An open economy multiplier measures how changes in fiscal policy affect national income considering foreign trade impacts, such as imports and exports, which dilute the multiplier effect compared to a closed economy. Understanding this concept helps you gauge the broader economic consequences of government spending and taxation decisions in an interconnected global market. Explore the rest of the article to see how these dynamics shape economic growth.

Table of Comparison

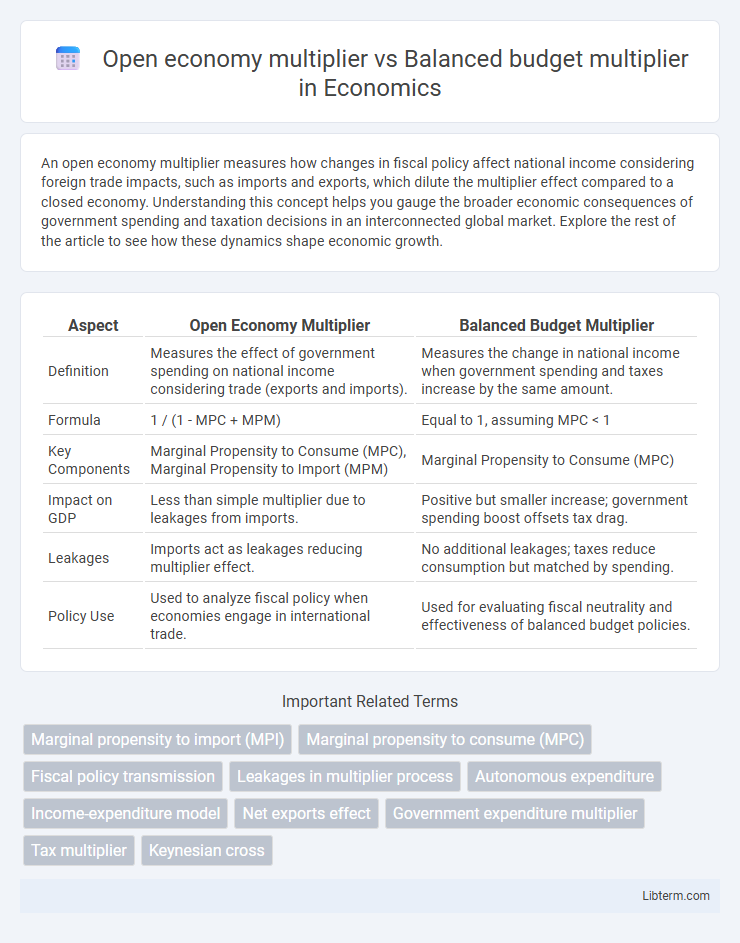

| Aspect | Open Economy Multiplier | Balanced Budget Multiplier |

|---|---|---|

| Definition | Measures the effect of government spending on national income considering trade (exports and imports). | Measures the change in national income when government spending and taxes increase by the same amount. |

| Formula | 1 / (1 - MPC + MPM) | Equal to 1, assuming MPC < 1 |

| Key Components | Marginal Propensity to Consume (MPC), Marginal Propensity to Import (MPM) | Marginal Propensity to Consume (MPC) |

| Impact on GDP | Less than simple multiplier due to leakages from imports. | Positive but smaller increase; government spending boost offsets tax drag. |

| Leakages | Imports act as leakages reducing multiplier effect. | No additional leakages; taxes reduce consumption but matched by spending. |

| Policy Use | Used to analyze fiscal policy when economies engage in international trade. | Used for evaluating fiscal neutrality and effectiveness of balanced budget policies. |

Understanding the Open Economy Multiplier

The open economy multiplier measures the impact of fiscal policy on national income considering international trade, reflecting how changes in government spending or taxation influence aggregate demand through both domestic consumption and net exports. Unlike the balanced budget multiplier, which evaluates the effect of equal increases in government spending and taxation, the open economy multiplier captures leakages from imports that reduce the overall multiplier effect. Understanding the open economy multiplier is crucial for policymakers to anticipate how fiscal stimulus translates into GDP growth in countries exposed to global trade dynamics.

Defining the Balanced Budget Multiplier

The Balanced Budget Multiplier measures the change in aggregate demand resulting from equal changes in government spending and taxation, typically equating to a value of one in a closed economy. Unlike the Open Economy Multiplier, which accounts for net exports and imports and often yields a smaller multiplier effect due to leakage through trade, the Balanced Budget Multiplier emphasizes fiscal neutrality by simultaneously increasing spending and taxes. This concept highlights how government fiscal policy can stimulate economic output without altering the overall budget deficit.

Key Differences Between the Two Multipliers

The open economy multiplier measures the effect of fiscal policy changes on national income considering foreign trade, incorporating imports and exports, which dampens the multiplier effect compared to a closed economy. The balanced budget multiplier, however, indicates the change in aggregate demand when government spending and taxation increase by the same amount, typically equaling one in a closed economy. Key differences include that the open economy multiplier is generally smaller due to leakages through imports, while the balanced budget multiplier assumes fiscal neutrality but still stimulates demand by increasing both spending and taxes simultaneously.

Calculating the Open Economy Multiplier

Calculating the open economy multiplier involves determining the marginal propensities to consume, save, and import within a country's economy, expressed as 1/(1 - MPC(1 - t) + MPM), where MPC is the marginal propensity to consume, t is the tax rate, and MPM is the marginal propensity to import. This multiplier reflects the total change in aggregate demand resulting from an initial change in autonomous spending in an open economy, accounting for leakages due to savings, taxes, and imports. In contrast, the balanced budget multiplier, typically equal to one, measures the impact of simultaneous equal changes in government spending and taxation on aggregate demand without considering trade effects.

Calculation of the Balanced Budget Multiplier

The balanced budget multiplier measures the impact on national income when government spending and taxation increase by the same amount, calculated as one since the increase in spending directly raises aggregate demand while the equal tax hike reduces consumption by less than the spending increase. In contrast, the open economy multiplier incorporates net exports and typically yields a smaller effect on income due to leakages from imports and taxes. The balanced budget multiplier calculation relies on the marginal propensity to consume (MPC) and assumes that the changes in government spending and taxes occur simultaneously, resulting in a net positive effect on output equal to the initial spending increase.

The Role of Imports and Exports

In an open economy multiplier, imports create a leakage that reduces the overall impact of fiscal stimulus on aggregate demand, as portions of increased spending flow abroad. Exports act as injections, enhancing national income by increasing demand for domestic goods from foreign markets, thereby influencing the multiplier effect positively. The balanced budget multiplier remains close to one because simultaneous government spending and taxation changes largely offset leakages, with net exports playing a critical role in determining the final impact on output.

Fiscal Policy Implications

The open economy multiplier tends to be larger than the balanced budget multiplier due to cross-border trade effects influencing aggregate demand through exports and imports. Fiscal policy in an open economy must account for leakage via imports, which dampens the effectiveness of government spending compared to a closed economy, while the balanced budget multiplier, typically equal to one, reflects the neutral net effect of simultaneous government spending and taxation changes on output. Policymakers leverage these multipliers to tailor stimulus measures, ensuring spending increases induce sufficient demand without causing excessive deficits or import-driven leakages in a globalized market.

Impact on National Income

The open economy multiplier measures the change in national income resulting from autonomous changes in spending, accounting for both domestic and foreign leakages such as imports. The balanced budget multiplier reflects the effect on national income when government spending and taxes increase by the same amount, typically causing a net increase in income equal to the initial change in spending due to induced consumption. In an open economy, the balanced budget multiplier is less than one because imports reduce the marginal propensity to consume domestically, dampening the overall impact on national income.

Limitations and Assumptions

The open economy multiplier assumes constant exchange rates and ignores potential capital flows, limiting its accuracy in fluctuating international markets. The balanced budget multiplier relies on the assumption that government spending and taxation changes are equal and simultaneous, which may not hold true in real-world fiscal policy implementation. Both models often overlook time lags, supply-side constraints, and crowding-out effects, reducing their predictive reliability in dynamic economies.

Real-World Applications and Examples

The open economy multiplier incorporates the effects of net exports on aggregate demand, making it crucial in countries with significant trade activity, such as Germany, where changes in government spending can influence both domestic output and trade balances. In contrast, the balanced budget multiplier, typically equal to one, demonstrates that simultaneous increases in government spending and taxation can stimulate economic growth without increasing the deficit, as seen in targeted fiscal policies used by countries like Australia to maintain fiscal discipline while boosting demand. Real-world examples highlight that open economy multipliers are sensitive to exchange rates and global economic conditions, whereas balanced budget multipliers offer a fiscal tool for demand management without necessitating external borrowing.

Open economy multiplier Infographic

libterm.com

libterm.com