Equity-financed projects rely on capital raised through the sale of shares, providing companies with funding without incurring debt. This approach can enhance financial stability and attract investors seeking ownership stakes and potential dividends. Explore the article to understand how equity financing can impact Your business growth and investment strategy.

Table of Comparison

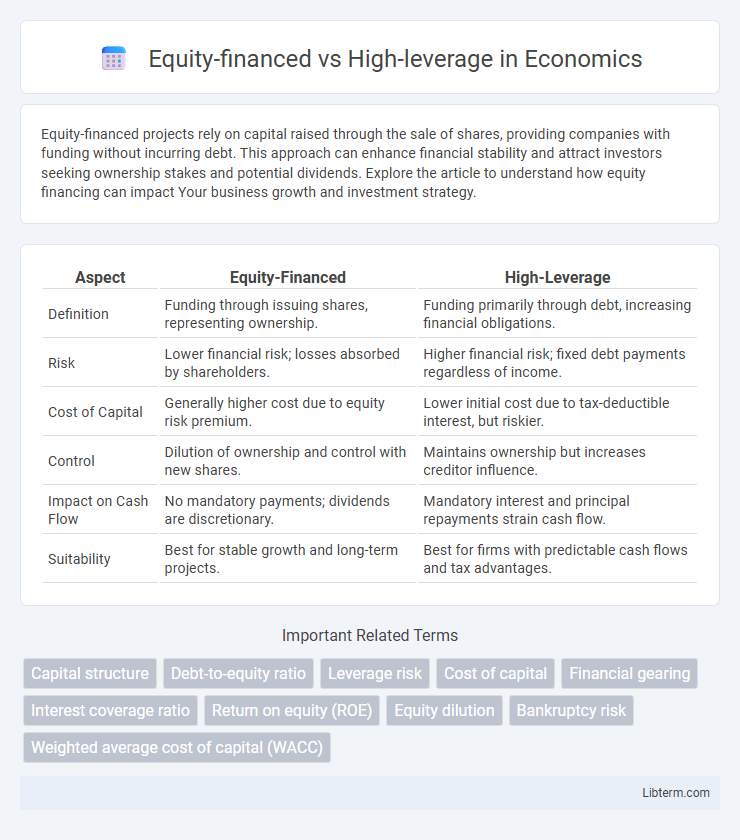

| Aspect | Equity-Financed | High-Leverage |

|---|---|---|

| Definition | Funding through issuing shares, representing ownership. | Funding primarily through debt, increasing financial obligations. |

| Risk | Lower financial risk; losses absorbed by shareholders. | Higher financial risk; fixed debt payments regardless of income. |

| Cost of Capital | Generally higher cost due to equity risk premium. | Lower initial cost due to tax-deductible interest, but riskier. |

| Control | Dilution of ownership and control with new shares. | Maintains ownership but increases creditor influence. |

| Impact on Cash Flow | No mandatory payments; dividends are discretionary. | Mandatory interest and principal repayments strain cash flow. |

| Suitability | Best for stable growth and long-term projects. | Best for firms with predictable cash flows and tax advantages. |

Introduction to Equity-Financed and High-Leverage Models

Equity-financed models rely on raising capital through the sale of shares, reducing financial risk by avoiding debt repayments and interest obligations. High-leverage models utilize significant borrowing to amplify potential returns but increase exposure to financial distress and liquidity risks. Understanding the trade-offs between equity financing's risk mitigation and high leverage's return amplification is critical for capital structure decisions.

Defining Equity Financing

Equity financing involves raising capital by selling shares of ownership in a company, allowing investors to claim a portion of future profits and losses. This method reduces the risk of debt default since there are no fixed repayment obligations, making it suitable for businesses seeking long-term growth without immediate financial pressure. Compared to high-leverage strategies, equity financing minimizes financial risk but may dilute existing ownership control.

Understanding High-Leverage Financing

High-leverage financing involves using significant amounts of debt to amplify potential returns on equity, typically resulting in higher financial risk compared to equity-financed strategies. Companies adopting high-leverage structures benefit from tax-deductible interest payments, but face increased vulnerability to market fluctuations and cash flow constraints. Understanding the balance between debt and equity is crucial for optimizing capital structure and ensuring sustainable long-term growth.

Key Differences Between Equity and High-Leverage Approaches

Equity-financed strategies involve raising capital through the sale of ownership shares, which reduces financial risk since no fixed repayments are required. High-leverage approaches rely heavily on debt financing, increasing potential returns but also amplifying the risk due to mandatory interest payments and principal repayment schedules. Key differences include the impact on cash flow, risk exposure, and ownership dilution, where equity financing dilutes ownership but preserves cash, while high leverage maintains ownership but strains cash flow with fixed debt obligations.

Impact on Business Growth and Expansion

Equity-financed businesses benefit from increased financial stability and lower risk, enabling sustainable long-term growth and easier access to additional capital for expansion. High-leverage companies can accelerate growth through significant borrowing but face heightened insolvency risk and cash flow constraints that may limit operational flexibility. Balancing equity financing with manageable debt levels optimizes growth potential while minimizing financial distress during expansion.

Risk Assessment: Equity vs High-Leverage

Equity-financed projects distribute risk among shareholders, reducing financial distress likelihood due to lower fixed obligations compared to high-leverage financing. High-leverage structures increase risk exposure through substantial debt repayments, amplifying potential losses during cash flow volatility. Risk assessment in equity-financed ventures emphasizes ownership dilution, while high-leverage prioritizes debt service capacity and default probability.

Financial Flexibility and Control Considerations

Equity-financed companies maintain higher financial flexibility by avoiding fixed debt obligations, enabling easier access to additional capital without increasing risk of insolvency. High-leverage firms face restricted financial flexibility due to mandatory interest payments and covenants, which can limit operational decisions and strategic investments. Equity financing preserves shareholder control and prevents dilution through concentrated ownership, whereas high leverage may impose lender oversight and trigger restrictive covenants affecting management autonomy.

Cost of Capital: Equity vs Debt

Equity-financed companies typically face higher costs of capital compared to high-leverage firms due to the higher required returns demanded by equity investors reflecting greater risk. Debt financing usually offers lower cost of capital because interest payments are tax-deductible, reducing the firm's taxable income and thus its overall cost of borrowing. However, excessive leverage increases financial risk and may lead to higher equity risk premiums, potentially offsetting debt cost advantages.

Long-Term Strategic Implications

Equity-financed firms maintain lower debt levels, enabling sustained investment flexibility and reducing financial risk during economic downturns, which supports long-term strategic growth and innovation. High-leverage companies benefit from tax advantages and amplified returns on equity but face increased bankruptcy risk and constrained operational decisions, potentially limiting adaptability in volatile markets. Strategic planning must balance the cost of capital with financial stability to optimize long-term shareholder value and competitive positioning.

Choosing the Right Financing Structure

Equity-financed structures reduce financial risk by avoiding debt obligations, making them ideal for companies seeking long-term stability without interest burdens. High-leverage financing can amplify returns through borrowed capital but increases default risk and financial distress in volatile markets. Selecting the right financing structure depends on factors such as cash flow stability, risk tolerance, growth opportunities, and market conditions to balance cost of capital and operational flexibility.

Equity-financed Infographic

libterm.com

libterm.com