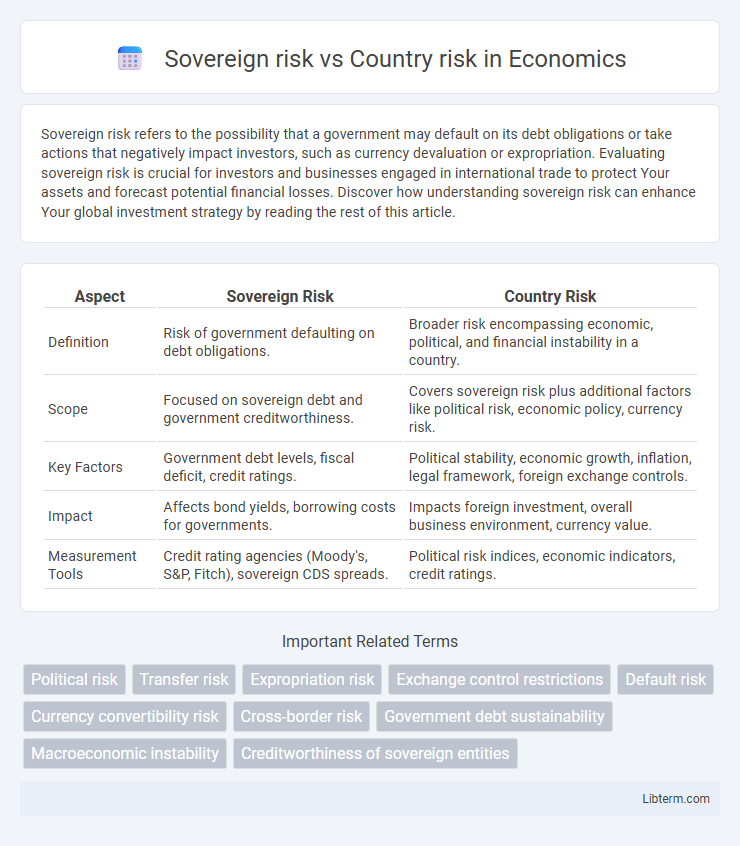

Table of Comparison

| Aspect | Sovereign Risk | Country Risk |

|---|---|---|

| Definition | Risk of government defaulting on debt obligations. | Broader risk encompassing economic, political, and financial instability in a country. |

| Scope | Focused on sovereign debt and government creditworthiness. | Covers sovereign risk plus additional factors like political risk, economic policy, currency risk. |

| Key Factors | Government debt levels, fiscal deficit, credit ratings. | Political stability, economic growth, inflation, legal framework, foreign exchange controls. |

| Impact | Affects bond yields, borrowing costs for governments. | Impacts foreign investment, overall business environment, currency value. |

| Measurement Tools | Credit rating agencies (Moody's, S&P, Fitch), sovereign CDS spreads. | Political risk indices, economic indicators, credit ratings. |

Introduction to Sovereign Risk and Country Risk

Sovereign risk refers to the possibility that a government will default on its debt obligations or enact policies that negatively affect investors, impacting sovereign bonds and foreign investments. Country risk encompasses a broader spectrum, including political instability, economic performance, currency fluctuations, and regulatory changes, all of which can influence the overall investment climate within a nation. Understanding sovereign risk as a subset of country risk helps investors assess the specific dangers associated with government-related financial exposure versus broader macroeconomic and political factors.

Defining Sovereign Risk: Core Concepts

Sovereign risk refers to the likelihood that a government will default on its debt obligations or impose capital controls, affecting investors and lenders. Core concepts include political stability, economic policies, debt levels, and foreign exchange risks that influence a sovereign's ability to meet its financial commitments. Understanding sovereign risk is essential for assessing the creditworthiness of countries and managing international investment portfolios.

Understanding Country Risk: Broader Perspectives

Country risk encompasses the total potential financial losses from investing in a specific nation due to economic, political, and social instability. Sovereign risk is a subset, specifically addressing the government's ability or willingness to meet its debt obligations. Understanding country risk requires analyzing factors beyond sovereign defaults, including currency fluctuations, regulatory changes, and geopolitical tensions.

Key Differences Between Sovereign and Country Risk

Sovereign risk refers specifically to the risk that a government will default on its debt or fail to meet its financial obligations, while country risk encompasses a broader range of factors including political instability, economic performance, and social unrest that may affect investments. Sovereign risk is primarily financial and legal in nature, involving issues like currency controls and debt restructuring, whereas country risk includes non-financial elements such as corruption, regulatory changes, and security threats. Understanding these key differences helps investors assess both the direct credit risk of government bonds and the wider macroeconomic and political environment impacting overall country exposure.

Common Factors Influencing Sovereign Risk

Sovereign risk primarily stems from a country's ability and willingness to repay its debt, influenced by factors such as political stability, fiscal policy, and external debt levels. Country risk encompasses broader economic and geopolitical elements, including currency volatility, legal environment, and economic performance. Common factors influencing sovereign risk include government debt sustainability, macroeconomic indicators like GDP growth and inflation, and political stability metrics.

Major Components of Country Risk Analysis

Country risk analysis primarily includes political risk, economic risk, and sovereign risk, each reflecting different dimensions of a country's stability and creditworthiness. Sovereign risk specifically assesses the risk of a government defaulting on its debt obligations, focusing on fiscal policies, debt levels, and foreign reserves. Other major components of country risk involve evaluating political stability, regulatory environment, economic growth, inflation rates, and external vulnerabilities such as balance of payments and exposure to global markets.

Sovereign Debt Defaults: Case Studies

Sovereign risk involves the possibility that a government will default on its debt obligations, often analyzed through notable sovereign debt defaults such as Argentina's 2001 crisis and Greece's 2015 financial turmoil. Country risk encompasses sovereign risk but also includes political instability, economic downturns, and regulatory changes affecting both government and private sector solvency. Case studies of sovereign debt defaults highlight the cascading effects on global markets, investor confidence, and credit ratings, emphasizing the critical importance of assessing sovereign risk within broader country risk frameworks.

Political and Economic Drivers of Country Risk

Sovereign risk primarily measures a government's likelihood to default on its debt obligations, while country risk encompasses a broader assessment including political, economic, and social factors impacting investments. Political drivers of country risk involve government stability, policy changes, corruption levels, and geopolitical tensions that can disrupt economic activities. Economic drivers include inflation rates, fiscal deficits, currency volatility, and the overall strength of economic institutions, which influence a country's capacity to honor financial commitments and sustain growth.

Risk Assessment Tools and Methodologies

Sovereign risk and country risk assessments utilize specialized tools such as credit rating models, political risk indices, and macroeconomic indicators to evaluate a nation's ability to meet financial obligations and the overall stability of its environment. Quantitative methodologies include econometric models analyzing fiscal deficits, debt levels, and foreign exchange reserves, while qualitative approaches assess political stability, governance quality, and regulatory frameworks. Integrating these data points enables investors and institutions to differentiate between risks related to sovereign debt default and broader economic or political instability affecting investment returns.

Sovereign Risk vs Country Risk: Implications for Investors

Sovereign risk refers specifically to the possibility that a government will default on its debt or fail to meet financial obligations, directly affecting bonds and loans issued by that country. Country risk encompasses a broader spectrum, including political instability, economic performance, and regulatory changes that can impact all investments within that nation. Investors facing sovereign risk must prioritize creditworthiness and debt sustainability, while managing country risk requires comprehensive analysis of political, economic, and currency conditions to mitigate potential financial losses.

Sovereign risk Infographic

libterm.com

libterm.com