Structural policy focuses on long-term economic growth by addressing underlying imbalances in labor markets, industrial sectors, and regional development. It aims to enhance productivity, competitiveness, and social cohesion through reforms in education, infrastructure, and innovation systems. Discover how these strategic measures can shape Your country's economic future in the rest of this article.

Table of Comparison

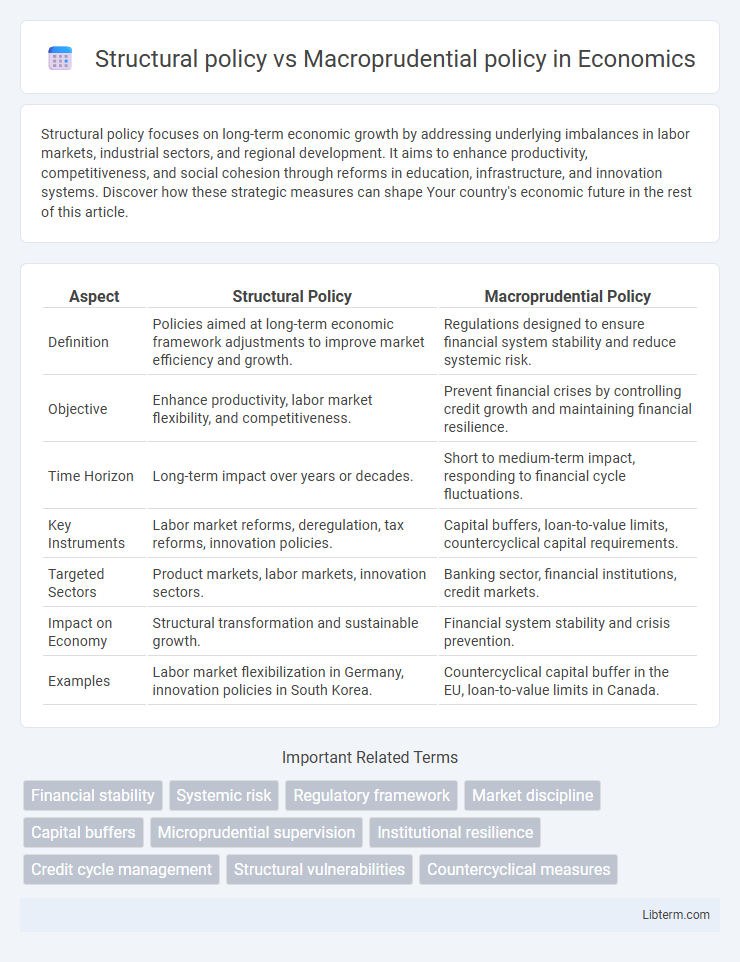

| Aspect | Structural Policy | Macroprudential Policy |

|---|---|---|

| Definition | Policies aimed at long-term economic framework adjustments to improve market efficiency and growth. | Regulations designed to ensure financial system stability and reduce systemic risk. |

| Objective | Enhance productivity, labor market flexibility, and competitiveness. | Prevent financial crises by controlling credit growth and maintaining financial resilience. |

| Time Horizon | Long-term impact over years or decades. | Short to medium-term impact, responding to financial cycle fluctuations. |

| Key Instruments | Labor market reforms, deregulation, tax reforms, innovation policies. | Capital buffers, loan-to-value limits, countercyclical capital requirements. |

| Targeted Sectors | Product markets, labor markets, innovation sectors. | Banking sector, financial institutions, credit markets. |

| Impact on Economy | Structural transformation and sustainable growth. | Financial system stability and crisis prevention. |

| Examples | Labor market flexibilization in Germany, innovation policies in South Korea. | Countercyclical capital buffer in the EU, loan-to-value limits in Canada. |

Introduction to Structural and Macroprudential Policies

Structural policy targets long-term changes in economic frameworks by reforming institutions, labor markets, and regulatory environments to enhance productivity and growth. Macroprudential policy addresses systemic financial risks by implementing regulatory measures like capital buffers, liquidity requirements, and stress testing to ensure financial stability. Both policies aim to foster economic resilience but operate on different time horizons and mechanisms.

Defining Structural Policy: Goals and Instruments

Structural policy aims to enhance economic efficiency and long-term growth by reforming institutional frameworks, labor markets, and product markets through instruments such as regulatory changes, competition policies, and investment in education and infrastructure. It focuses on addressing underlying structural weaknesses to promote sustainable development and improve productivity. Unlike macroprudential policy, which targets financial system stability through tools like capital requirements and countercyclical buffers, structural policy emphasizes fundamental economic reforms and regulatory adjustments.

Understanding Macroprudential Policy: Scope and Tools

Macroprudential policy focuses on safeguarding the financial system's stability by mitigating systemic risks through targeted tools like countercyclical capital buffers, loan-to-value (LTV) limits, and stress testing. This policy framework differs from structural policy, which addresses long-term economic growth and institutional reforms, by concentrating on short- to medium-term risk cycles and interconnectedness within financial institutions. Effective macroprudential regulation enhances resilience against shocks, minimizing contagion effects and promoting sustainable credit expansion.

Key Differences Between Structural and Macroprudential Policies

Structural policies target long-term economic framework improvements, such as labor market reforms and infrastructure investments, to enhance productivity and potential growth. Macroprudential policies focus on short- to medium-term financial system stability by managing systemic risks like credit bubbles and leverage through tools like countercyclical capital buffers and loan-to-value ratios. While structural policies reshape underlying economic fundamentals, macroprudential policies adjust regulatory measures to prevent financial crises and maintain economic resilience.

The Role of Structural Policy in Economic Stability

Structural policy plays a crucial role in enhancing economic stability by improving labor market flexibility, encouraging innovation, and supporting sustainable productivity growth. Unlike macroprudential policy, which targets financial system risks and cyclical fluctuations, structural policy addresses underlying economic weaknesses and promotes long-term resilience. Effective reforms in education, infrastructure, and regulation create a stable foundation for growth and reduce vulnerability to external shocks.

Macroprudential Policy and Financial System Resilience

Macroprudential policy aims to enhance financial system resilience by addressing systemic risks and vulnerabilities that can trigger widespread instability. It focuses on tools such as countercyclical capital buffers, loan-to-value ratios, and stress testing to mitigate credit booms, leverage, and interconnectedness among financial institutions. Effective macroprudential measures strengthen the stability of banking sectors, reduce the likelihood of financial crises, and support sustained economic growth.

Interaction and Overlap: Where Structural Meets Macroprudential

Structural policy shapes the long-term framework of financial systems by influencing institutions, market structure, and incentives, while macroprudential policy targets short-term systemic risks and financial stability through tools like countercyclical capital buffers and loan-to-value ratios. Their interaction occurs where regulatory measures overlap, such as in banking sector resilience, where structural reforms in capital requirements complement macroprudential stress testing and risk monitoring. Harmonizing these policies enhances financial stability by addressing both fundamental vulnerabilities and cyclical fluctuations in the financial system.

Case Studies: Applying Structural and Macroprudential Policies

Structural policy targets long-term economic stability by reforming institutional frameworks, labor markets, and financial regulations, as evidenced by Sweden's post-1990 crisis reforms that enhanced banking resilience and labor flexibility. Macroprudential policy focuses on short-term financial stability by implementing tools like countercyclical capital buffers, evident in South Korea's response to rapid credit growth through tightened loan-to-value ratios, effectively curbing housing market risks. Case studies reveal that integrating structural reforms with dynamic macroprudential measures fosters robust economic resilience and mitigates systemic risks more effectively than isolated approaches.

Policy Challenges and Implementation Barriers

Structural policy faces challenges in addressing long-term economic imbalances due to rigid regulations and slow adjustment processes, often hindered by political resistance and coordination difficulties across sectors. Macroprudential policy implementation is constrained by data limitations, the complexity of financial markets, and the potential for regulatory arbitrage, which can undermine its effectiveness in curbing systemic risks. Both policies must overcome institutional inertia and the need for timely, accurate indicators to enhance responsiveness and minimize unintended economic consequences.

Future Directions for Structural and Macroprudential Policymaking

Future directions for structural and macroprudential policymaking emphasize integrating data-driven risk assessments and enhancing coordination between regulatory frameworks to strengthen financial stability. Embracing advanced analytics, such as machine learning and big data, enables more precise identification of systemic vulnerabilities and targeted interventions. Policymakers increasingly focus on adaptive regulatory mechanisms that evolve with financial innovation and interconnected global markets to mitigate emerging risks effectively.

Structural policy Infographic

libterm.com

libterm.com