Cryptocurrency-based systems leverage blockchain technology to enable secure, decentralized digital transactions without relying on traditional banking institutions. These systems offer enhanced transparency, reduced transaction fees, and fast cross-border payments, transforming how value is exchanged globally. Explore the rest of this article to understand how your financial activities can benefit from adopting cryptocurrency solutions.

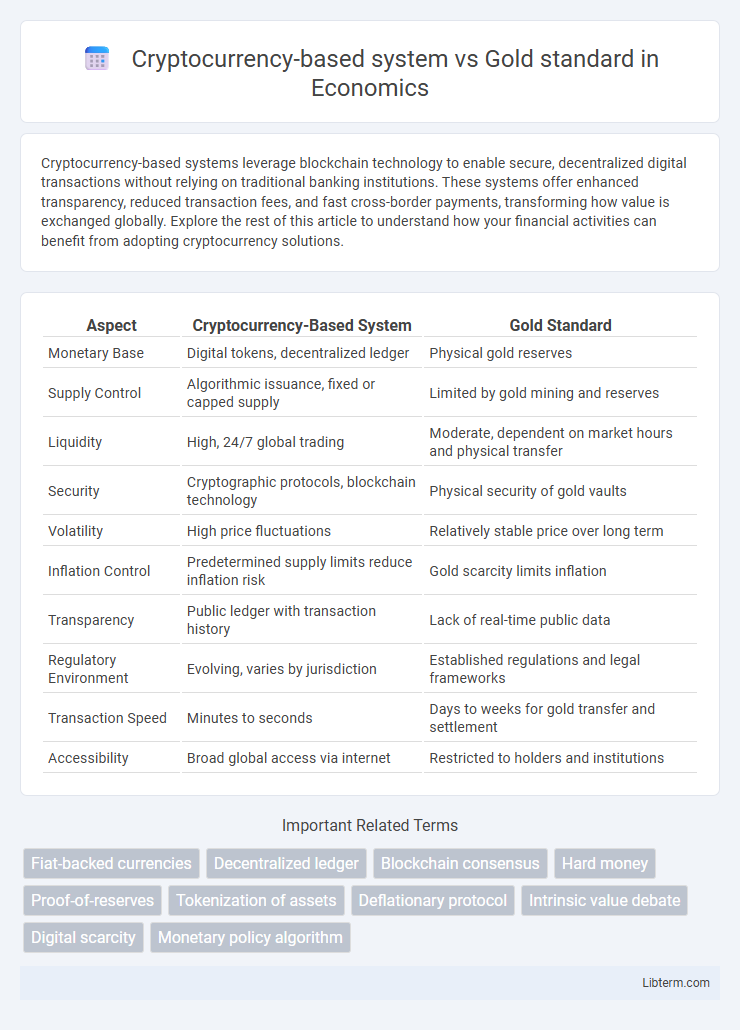

Table of Comparison

| Aspect | Cryptocurrency-Based System | Gold Standard |

|---|---|---|

| Monetary Base | Digital tokens, decentralized ledger | Physical gold reserves |

| Supply Control | Algorithmic issuance, fixed or capped supply | Limited by gold mining and reserves |

| Liquidity | High, 24/7 global trading | Moderate, dependent on market hours and physical transfer |

| Security | Cryptographic protocols, blockchain technology | Physical security of gold vaults |

| Volatility | High price fluctuations | Relatively stable price over long term |

| Inflation Control | Predetermined supply limits reduce inflation risk | Gold scarcity limits inflation |

| Transparency | Public ledger with transaction history | Lack of real-time public data |

| Regulatory Environment | Evolving, varies by jurisdiction | Established regulations and legal frameworks |

| Transaction Speed | Minutes to seconds | Days to weeks for gold transfer and settlement |

| Accessibility | Broad global access via internet | Restricted to holders and institutions |

Introduction: Understanding Cryptocurrency and the Gold Standard

Cryptocurrency operates as a decentralized digital currency secured by blockchain technology, enabling secure peer-to-peer transactions without intermediaries. The Gold Standard historically linked national currencies' values directly to a specific quantity of gold, providing tangible backing and limiting inflation. Comparing both systems highlights differences in liquidity, security, and asset-backed value, essential for understanding modern versus traditional monetary frameworks.

Historical Background of the Gold Standard

The gold standard, established in the 19th century, pegged national currencies to fixed quantities of gold, ensuring long-term price stability and international monetary cooperation. It dominated global finance until the early 20th century when World War I and economic pressures led to its gradual abandonment. In contrast, cryptocurrency-based systems operate without physical backing, relying on decentralized blockchain technology and cryptographic proof to establish trust and value.

Rise of Cryptocurrency as a Financial System

The rise of cryptocurrency as a financial system challenges the traditional gold standard by offering decentralized digital assets that enable faster, borderless transactions without reliance on physical reserves. Blockchain technology ensures transparency and security, attracting investors seeking alternatives to inflation-prone fiat currencies backed by gold's finite supply. Market adoption grows as financial institutions and governments explore integrating cryptocurrencies, signaling a paradigm shift from commodity-backed money to programmable digital finance.

Core Principles: Decentralization vs. Centralization

Cryptocurrency-based systems operate on decentralized blockchain networks, eliminating the need for central authorities by distributing ledger control across numerous nodes worldwide. In contrast, the gold standard relies on centralized government institutions and central banks to regulate currency value through physical gold reserves. This fundamental difference in core principles highlights cryptocurrencies' emphasis on transparency, security, and peer-to-peer trust versus the gold standard's dependence on centralized control and asset backing.

Transparency and Security in Both Systems

Cryptocurrency-based systems leverage blockchain technology to offer enhanced transparency through decentralized ledgers that enable real-time, immutable transaction records accessible to all participants. Security in cryptocurrencies hinges on cryptographic protocols and consensus algorithms, reducing risks of fraud and counterfeiting common in traditional systems. In contrast, the gold standard relies on physical asset backing, which provides tangible security but lacks the transparent, instant verification mechanisms inherent in digital ledgers, often resulting in delayed audits and potential opacity in reserves.

Volatility and Stability: Comparing Market Behaviors

Cryptocurrency-based systems exhibit high volatility due to decentralized markets and speculative trading, leading to rapid price fluctuations within short timeframes. In contrast, the gold standard ensures relative price stability anchored by physical asset backing, restricting oversupply and inflation risks. Market behaviors under cryptocurrency reflect dynamic, high-risk investments, whereas the gold standard operates with historically steady value preservation and lower market turbulence.

Accessibility and Global Reach

Cryptocurrency-based systems offer unparalleled accessibility by enabling users worldwide to participate in financial transactions via internet-connected devices without reliance on traditional banking infrastructure. Unlike the gold standard, which requires physical storage and is limited by geographical and regulatory constraints, cryptocurrencies operate on decentralized blockchain networks that facilitate seamless cross-border transfers and inclusivity. This global reach democratizes financial services, providing access to unbanked populations and reducing barriers posed by currency exchange and regional financial policies.

Economic Impacts of Cryptocurrency and Gold

Cryptocurrency-based systems promote decentralized financial transactions, reducing reliance on traditional banking and potentially lowering transaction costs while enhancing global accessibility to capital. The gold standard, historically providing currency stability through intrinsic asset backing, limits monetary policy flexibility and can constrain economic growth during periods of deflation or financial crises. Cryptocurrency's volatility and rapid innovation contrast with gold's stable store of value, influencing inflation control, investment behavior, and economic resilience diversely across global markets.

Regulatory Challenges and Legal Implications

Cryptocurrency-based systems face significant regulatory challenges due to their decentralized nature, lack of centralized control, and susceptibility to fraud and money laundering, prompting many governments to impose strict compliance requirements and oversight. In contrast, the gold standard involves tangible assets with established legal frameworks and historical regulatory precedents that facilitate easier governance and dispute resolution. Legal implications for cryptocurrencies include ambiguous asset classification and evolving securities laws, whereas gold's legal status as a commodity is well-defined and widely accepted in financial markets.

Future Prospects: Which System is More Sustainable?

Cryptocurrency-based systems offer enhanced scalability, lower transaction costs, and decentralized control, making them adaptive to digital economies and evolving financial technologies. The gold standard provides intrinsic value and long-term stability but struggles with limited supply and inflexible monetary policy, which may hinder economic growth. Future sustainability favors cryptocurrencies due to their programmability, liquidity, and potential integration with blockchain innovations, positioning them as more versatile in a rapidly digitizing global market.

Cryptocurrency-based system Infographic

libterm.com

libterm.com