Revenue deficit occurs when a government's revenue expenditure exceeds its revenue receipts, indicating that current income is insufficient to cover everyday expenses. This imbalance can signal fiscal stress, requiring careful budget management to avoid borrowing that hampers economic growth. Explore the rest of the article to understand how revenue deficit impacts your economy and the measures to address it.

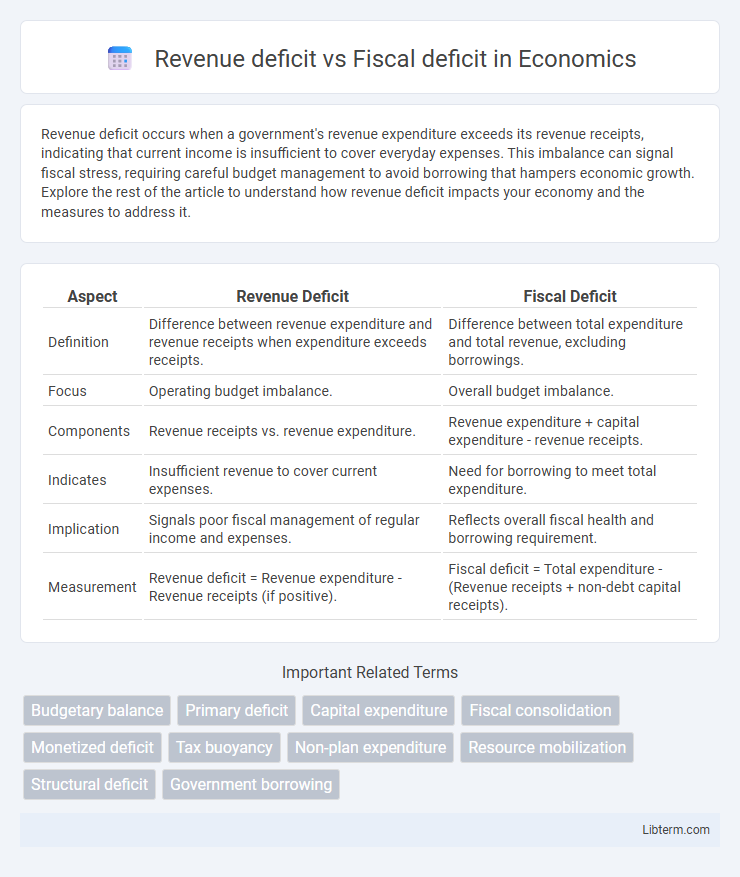

Table of Comparison

| Aspect | Revenue Deficit | Fiscal Deficit |

|---|---|---|

| Definition | Difference between revenue expenditure and revenue receipts when expenditure exceeds receipts. | Difference between total expenditure and total revenue, excluding borrowings. |

| Focus | Operating budget imbalance. | Overall budget imbalance. |

| Components | Revenue receipts vs. revenue expenditure. | Revenue expenditure + capital expenditure - revenue receipts. |

| Indicates | Insufficient revenue to cover current expenses. | Need for borrowing to meet total expenditure. |

| Implication | Signals poor fiscal management of regular income and expenses. | Reflects overall fiscal health and borrowing requirement. |

| Measurement | Revenue deficit = Revenue expenditure - Revenue receipts (if positive). | Fiscal deficit = Total expenditure - (Revenue receipts + non-debt capital receipts). |

Introduction to Revenue Deficit and Fiscal Deficit

Revenue deficit occurs when a government's revenue expenditure exceeds its revenue receipts, indicating that current income is insufficient to cover expenses like salaries and subsidies. Fiscal deficit represents the total shortfall between the government's total expenditure and its total receipts excluding borrowings, reflecting the need for borrowing to meet overall spending. Understanding the distinction between revenue deficit and fiscal deficit is crucial for assessing a government's financial health and sustainability.

Defining Revenue Deficit

Revenue deficit occurs when a government's revenue expenditure exceeds its revenue receipts, indicating that the government is not generating enough income to cover its day-to-day expenses. It highlights a shortfall in the current account, reflecting insufficient funds to maintain government services without borrowing. Understanding revenue deficit is crucial for fiscal management, as it directly impacts the sustainability of ongoing government operations and public welfare programs.

Understanding Fiscal Deficit

Fiscal deficit represents the total shortfall between a government's total expenditure and its total revenue, excluding borrowings, indicating the need to finance this gap through debt. It affects macroeconomic stability by influencing inflation, interest rates, and public debt sustainability. Unlike revenue deficit, which measures the gap between revenue receipts and revenue expenditures, fiscal deficit provides a comprehensive view of overall government borrowing requirements and fiscal health.

Key Differences Between Revenue Deficit and Fiscal Deficit

Revenue deficit occurs when the government's revenue expenditure exceeds its revenue receipts, indicating that current income cannot cover current expenses. Fiscal deficit measures the total borrowing requirement, representing the gap between total expenditure (both revenue and capital) and total receipts excluding borrowings. Key differences include that revenue deficit highlights shortfalls in regular income versus expenses, while fiscal deficit reflects overall funding needs including capital spending and investment.

Components Involved in Revenue Deficit

Revenue deficit occurs when the government's revenue expenditure exceeds its revenue receipts, primarily involving operational expenses like salaries, subsidies, and interest payments. Fiscal deficit represents the total shortfall between the government's total expenditure and its total receipts excluding borrowings. Components involved in revenue deficit mainly include recurrent expenses that do not lead to asset creation, reflecting inefficiencies in meeting regular spending through current revenues.

Components of Fiscal Deficit

Fiscal deficit comprises the total shortfall in a government's budget, including both revenue deficit and capital expenditure exceeding receipts. Revenue deficit arises when the government's revenue expenditure exceeds its revenue receipts, reflecting the gap in funding day-to-day operations. Components of fiscal deficit also include capital expenditure and borrowing requirements necessary to finance infrastructure and investment projects beyond regular revenues.

Causes of Revenue Deficit

Revenue deficit arises when the government's revenue expenditure exceeds its revenue receipts, primarily due to insufficient tax revenues, excessive subsidies, and poor collection efficiency. Structural issues like an over-reliance on non-tax revenues and rising interest payments on past borrowings also contribute significantly to widening the revenue deficit. Fiscal deficit, by contrast, measures the total borrowings needed to cover both revenue and capital expenditures exceeding total receipts.

Causes of Fiscal Deficit

Fiscal deficit occurs when a government's total expenditure exceeds its total revenue, excluding borrowings, primarily caused by high public spending, insufficient tax revenue, and increased subsidies. Revenue deficit specifically refers to the shortfall in revenue receipts over revenue expenditure, mainly driven by inefficient tax collection and excessive interest payments on debt. Key causes of fiscal deficit include expansionary fiscal policies, rising social sector commitments, and poor non-tax revenue generation.

Economic Implications of Both Deficits

Revenue deficit occurs when the government's revenue expenditure exceeds its revenue receipts, leading to a shortfall in funds available for daily operations, which can hinder essential public services and reduce fiscal space for development projects. Fiscal deficit, representing the total borrowing requirement when total expenditure surpasses total receipts (including capital receipts), tends to increase public debt and can trigger inflationary pressures if financed by printing money. Persistent revenue deficits undermine fiscal sustainability and strain economic growth, while sustained fiscal deficits may lead to higher interest rates, crowding out private investment and weakening macroeconomic stability.

Policy Measures to Manage Deficits

Policy measures to manage revenue deficit focus on enhancing tax compliance, broadening the tax base, and controlling non-essential government expenditures to ensure sustainable fiscal health. Fiscal deficit management often involves strategic borrowing limits, rationalizing subsidies, and improving public sector efficiency to balance developmental needs with fiscal prudence. Both deficits require targeted reforms in public financial management systems and periodic fiscal responsibility legislations to maintain macroeconomic stability.

Revenue deficit Infographic

libterm.com

libterm.com