Discretion is crucial in maintaining trust and protecting sensitive information in both personal and professional settings. Handling confidential matters with care prevents misunderstandings and promotes respect in relationships. Discover more about how discretion can enhance your communication and decision-making by reading the rest of this article.

Table of Comparison

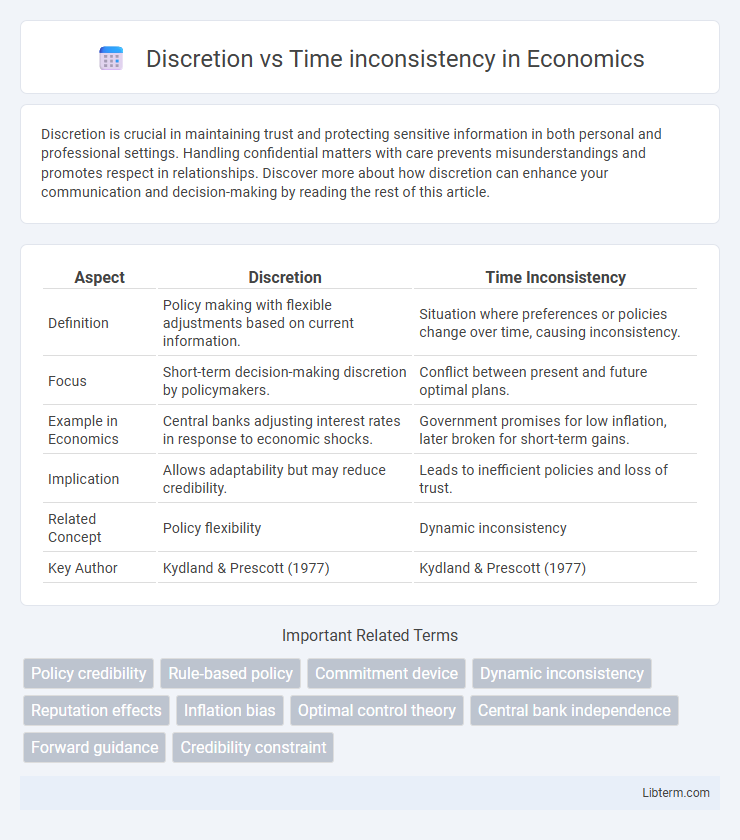

| Aspect | Discretion | Time Inconsistency |

|---|---|---|

| Definition | Policy making with flexible adjustments based on current information. | Situation where preferences or policies change over time, causing inconsistency. |

| Focus | Short-term decision-making discretion by policymakers. | Conflict between present and future optimal plans. |

| Example in Economics | Central banks adjusting interest rates in response to economic shocks. | Government promises for low inflation, later broken for short-term gains. |

| Implication | Allows adaptability but may reduce credibility. | Leads to inefficient policies and loss of trust. |

| Related Concept | Policy flexibility | Dynamic inconsistency |

| Key Author | Kydland & Prescott (1977) | Kydland & Prescott (1977) |

Understanding Discretion in Economic Policy

Discretion in economic policy refers to the ability of policymakers to adjust decisions based on current information rather than following predetermined rules, allowing flexibility in response to unexpected economic shocks. This adaptability contrasts with time inconsistency problems, where policymakers' optimal plans change over time, potentially undermining credibility and leading to suboptimal outcomes. Understanding discretion involves analyzing how its use can balance the benefits of responsive policymaking against risks of eroding trust and creating volatility in economic expectations.

Defining Time Inconsistency in Decision-Making

Time inconsistency in decision-making occurs when preferences change over time, leading individuals or policymakers to make decisions that their future selves would regret or revise. This phenomenon arises because the valuation of outcomes shifts as the decision horizon shortens, often causing a conflict between short-term impulses and long-term goals. Understanding time inconsistency is crucial for designing commitment mechanisms and policies that align current decisions with future welfare.

Historical Overview: Discretion vs Time Inconsistency

The historical overview of discretion versus time inconsistency highlights key developments in economic theory during the late 20th century, particularly through the work of Finn Kydland and Edward Prescott in 1977. Their seminal paper demonstrated that discretionary monetary policy often leads to suboptimal outcomes due to policymakers' incentives to deviate from previously announced plans, causing time inconsistency problems. This insight fundamentally changed the understanding of central banking and policy credibility, influencing the adoption of rules-based approaches to monetary policy.

Theoretical Foundations: Kydland and Prescott’s Framework

Kydland and Prescott's seminal 1977 framework highlights the inherent conflict between discretion and time inconsistency in economic policy, demonstrating how policymakers' temptation to deviate from previously announced plans reduces policy credibility. Their model reveals that time-inconsistent policies can lead to suboptimal outcomes like higher inflation without gains in employment, emphasizing the need for commitment mechanisms. This theoretical foundation underpins modern macroeconomic policy design, promoting rules-based approaches to mitigate distortions caused by discretionary interventions.

Real-World Implications of Policy Discretion

Policy discretion allows governments to adapt fiscal or monetary measures in response to unforeseen economic shocks, but it often leads to time inconsistency problems where promises made today are abandoned tomorrow, eroding credibility. Central banks with discretionary power may face inflationary bias as they exploit the short-term trade-off between inflation and unemployment, resulting in higher long-term inflation without gains in employment. Time inconsistency in policy discretion can undermine investment decisions, increase market volatility, and necessitate institutional commitments such as inflation targeting or rules-based frameworks to maintain economic stability.

Costs and Risks of Time Inconsistency

Time inconsistency leads to significant costs, including inefficient policy decisions and reduced credibility as agents may deviate from prior commitments, undermining long-term planning. The risks involve escalating inflation expectations, suboptimal investment, and distorted incentives, which can trigger economic volatility and erode trust in institutions. Managing time inconsistency requires credible commitment mechanisms to mitigate reneging behavior and ensure consistent policy implementation over time.

Commitment Mechanisms to Counteract Time Inconsistency

Commitment mechanisms are critical tools for counteracting time inconsistency by aligning future actions with present intentions, thus reducing the temptation to deviate from optimal plans. These mechanisms include contracts, financial penalties, or automated decision rules that bind agents to their initial strategies, ensuring consistency in long-term decision-making. Empirical studies reveal that self-imposed constraints and institutional arrangements effectively mitigate the negative impacts of time-inconsistent preferences on economic and behavioral outcomes.

Case Studies: Discretionary Policy vs Rules-Based Approaches

Case studies comparing discretionary policy and rules-based approaches reveal that discretionary policies often lead to time inconsistency problems, where policymakers deviate from previously announced plans due to changing incentives, undermining credibility and long-term economic stability. In contrast, rules-based approaches, such as inflation targeting or fixed monetary rules, enhance commitment by reducing the temptation to exploit short-term gains, thereby improving policy predictability and investor confidence. Empirical evidence from countries adopting strict rules, like New Zealand's inflation targeting framework, shows more stable inflation rates and reduced output volatility compared to those relying heavily on discretionary interventions.

Balancing Flexibility and Credibility in Policymaking

Discretion allows policymakers to adapt decisions to current economic conditions, enhancing flexibility in implementation. However, time inconsistency arises when policymakers' incentives shift over time, undermining credibility and leading to suboptimal outcomes like inflation bias. Balancing flexibility and credibility requires commitment mechanisms, such as rule-based policies or transparent frameworks, that preserve adaptability while ensuring consistent, predictable actions.

Future Perspectives on Discretion and Time Consistency

Future perspectives on discretion and time consistency emphasize integrating dynamic decision-making frameworks with advanced econometric models to balance policy flexibility and commitment credibility. Innovations in adaptive learning algorithms and real-time data analytics enhance policymakers' ability to adjust interventions without undermining long-term economic expectations. This approach improves the transparency and predictability of monetary and fiscal policies, fostering stable inflation targets and sustainable growth trajectories.

Discretion Infographic

libterm.com

libterm.com