Producer surplus represents the difference between the amount a producer is paid for a good and the minimum amount they are willing to accept. This concept is crucial in understanding market efficiency and the benefits producers receive from market transactions. Explore the rest of the article to learn how producer surplus impacts your economic decisions and market dynamics.

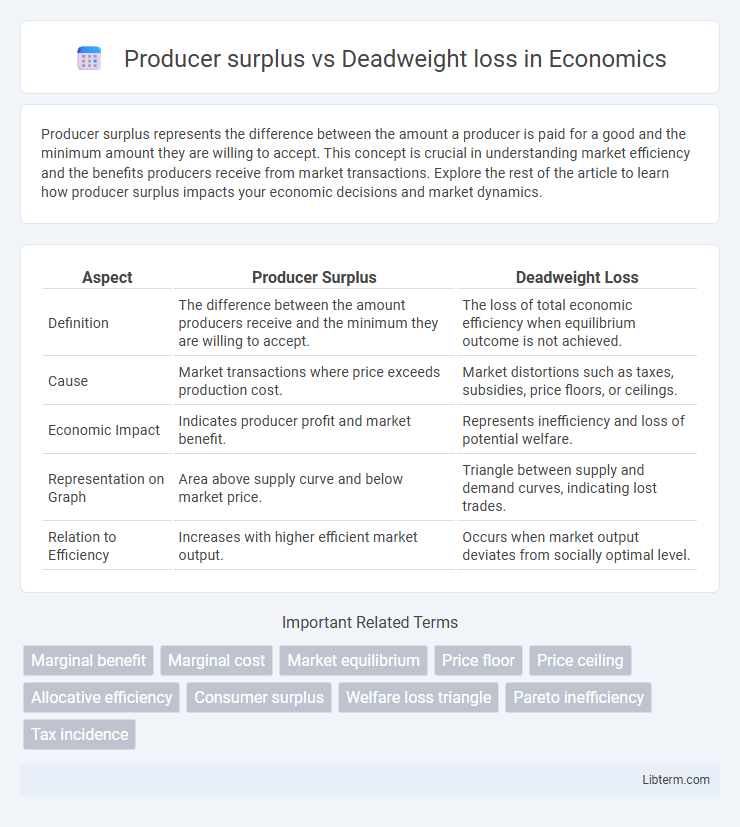

Table of Comparison

| Aspect | Producer Surplus | Deadweight Loss |

|---|---|---|

| Definition | The difference between the amount producers receive and the minimum they are willing to accept. | The loss of total economic efficiency when equilibrium outcome is not achieved. |

| Cause | Market transactions where price exceeds production cost. | Market distortions such as taxes, subsidies, price floors, or ceilings. |

| Economic Impact | Indicates producer profit and market benefit. | Represents inefficiency and loss of potential welfare. |

| Representation on Graph | Area above supply curve and below market price. | Triangle between supply and demand curves, indicating lost trades. |

| Relation to Efficiency | Increases with higher efficient market output. | Occurs when market output deviates from socially optimal level. |

Introduction to Producer Surplus and Deadweight Loss

Producer surplus represents the difference between the amount producers are willing to accept for a good or service and the actual amount they receive, reflecting the economic benefit to sellers. Deadweight loss occurs when market inefficiencies, such as taxes or price controls, prevent equilibrium, leading to lost total surplus for both consumers and producers. Understanding the interplay between producer surplus and deadweight loss is crucial for analyzing market efficiency and the impacts of policy interventions.

Defining Producer Surplus: Key Concepts

Producer surplus represents the difference between the amount producers receive for selling a good and the minimum amount they are willing to accept, reflecting the economic benefit to sellers. It is calculated as the area above the supply curve and below the market price, indicating the net gain for producers in a market transaction. Understanding producer surplus is essential for analyzing market efficiency, as it measures producer welfare and potential impacts on production incentives.

Understanding Deadweight Loss in Economics

Deadweight loss in economics represents the loss of total surplus that occurs when market equilibrium is not achieved, often due to taxes, price floors, or ceilings. Producer surplus decreases as inefficiencies reduce the quantity suppliers are willing or able to sell at market prices, leading to a reduction in overall economic welfare. Understanding deadweight loss is crucial for evaluating the impact of government interventions and market distortions on both producers and consumers.

Graphical Representation: Producer Surplus vs Deadweight Loss

Producer surplus is visually represented on a supply and demand graph as the area above the supply curve and below the market price, highlighting the benefit producers receive from selling at a higher price than their minimum acceptable price. Deadweight loss appears as a triangular area between the supply and demand curves, indicating the lost economic efficiency due to market distortions like taxes or price controls. The graphical distinction shows producer surplus as gained value, while deadweight loss reflects value lost to society from reduced transactions.

Factors Influencing Producer Surplus

Producer surplus is influenced by factors such as the price level, cost of production, and market supply elasticity, which determine the difference between the market price and the minimum price at which producers are willing to sell. Changes in input costs or technological advancements directly affect producer surplus by altering production costs and supply capabilities. In contrast, deadweight loss arises from market inefficiencies like taxes or price ceilings that reduce total welfare by distorting production and consumption, thereby decreasing both consumer and producer surplus.

Causes and Consequences of Deadweight Loss

Deadweight loss occurs when market inefficiencies prevent the allocation of resources at optimal equilibrium, often caused by price floors, price ceilings, taxes, or monopolistic practices that reduce trade volume and consumer surplus. While producer surplus represents the benefit producers receive from selling at market prices above their minimum acceptable price, deadweight loss signifies the lost total welfare that neither producers nor consumers capture due to distorted incentives. This inefficiency results in underproduction or overproduction, leading to a net loss in social welfare and reduced economic efficiency.

Market Equilibrium and Welfare Analysis

Producer surplus represents the difference between the amount producers are willing to accept for a good and the actual market price, reflecting gains from trade at market equilibrium. Deadweight loss occurs when market equilibrium is not achieved due to distortions like taxes or price controls, resulting in lost total welfare that neither consumers nor producers capture. Analyzing market equilibrium allows economists to evaluate the balance between producer surplus and deadweight loss, thereby assessing overall economic efficiency and welfare distribution.

Taxation: Impact on Producer Surplus and Deadweight Loss

Taxation reduces producer surplus by decreasing the price producers receive, leading to lower quantities supplied in the market. The imposed tax creates a wedge between what buyers pay and what sellers receive, generating deadweight loss due to inefficient market transactions. This deadweight loss represents the total loss in economic welfare as mutually beneficial trades are prevented by the tax.

Real-world Examples: Case Studies and Applications

Producer surplus represents the difference between what producers are willing to accept and what they actually receive, often illustrated in agriculture markets where farmers gain from higher prices during seasonal shortages. Deadweight loss occurs when market inefficiencies, such as taxes or price floors, reduce total economic welfare, exemplified by rent control in urban housing markets leading to under-supply and reduced quality. Case studies of tariff imposition on steel imports demonstrate increased producer surplus for domestic manufacturers, but also significant deadweight loss impacting consumer surplus and overall market efficiency.

Key Differences: Producer Surplus vs Deadweight Loss

Producer surplus represents the difference between the amount producers are willing to accept for a good or service and the actual price they receive, reflecting producer benefits in market transactions. Deadweight loss quantifies the loss of total economic efficiency when market equilibrium is not achieved, often due to taxes, price controls, or other market distortions. The key difference is that producer surplus measures the gains to producers, while deadweight loss indicates the overall welfare loss to society caused by inefficiencies.

Producer surplus Infographic

libterm.com

libterm.com