Linear flow of income refers to a one-way stream where money is earned through active work or fixed sources, such as a salary or hourly wages. This model often limits your ability to grow wealth without increasing work hours or effort. Explore the rest of the article to understand how you can transform your income flow for better financial freedom.

Table of Comparison

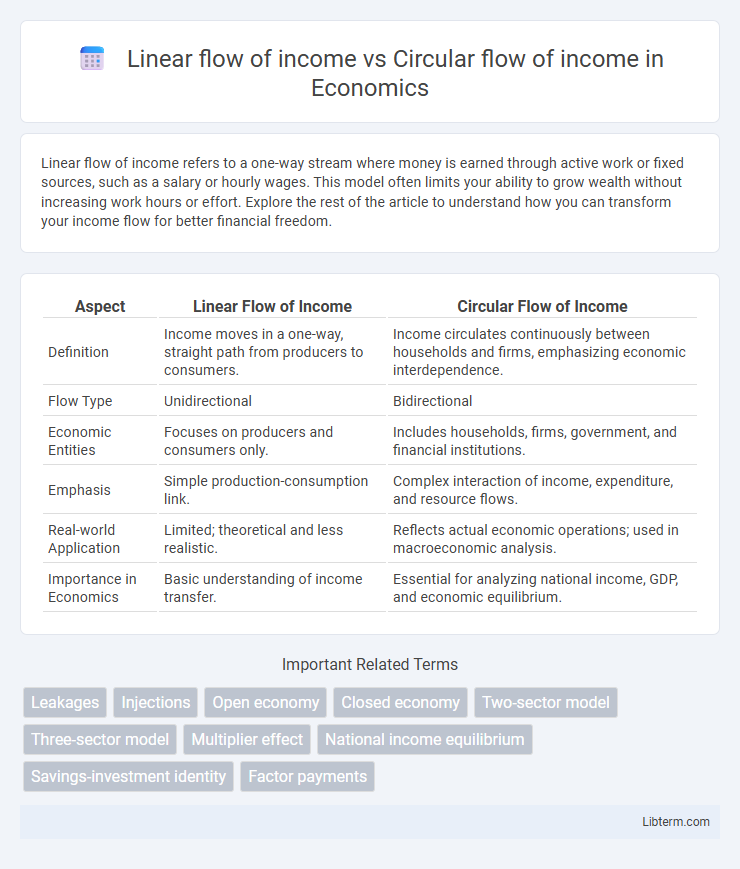

| Aspect | Linear Flow of Income | Circular Flow of Income |

|---|---|---|

| Definition | Income moves in a one-way, straight path from producers to consumers. | Income circulates continuously between households and firms, emphasizing economic interdependence. |

| Flow Type | Unidirectional | Bidirectional |

| Economic Entities | Focuses on producers and consumers only. | Includes households, firms, government, and financial institutions. |

| Emphasis | Simple production-consumption link. | Complex interaction of income, expenditure, and resource flows. |

| Real-world Application | Limited; theoretical and less realistic. | Reflects actual economic operations; used in macroeconomic analysis. |

| Importance in Economics | Basic understanding of income transfer. | Essential for analyzing national income, GDP, and economic equilibrium. |

Introduction to Flow of Income

The flow of income refers to the movement of money between different sectors of the economy, illustrating how income is generated and distributed. In a linear flow of income, money moves in a one-way direction from producers to consumers without feedback loops, simplifying the economic cycle. The circular flow of income, however, represents a continuous loop where households provide factors of production to firms and receive wages, while firms produce goods and services consumed by households, emphasizing the interdependence and ongoing exchange within the economy.

Defining Linear Flow of Income

The linear flow of income represents a simplified economic model where money moves in a one-way direction from producers to consumers without feedback loops. In this model, households provide factors of production to firms, receiving wages and spending income on goods and services, creating a straightforward path of income circulation. Unlike the circular flow, the linear flow neglects the reinvestment and savings that feed back into the economy, making it less dynamic and comprehensive.

Defining Circular Flow of Income

The circular flow of income represents the continuous movement of money, goods, and services between households and firms within an economy, illustrating the interdependence of production and consumption. Unlike the linear flow of income, which depicts a one-way transfer of resources from producers to consumers, the circular flow emphasizes the reciprocal exchange of income and expenditures, including factors such as wages, rent, and profits. This model highlights the dynamic interactions that sustain economic activity, encompassing markets for goods and services as well as factor markets, reinforcing the concept of economic equilibrium.

Key Differences Between Linear and Circular Income Flows

The linear flow of income depicts a one-way movement of money, resources, and goods primarily between households and firms, where income flows from firms to households and expenditures flow back to firms without feedback loops. In contrast, the circular flow of income illustrates a continuous, reciprocal exchange involving households, firms, government, and foreign sectors, where income circulates through multiple interdependent markets, promoting economic equilibrium. Key differences include the linear model's simplicity and focus on a direct exchange, whereas the circular model accounts for injections, leakages, and feedback mechanisms, providing a more comprehensive understanding of economic activity.

Components Involved in Linear Flow

The linear flow of income involves two main components: households and firms, where firms produce goods and services sold to households, and households provide factors of production like labor to firms. This one-way flow emphasizes the movement of money from firms to households as wages and back from households to firms as consumption expenditure. Unlike the circular flow, the linear model simplifies economic transactions by excluding government, financial markets, and foreign sectors, focusing solely on the direct exchange between producers and consumers.

Components Involved in Circular Flow

The circular flow of income involves households, firms, government, and foreign sectors, facilitating continuous exchange of goods, services, and resources within the economy. Households supply factors of production to firms, which produce goods and services sold back to households, while government imposes taxes and provides public services, and foreign trade adds import-export dynamics. This interconnected network contrasts with the linear flow of income, where money moves in a one-way stream without feedback loops or reinvestment cycles.

Economic Implications of Linear Flow

The linear flow of income model emphasizes a one-way movement of money from producers to consumers, neglecting the reinvestment and redistribution mechanisms inherent in real economies. This oversimplification can lead to inaccurate predictions about economic growth and the sustainability of income levels, as it ignores the feedback loops that circular flow models capture. Consequently, policies based solely on the linear flow may underestimate the importance of saving, investment, and government intervention necessary for economic stability.

Economic Implications of Circular Flow

The circular flow of income model illustrates the continuous movement of money, goods, and services between households and firms, reflecting the interdependency within an economy and promoting economic stability. Unlike the linear flow, which depicts a one-way movement, the circular flow emphasizes the reinvestment of income through consumption and production cycles, supporting sustainable economic growth. This cyclical interaction helps policymakers understand aggregate demand, income distribution, and the potential impact of fiscal and monetary policies on national economic equilibrium.

Advantages and Limitations of Each Model

The linear flow of income model simplifies economic transactions by depicting a one-way movement of money from households to firms and back through wages and consumption, making it easy to understand but limited in capturing the complexity of real economies such as government and foreign sector interactions. The circular flow of income model offers a more comprehensive view by including multiple sectors like households, firms, government, and foreign markets, highlighting interdependencies and leakages that affect national income, yet it can be complex to analyze and may require extensive data for accuracy. While the linear model is advantageous for teaching basic economic principles due to its simplicity, it falls short in addressing economic realities, whereas the circular model, despite its complexity, provides a better framework for policymakers to design interventions based on a more realistic depiction of economic flows.

Conclusion: Comparing Linear and Circular Income Systems

The circular flow of income presents a dynamic model depicting continuous exchanges among households, firms, and governments, highlighting how money circulates within an economy to sustain growth. In contrast, the linear flow of income simplifies economic activity into a one-way path, ignoring feedback loops and resource reutilization, thus limiting understanding of systemic interdependencies. Evaluating both systems reveals that the circular flow offers a more comprehensive framework for analyzing economic health and policy impacts by accounting for the reciprocal nature of income generation and expenditure.

Linear flow of income Infographic

libterm.com

libterm.com