A regressive tax imposes a higher relative burden on lower-income earners compared to those with higher incomes, as it takes a larger percentage of income from the poor than the rich. This tax structure can exacerbate income inequality by reducing the disposable income of vulnerable populations. Explore the rest of the article to understand how regressive taxes impact your financial well-being and economic fairness.

Table of Comparison

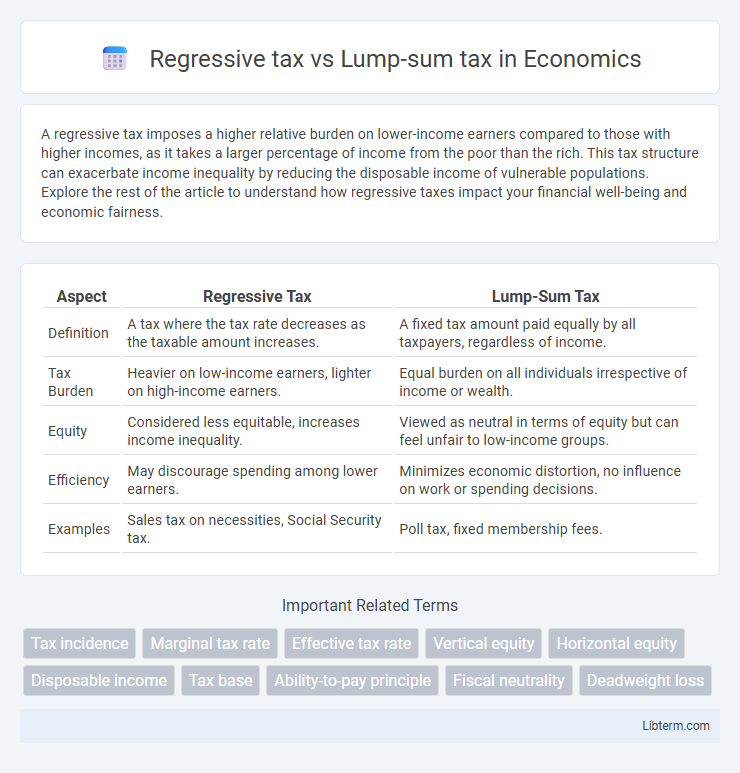

| Aspect | Regressive Tax | Lump-Sum Tax |

|---|---|---|

| Definition | A tax where the tax rate decreases as the taxable amount increases. | A fixed tax amount paid equally by all taxpayers, regardless of income. |

| Tax Burden | Heavier on low-income earners, lighter on high-income earners. | Equal burden on all individuals irrespective of income or wealth. |

| Equity | Considered less equitable, increases income inequality. | Viewed as neutral in terms of equity but can feel unfair to low-income groups. |

| Efficiency | May discourage spending among lower earners. | Minimizes economic distortion, no influence on work or spending decisions. |

| Examples | Sales tax on necessities, Social Security tax. | Poll tax, fixed membership fees. |

Understanding Regressive Tax: Definition and Features

Regressive tax is a taxation system where the tax rate decreases as the taxpayer's income increases, imposing a heavier burden on lower-income individuals. This tax structure is characterized by a fixed percentage or amount that takes a larger proportion of income from the poor than from the wealthy, contributing to income inequality. Unlike lump-sum taxes, which charge a fixed amount regardless of income, regressive taxes can include sales taxes and excise taxes that disproportionately affect those with less disposable income.

Lump-sum Tax Explained: Concept and Characteristics

Lump-sum tax is a fixed amount imposed on individuals or entities regardless of their income or economic behavior, making it non-distortionary and efficient in terms of economic incentives. This tax type does not alter consumer choices or production decisions since the amount owed remains constant, ensuring minimal administrative costs and simplicity in implementation. Unlike regressive taxes, which place a heavier burden on lower-income groups, lump-sum taxes are neutral but can raise equity concerns due to their uniform application across all taxpayers.

Key Differences Between Regressive and Lump-sum Taxation

Regressive taxes impose a higher burden on lower-income individuals as the tax rate decreases when income increases, often seen in sales taxes or excise taxes. Lump-sum taxes require a fixed amount from all taxpayers regardless of income, making them non-distortionary and easier to administer but potentially less equitable. Key differences include the impact on income distribution, with regressive taxes exacerbating inequality, while lump-sum taxes maintain neutrality but may be politically challenging due to uniform charges.

Examples of Regressive Taxes in Practice

Sales taxes and excise taxes on goods like gasoline and tobacco are common examples of regressive taxes, as they take a larger percentage of income from low-income individuals than from high-income earners. Payroll taxes, such as Social Security contributions in the United States, also tend to be regressive because they apply only up to a certain income limit, disproportionately affecting lower-income workers. Property taxes can be considered regressive in some contexts when assessed uniformly, as they represent a higher relative burden on lower-income homeowners.

Real-world Applications of Lump-sum Taxes

Lump-sum taxes are often applied in real-world scenarios such as licensing fees, property taxes, and certain fixed government charges, where the tax amount remains constant regardless of income or consumption levels. Unlike regressive taxes, which disproportionately impact lower-income individuals by taxing a higher percentage of their income, lump-sum taxes maintain neutrality because the amount paid does not vary with economic behavior or earnings. This neutrality makes lump-sum taxes an efficient tool for public finance with minimal distortion in economic decisions and resource allocation.

Economic Impact: Regressive vs Lump-sum Tax

Regressive taxes disproportionately burden lower-income households, reducing their disposable income and potentially increasing income inequality and poverty levels. Lump-sum taxes impose a fixed amount regardless of income, minimizing distortions in labor supply and consumption decisions while maintaining equity from an efficiency perspective. Economic impact analysis shows regressive taxes may slow economic growth by lowering aggregate demand, whereas lump-sum taxes preserve incentives for productivity and investment without exacerbating income disparities.

Equity and Fairness: Who Bears the Greater Burden?

Regressive taxes impose a higher relative burden on lower-income individuals as they take a larger percentage of income from those with less ability to pay, undermining equity and fairness. Lump-sum taxes charge a fixed amount regardless of income, which can be considered equitable in administrative simplicity but disproportionately burdens lower-income taxpayers, raising concerns about fairness. The greater burden typically falls on low-income groups under regressive tax systems, whereas lump-sum taxes are uniform but socially regressive in impact due to fixed costs relative to income.

Administrative Complexity and Implementation

Regressive taxes often involve greater administrative complexity due to the need for income verification and tiered tax rate calculations, increasing compliance costs and enforcement challenges. Lump-sum taxes feature straightforward implementation because they require a fixed payment from all individuals regardless of income, resulting in minimal administrative burden and easier collection processes. Governments favor lump-sum taxes for their simplicity, though these taxes lack progressivity and may be politically unpopular.

Policy Implications: Choosing the Right Tax System

Regressive taxes place a heavier burden on lower-income individuals, potentially exacerbating income inequality and reducing consumer spending power, which policymakers must consider when aiming for equity. Lump-sum taxes are fixed amounts regardless of income, offering administrative simplicity and minimal economic distortion but may face fairness concerns in progressive societies. Selecting the right tax system requires balancing efficiency, equity, and political feasibility to promote sustainable economic growth and social welfare.

Regressive Tax vs Lump-sum Tax: Pros and Cons Comparison

Regressive tax imposes a higher relative burden on low-income earners, potentially exacerbating income inequality, while lump-sum tax charges a fixed amount regardless of income, ensuring simplicity and predictability. The pro of regressive tax is its simplicity and ease of collection, but it can lead to unfair financial strain on poorer households. Lump-sum tax promotes equity in tax burden distribution and minimizes economic distortions, though it may be seen as less fair since it ignores taxpayers' ability to pay.

Regressive tax Infographic

libterm.com

libterm.com