The inflation rate measures the percentage increase in the general price level of goods and services over a specific period, reflecting the decrease in purchasing power of money. It directly affects Your cost of living, savings, and investment returns. Explore the rest of the article to understand how inflation impacts the economy and Your financial planning.

Table of Comparison

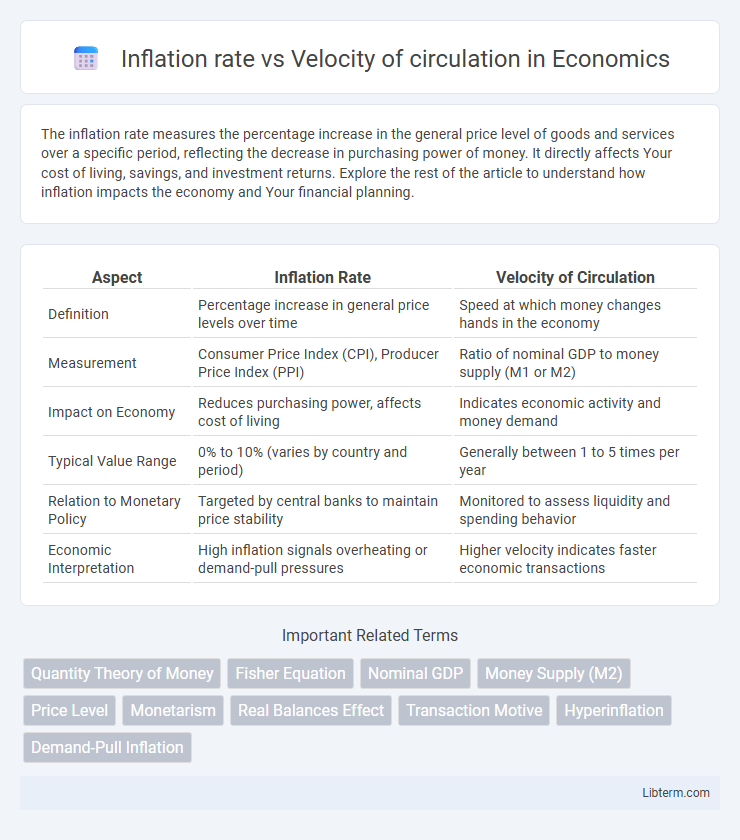

| Aspect | Inflation Rate | Velocity of Circulation |

|---|---|---|

| Definition | Percentage increase in general price levels over time | Speed at which money changes hands in the economy |

| Measurement | Consumer Price Index (CPI), Producer Price Index (PPI) | Ratio of nominal GDP to money supply (M1 or M2) |

| Impact on Economy | Reduces purchasing power, affects cost of living | Indicates economic activity and money demand |

| Typical Value Range | 0% to 10% (varies by country and period) | Generally between 1 to 5 times per year |

| Relation to Monetary Policy | Targeted by central banks to maintain price stability | Monitored to assess liquidity and spending behavior |

| Economic Interpretation | High inflation signals overheating or demand-pull pressures | Higher velocity indicates faster economic transactions |

Understanding Inflation Rate: A Brief Overview

The inflation rate measures the percentage increase in general price levels over a specific period, reflecting changes in purchasing power. Velocity of circulation denotes the frequency at which money exchanges hands within the economy, impacting overall demand. A higher velocity can amplify inflation when money supply grows, while a low velocity may temper inflation despite increased money supply.

Defining the Velocity of Money Circulation

The velocity of money circulation measures how quickly money moves through an economy, calculated as the ratio of nominal GDP to the money supply (V = GDP/M). It reflects the frequency of transactions per unit of currency within a specific period, influencing inflation rates by determining the demand for goods and services relative to available money. Higher velocity can lead to increased inflation if the money supply remains constant, as more frequent spending boosts aggregate demand.

The Relationship Between Inflation and Money Velocity

The relationship between inflation and the velocity of money circulation is central to understanding price level changes in an economy. Higher velocity, indicating faster spending of money, often correlates with increased inflation as more transactions push demand relative to supply. Conversely, a decline in velocity can signal reduced economic activity and lower inflationary pressures despite monetary expansion.

Key Economic Theories on Inflation and Velocity

The relationship between inflation rate and velocity of circulation is central to the Quantity Theory of Money, which posits that inflation occurs when the money supply grows faster than real output, assuming velocity remains stable. The Fisher Equation of Exchange (MV = PT) highlights that increases in velocity (V) amplify inflation (P) if money supply (M) and transaction volume (T) remain constant. Keynesian and Monetarist theories also emphasize velocity's role; Keynesians assert velocity fluctuates with liquidity preferences and economic activity, while Monetarists treat velocity as relatively stable, making money supply the primary driver of inflation.

Historical Trends: Inflation Rate vs. Velocity of Circulation

Historical trends reveal a complex relationship between inflation rate and velocity of circulation, where periods of high inflation often coincide with increased velocity as money changes hands more rapidly. During the 1970s stagflation, velocity surged alongside rising inflation, reflecting decreased money demand and heightened price levels. Conversely, in recent decades, especially post-2008 financial crisis, velocity has declined despite low inflation rates, illustrating shifts in economic behavior and monetary policy effects.

Factors Influencing the Velocity of Money

The velocity of money is influenced by factors such as technological advancements in payment systems, frequency of transactions, and consumer confidence in the economy. A higher velocity of circulation typically indicates increased economic activity, affecting the inflation rate by accelerating the exchange of goods and services. Changes in monetary policy, interest rates, and financial innovation also play significant roles in determining how quickly money moves within an economy.

The Role of Central Banks in Controlling Inflation

Central banks influence inflation by adjusting monetary policy tools that affect the velocity of circulation, such as interest rates and reserve requirements. By tightening or loosening money supply, central banks manage demand-side pressures and control how quickly money changes hands in the economy, directly impacting inflation rates. Effective regulation of velocity through policy interventions helps maintain price stability and fosters sustainable economic growth.

Case Studies: Real-World Examples of Inflation and Velocity

Examining the hyperinflation in Zimbabwe during the late 2000s reveals a drastic increase in the velocity of money as citizens rapidly spent currency fearing devaluation, which intensified the inflation rate beyond 79.6 billion percent by November 2008. In contrast, Japan's prolonged low inflation period since the 1990s has been accompanied by a sluggish velocity of circulation, averaging around 1.2, illustrating how stagnant spending slows inflation. These case studies demonstrate a strong correlation where rapid money turnover accelerates inflationary pressures, while reduced velocity tends to suppress price increases.

Measuring and Interpreting Economic Indicators

Measuring the inflation rate involves tracking changes in the Consumer Price Index (CPI) over time to assess the increase in average price levels. The velocity of circulation is calculated by dividing the nominal GDP by the money supply (M2), reflecting how quickly money is exchanged in the economy. Interpreting these indicators together helps economists understand the relationship between money supply growth, spending frequency, and inflationary pressures.

Policy Implications and Future Outlook

The relationship between inflation rate and velocity of circulation critically influences monetary policy decisions, as central banks monitor velocity to adjust interest rates and money supply effectively. A rising velocity typically signals increased spending and potential inflationary pressure, prompting tighter policy measures to stabilize prices. Future outlooks emphasize the importance of integrating real-time velocity data into predictive models to enhance policy responsiveness and economic stability.

Inflation rate Infographic

libterm.com

libterm.com