Exchange rate intervention involves a country's central bank buying or selling foreign currency to influence the domestic currency's value. This process aims to stabilize the exchange rate, control inflation, and support economic growth. Discover how these interventions impact your investments and the global economy in the rest of the article.

Table of Comparison

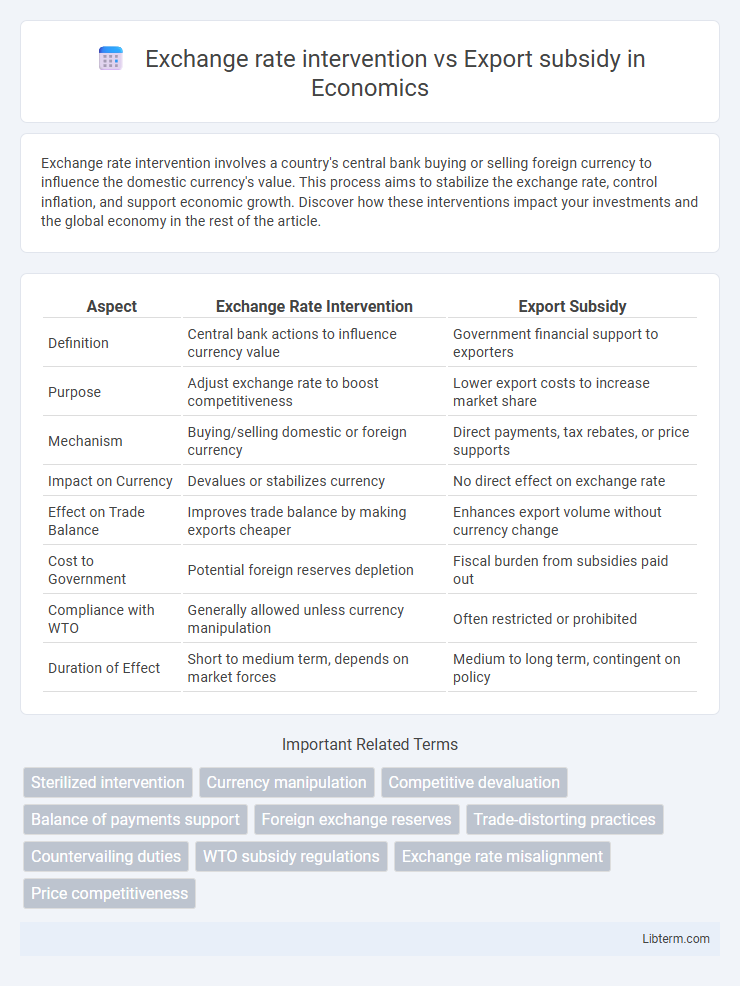

| Aspect | Exchange Rate Intervention | Export Subsidy |

|---|---|---|

| Definition | Central bank actions to influence currency value | Government financial support to exporters |

| Purpose | Adjust exchange rate to boost competitiveness | Lower export costs to increase market share |

| Mechanism | Buying/selling domestic or foreign currency | Direct payments, tax rebates, or price supports |

| Impact on Currency | Devalues or stabilizes currency | No direct effect on exchange rate |

| Effect on Trade Balance | Improves trade balance by making exports cheaper | Enhances export volume without currency change |

| Cost to Government | Potential foreign reserves depletion | Fiscal burden from subsidies paid out |

| Compliance with WTO | Generally allowed unless currency manipulation | Often restricted or prohibited |

| Duration of Effect | Short to medium term, depends on market forces | Medium to long term, contingent on policy |

Introduction to Exchange Rate Intervention and Export Subsidy

Exchange rate intervention involves a country's central bank buying or selling its own currency to influence its exchange rate, aiming to stabilize the currency or improve trade competitiveness. Export subsidies are government financial support granted to domestic producers to lower export prices, enhancing their international market position. Both tools impact trade balance and currency value but operate through distinct mechanisms affecting exporters and currency markets.

Defining Exchange Rate Intervention

Exchange rate intervention involves a government or central bank actively buying or selling foreign currencies to influence the national currency's value in the foreign exchange market. This policy aims to stabilize the currency, control inflation, or enhance export competitiveness without directly altering trade policies. Unlike export subsidies, which provide financial support to domestic exporters, exchange rate interventions manipulate currency valuation to indirectly affect export prices and trade balances.

Understanding Export Subsidy Mechanisms

Export subsidy mechanisms involve direct financial support from governments to domestic producers, reducing their costs and making their goods more competitive in international markets. Exchange rate intervention influences export competitiveness indirectly by stabilizing or devaluing the national currency to lower export prices abroad. Both strategies aim to boost exports, but export subsidies provide targeted benefits to specific industries, while exchange rate interventions affect the entire economy's trade balance.

Objectives and Goals of Both Policies

Exchange rate intervention aims to stabilize or adjust a country's currency value to boost export competitiveness and control inflation, ensuring macroeconomic stability. Export subsidies directly lower the cost of exported goods, encouraging higher export volumes and improving trade balances by making domestic products more attractive internationally. Both policies target enhancing export performance but differ as exchange rate intervention primarily influences currency markets, while export subsidies impact production costs and pricing.

Economic Impacts on Domestic Industries

Exchange rate intervention can enhance domestic export competitiveness by artificially lowering the currency value, making goods cheaper in global markets and boosting industry revenues. Export subsidies directly reduce production costs for exporters, increasing output and market share but risk provoking retaliatory trade measures and budget strains. Both tools stimulate domestic industries, yet exchange rate interventions may lead to inflationary pressures, while export subsidies can distort resource allocation and create inefficiencies.

Effects on International Trade Competitiveness

Exchange rate intervention directly alters a country's currency value, making exports cheaper or more expensive, which immediately impacts international trade competitiveness by influencing price attractiveness in foreign markets. Export subsidies provide direct financial support to domestic producers, lowering production costs and enabling exporters to offer more competitive prices globally without currency fluctuations. Both policies aim to boost trade competitiveness but differ in mechanisms: exchange rate interventions affect macroeconomic factors, while export subsidies target specific industries and can lead to trade disputes under international trade laws.

Currency Valuation and Global Market Influence

Exchange rate intervention directly impacts currency valuation by central banks buying or selling foreign currencies to stabilize or adjust their own currency's value, influencing trade competitiveness and capital flows. Export subsidies alter global market dynamics by lowering export prices artificially, affecting trade balances without changing currency valuation but potentially prompting retaliatory measures and market distortions. Both tools shape international trade patterns; exchange rate interventions adjust financial conditions, while export subsidies modify product pricing strategies globally.

Case Studies: Countries Employing Each Approach

China's exchange rate intervention strategy, characterized by sustained yuan devaluation and central bank foreign exchange market operations, enhanced export competitiveness and spurred economic growth during the early 2000s. Brazil implemented export subsidies in its agricultural sector, particularly for soybeans and sugar, boosting export volumes but drawing criticism from trading partners and WTO disputes. South Korea combines both approaches selectively, using modest exchange rate management alongside targeted subsidies in electronics and shipbuilding to maintain global market share.

WTO Regulations and Policy Controversies

Exchange rate intervention involves central bank actions to influence currency value, which can affect trade competitiveness but often raises WTO concerns if deemed currency manipulation obstructing fair trade. Export subsidies directly lower the cost of exported goods, clearly violating WTO rules under the Agreement on Subsidies and Countervailing Measures (SCM Agreement), leading to disputes and retaliatory measures. Policy controversies arise as both tools aim to boost exports but differ in legality and transparency, with the WTO consistently scrutinizing subsidies more rigorously than exchange rate interventions.

Conclusion: Choosing the Optimal Trade Policy

Exchange rate intervention influences currency value to enhance trade competitiveness, while export subsidies directly reduce costs for domestic producers. Optimal trade policy depends on balancing currency stability with targeted support for key industries to maximize export growth without triggering retaliatory measures or market distortions. Policymakers must evaluate economic conditions, trade partners' reactions, and long-term sustainability when selecting between these strategies.

Exchange rate intervention Infographic

libterm.com

libterm.com