Economic profit measures a company's financial gain after accounting for both explicit costs and opportunity costs, providing a deeper insight into true profitability than accounting profit alone. It helps businesses evaluate whether resources are being used effectively to maximize value. Discover how understanding economic profit can transform your decision-making by exploring the details in the rest of this article.

Table of Comparison

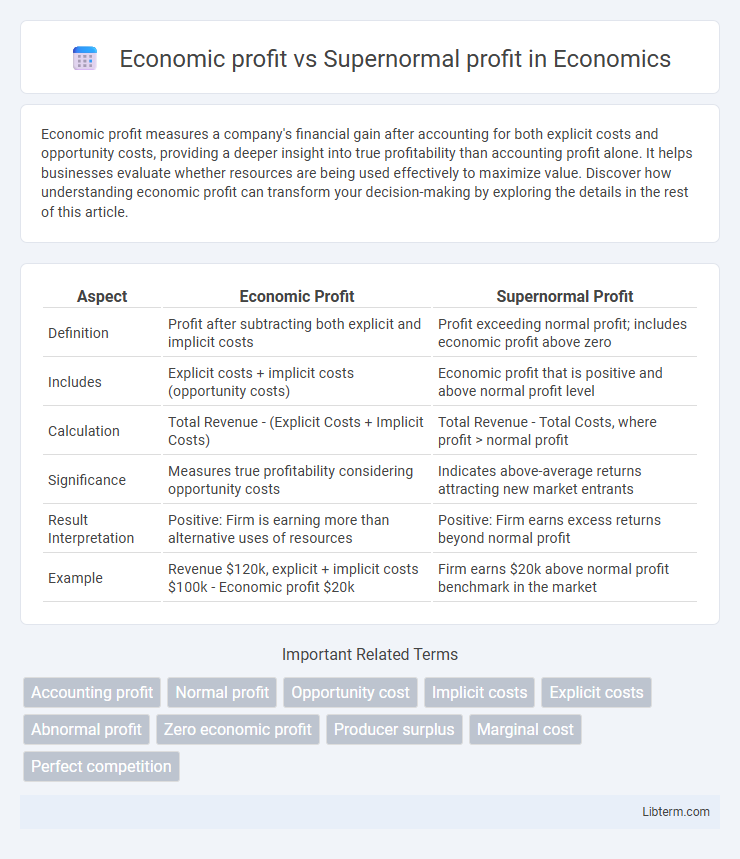

| Aspect | Economic Profit | Supernormal Profit |

|---|---|---|

| Definition | Profit after subtracting both explicit and implicit costs | Profit exceeding normal profit; includes economic profit above zero |

| Includes | Explicit costs + implicit costs (opportunity costs) | Economic profit that is positive and above normal profit level |

| Calculation | Total Revenue - (Explicit Costs + Implicit Costs) | Total Revenue - Total Costs, where profit > normal profit |

| Significance | Measures true profitability considering opportunity costs | Indicates above-average returns attracting new market entrants |

| Result Interpretation | Positive: Firm is earning more than alternative uses of resources | Positive: Firm earns excess returns beyond normal profit |

| Example | Revenue $120k, explicit + implicit costs $100k - Economic profit $20k | Firm earns $20k above normal profit benchmark in the market |

Introduction to Economic Profit and Supernormal Profit

Economic profit measures the difference between total revenue and total opportunity costs, including explicit and implicit costs, providing a comprehensive view of a firm's profitability. Supernormal profit, also known as abnormal profit, occurs when economic profit is positive, indicating returns exceed all opportunity costs and signal above-average business performance. Understanding these concepts is crucial for analyzing competitive advantages and long-term firm sustainability.

Defining Economic Profit

Economic profit measures a firm's total revenue minus both explicit costs and implicit opportunity costs, reflecting the true profitability beyond normal returns. It accounts for the opportunity cost of resources, distinguishing it from accounting profit, which only considers explicit expenses. Supernormal profit, also called economic profit, occurs when total revenue exceeds the sum of all opportunity costs, indicating above-normal returns.

Understanding Supernormal Profit

Supernormal profit, also known as economic profit, occurs when a firm's total revenue exceeds both explicit and implicit costs, including opportunity costs, resulting in returns above the normal profit level. Unlike economic profit, which accounts for all costs, accounting profit only considers explicit costs, potentially overlooking the true profitability of a firm. Understanding supernormal profit is essential for assessing a company's competitive advantage and market power within an industry.

Key Differences Between Economic and Supernormal Profit

Economic profit measures the difference between total revenue and the sum of explicit and implicit costs, reflecting the true profitability of a business. Supernormal profit, also known as abnormal profit, refers to the profit exceeding normal profit, where total revenue surpasses all opportunity costs, indicating above-average returns. Key differences include that economic profit accounts for opportunity costs and can be positive, zero, or negative, while supernormal profit specifically denotes profits greater than normal, highlighting temporary market advantages or monopolistic conditions.

Calculation Methods for Each Profit Type

Economic profit is calculated by subtracting both explicit costs (such as wages and raw materials) and implicit costs (opportunity costs of resources) from total revenue, reflecting true profitability beyond accounting measures. Supernormal profit, also known as abnormal profit, is determined by subtracting total costs, including normal profit (the minimum required return to keep resources in their current use), from total revenue, indicating earnings exceeding the normal profit level. The key distinction lies in economic profit accounting for opportunity costs, whereas supernormal profit focuses on profits above the normal expected return.

Role of Explicit and Implicit Costs

Economic profit accounts for both explicit costs, such as wages and materials, and implicit costs, including opportunity costs like foregone income from alternative investments, offering a comprehensive measure of profitability. Supernormal profit, also termed economic rent, occurs when total revenue exceeds the sum of explicit and implicit costs, signaling returns above the normal profit threshold. The distinction hinges on incorporating implicit costs, with economic profit reflecting true profitability by subtracting all costs, whereas supernormal profit identifies exceptional earnings beyond standard opportunity costs.

Significance in Business Decision-Making

Economic profit, representing total revenue minus both explicit and implicit costs, provides a more comprehensive measure of a firm's true profitability by considering opportunity costs, making it critical for long-term strategic decisions. Supernormal profit, defined as profit exceeding the normal expected return, signals market advantage and competitive strength, guiding firms in resource allocation and investment choices. Understanding the difference helps businesses identify when to expand, exit, or innovate, optimizing overall performance and sustaining growth.

Examples of Economic and Supernormal Profit in Real Markets

Economic profit occurs when a firm's total revenue exceeds both explicit and implicit costs, exemplified by a tech startup generating $500,000 in revenue with $300,000 in explicit costs and $100,000 in opportunity costs, resulting in $100,000 economic profit. Supernormal profit, also known as abnormal profit, arises when total revenue surpasses all opportunity costs, such as a pharmaceutical company earning $1 billion on a new drug with combined costs of $600 million, yielding $400 million in supernormal profit. Real market cases include Amazon's dominance in e-commerce leading to economic profit from operational efficiency, while patented drugs yield supernormal profits due to temporary market monopoly.

Impact on Market Entry and Competition

Economic profit represents total revenue minus explicit and implicit costs, including opportunity costs, signaling strong market incentives for new entrants when positive. Supernormal profit, or abnormal profit, exceeds normal profit and indicates higher-than-average returns, attracting competitors and intensifying market rivalry. Persistent supernormal profits encourage innovation and efficiency but may lead to market entry barriers due to increased competition and resource allocation.

Conclusion: Choosing the Right Profit Metric

Economic profit accounts for both explicit and implicit costs, providing a comprehensive measure of a firm's true profitability. Supernormal profit highlights returns exceeding normal industry expectations, signaling competitive advantage or market dominance. Selecting the right metric depends on strategic goals: economic profit suits long-term viability assessment, while supernormal profit emphasizes market position and short-term performance.

Economic profit Infographic

libterm.com

libterm.com