Geographic arbitrage maximizes financial benefits by leveraging cost-of-living differences between regions, allowing individuals to earn in stronger economies while spending in more affordable locations. This strategy can significantly enhance your savings and quality of life without requiring a change in income. Discover how you can strategically use geographic arbitrage to optimize your finances by exploring the rest of the article.

Table of Comparison

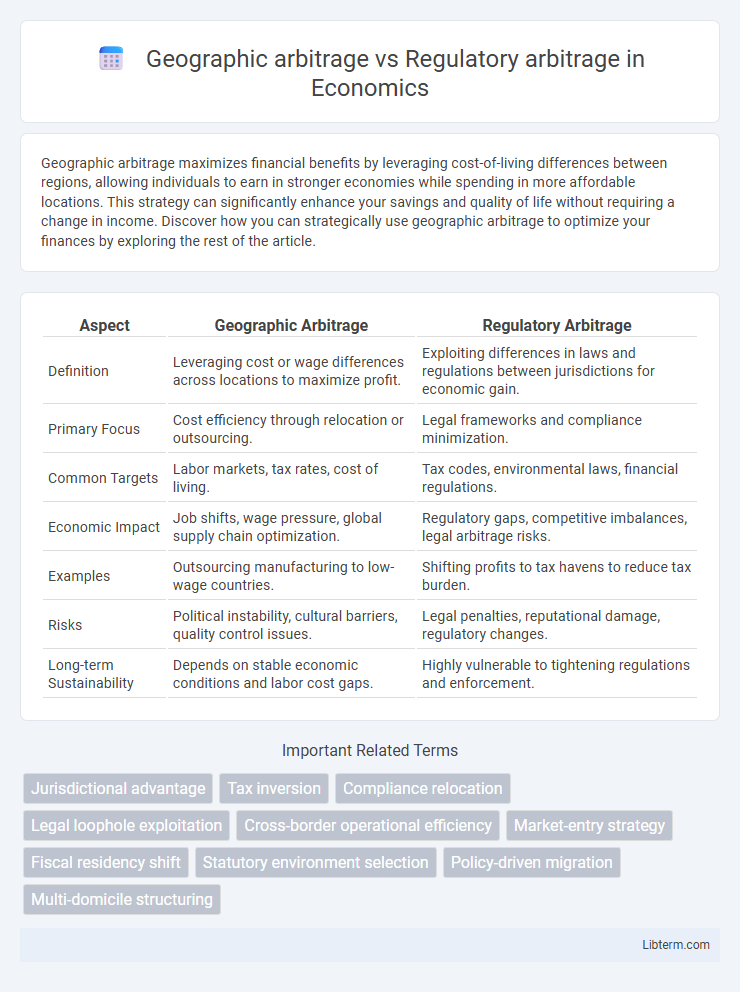

| Aspect | Geographic Arbitrage | Regulatory Arbitrage |

|---|---|---|

| Definition | Leveraging cost or wage differences across locations to maximize profit. | Exploiting differences in laws and regulations between jurisdictions for economic gain. |

| Primary Focus | Cost efficiency through relocation or outsourcing. | Legal frameworks and compliance minimization. |

| Common Targets | Labor markets, tax rates, cost of living. | Tax codes, environmental laws, financial regulations. |

| Economic Impact | Job shifts, wage pressure, global supply chain optimization. | Regulatory gaps, competitive imbalances, legal arbitrage risks. |

| Examples | Outsourcing manufacturing to low-wage countries. | Shifting profits to tax havens to reduce tax burden. |

| Risks | Political instability, cultural barriers, quality control issues. | Legal penalties, reputational damage, regulatory changes. |

| Long-term Sustainability | Depends on stable economic conditions and labor cost gaps. | Highly vulnerable to tightening regulations and enforcement. |

Introduction to Geographic and Regulatory Arbitrage

Geographic arbitrage involves capitalizing on cost-of-living or wage differences between locations to maximize financial benefits, often by living in a lower-cost country while earning income from a higher-cost region. Regulatory arbitrage focuses on exploiting variations in laws, regulations, or tax policies across jurisdictions to minimize legal constraints or financial burdens on businesses and individuals. Both strategies require thorough analysis of local economic conditions and legal frameworks to optimize advantages effectively.

Defining Geographic Arbitrage

Geographic arbitrage involves exploiting cost differences between locations by relocating business operations or labor to regions with lower expenses, such as reduced wages or cheaper real estate. This strategy primarily focuses on optimizing operational costs by leveraging international or domestic geographic disparities. Regulatory arbitrage, in contrast, centers on bypassing stringent regulations by moving activities to jurisdictions with more lenient legal frameworks.

Understanding Regulatory Arbitrage

Regulatory arbitrage involves exploiting differences in regulations between jurisdictions to minimize legal constraints and reduce operational costs. Companies often relocate or structure activities in regions with more favorable rules to gain competitive advantages, such as tax benefits or laxer compliance requirements. This strategy contrasts with geographic arbitrage, which primarily targets lower labor or production costs instead of regulatory discrepancies.

Key Differences Between Geographic and Regulatory Arbitrage

Geographic arbitrage involves capitalizing on cost differentials by relocating business operations or labor to regions with lower economic expenses, such as wages or real estate, while regulatory arbitrage exploits discrepancies in legal or regulatory frameworks across jurisdictions to minimize compliance costs or avoid stringent rules. Geographic arbitrage focuses primarily on tangible economic factors like labor costs and infrastructure, whereas regulatory arbitrage targets intangible legal environments, such as tax codes, environmental regulations, or financial oversight. The key difference lies in geographic arbitrage optimizing physical location advantages, while regulatory arbitrage leverages variations in policy and governance structures to enhance business efficiency or profitability.

Motivations Behind Geographic Arbitrage

Geographic arbitrage is driven by the motivation to exploit cost differentials across regions, such as lower labor costs, affordable real estate, and favorable tax regimes, enabling businesses to maximize profit margins. Companies often relocate operations to emerging markets with cheaper resources and operational expenses without compromising quality. This strategic move contrasts with regulatory arbitrage, which focuses primarily on exploiting differences in legal frameworks and compliance standards.

Common Strategies in Regulatory Arbitrage

Common strategies in regulatory arbitrage involve relocating operations to jurisdictions with favorable regulatory environments, exploiting discrepancies between local and international regulations, and structuring transactions to benefit from lower compliance costs. Companies often establish subsidiaries or affiliates in countries with lenient financial, tax, or labor regulations to minimize expenses and maximize profits. This approach leverages variations in regulatory frameworks to gain competitive advantages without altering the underlying economic activities.

Real-World Examples of Geographic Arbitrage

Geographic arbitrage occurs when businesses or individuals leverage cost differences between locations to maximize profits, such as outsourcing software development to countries like India or the Philippines, where labor costs are significantly lower than in the U.S. Regulatory arbitrage involves exploiting differences in legal or regulatory frameworks, exemplified by multinational corporations shifting profits to low-tax jurisdictions like Ireland or Bermuda to reduce tax liabilities. Real-world examples of geographic arbitrage include companies relocating manufacturing operations to Vietnam or Mexico to benefit from lower wages and operating expenses while maintaining access to major markets.

High-Profile Cases of Regulatory Arbitrage

High-profile cases of regulatory arbitrage often involve multinational corporations exploiting discrepancies between jurisdictions to minimize tax liabilities or circumvent stringent regulations. Notable examples include companies relocating intellectual property holdings to tax havens, such as Ireland or the Cayman Islands, to leverage lenient tax regimes while maintaining operational bases elsewhere. Regulatory arbitrage in finance is also seen in the 2008 financial crisis, where institutions shifted risky assets to less regulated entities, highlighting gaps in international regulatory frameworks.

Risks and Ethical Implications

Geographic arbitrage carries risks such as political instability, currency fluctuations, and differing labor standards that may lead to exploitation or reputational damage. Regulatory arbitrage involves exploiting variations in laws and regulations, which can result in legal penalties, increased scrutiny from authorities, and ethical controversies over compliance avoidance. Both strategies pose significant ethical implications, including potential undermining of local economies and fair market competition.

Choosing the Right Arbitrage Strategy

Geographic arbitrage involves leveraging cost differentials between locations by relocating operations or resources to lower-cost regions, while regulatory arbitrage exploits differences in legal or financial regulations to gain a competitive advantage. Choosing the right arbitrage strategy depends on factors such as the stability of local laws, operational costs, market access, and the potential risks related to compliance and reputational impact. Firms must analyze regional economic conditions, regulatory environments, and long-term growth prospects to optimize their arbitrage approach.

Geographic arbitrage Infographic

libterm.com

libterm.com