Monetarism emphasizes the critical role of managing the money supply to control inflation and stabilize the economy. This economic theory suggests that stable, predictable growth in the money supply supports sustainable economic development. Explore the full article to understand how monetarism influences modern economic policies and your financial decisions.

Table of Comparison

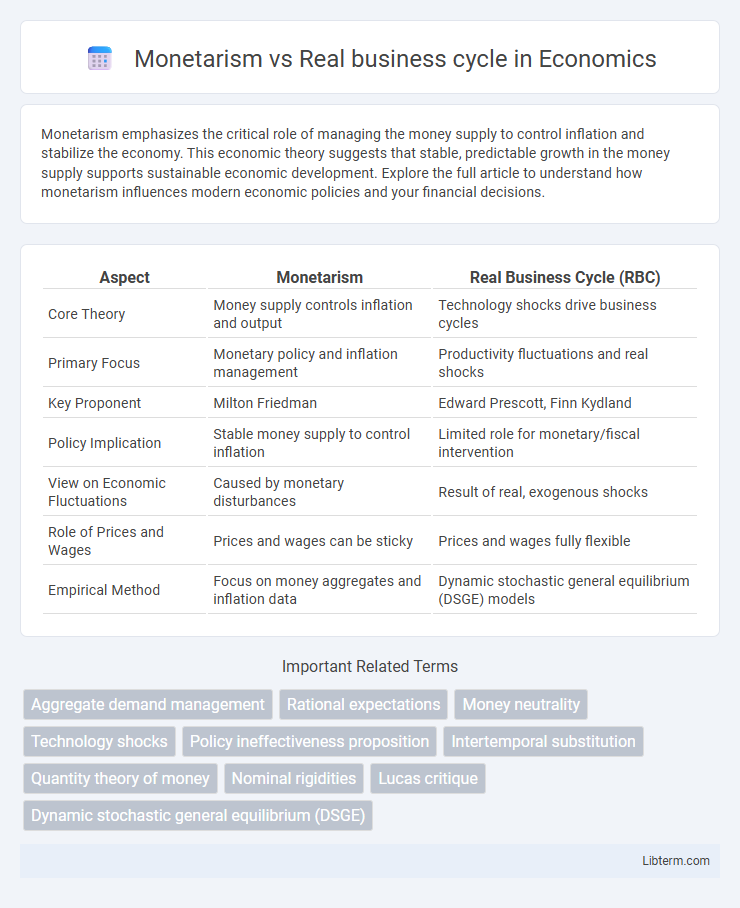

| Aspect | Monetarism | Real Business Cycle (RBC) |

|---|---|---|

| Core Theory | Money supply controls inflation and output | Technology shocks drive business cycles |

| Primary Focus | Monetary policy and inflation management | Productivity fluctuations and real shocks |

| Key Proponent | Milton Friedman | Edward Prescott, Finn Kydland |

| Policy Implication | Stable money supply to control inflation | Limited role for monetary/fiscal intervention |

| View on Economic Fluctuations | Caused by monetary disturbances | Result of real, exogenous shocks |

| Role of Prices and Wages | Prices and wages can be sticky | Prices and wages fully flexible |

| Empirical Method | Focus on money aggregates and inflation data | Dynamic stochastic general equilibrium (DSGE) models |

Introduction to Monetarism and Real Business Cycle Theory

Monetarism, pioneered by Milton Friedman, emphasizes the control of money supply as the primary driver of economic stability and inflation control, advocating for predictable monetary growth rates. Real Business Cycle (RBC) theory attributes economic fluctuations to real (rather than monetary) shocks, such as technology changes, affecting productivity and labor supply decisions in dynamic general equilibrium models. While Monetarism highlights monetary policy's role in influencing aggregate demand, RBC theory focuses on real factors and rational expectations to explain output and employment variations.

Historical Development of Monetarism

Monetarism, pioneered by Milton Friedman in the mid-20th century, emerged as a response to Keynesian economics, emphasizing the role of government control over money supply to manage inflation and economic stability. The historical development of monetarism traces back to the 1950s and 1960s when empirical work challenged the effectiveness of fiscal policy, leading to a focus on monetary policy and the natural rate of unemployment. This school of thought significantly influenced economic policy in the 1970s and 1980s, contrasting with Real Business Cycle theory, which attributes economic fluctuations to real shocks and technology changes rather than monetary factors.

Origins and Evolution of Real Business Cycle Theory

Real Business Cycle (RBC) theory originated in the 1980s as an alternative to Keynesian and Monetarist models, emphasizing technology shocks and real factors rather than monetary influences as drivers of economic fluctuations. Developed by economists Finn Kydland and Edward Prescott, RBC theory evolved through the incorporation of microeconomic foundations and dynamic stochastic general equilibrium models, highlighting the role of intertemporal choices under uncertainty. Monetarism, founded by Milton Friedman, focused on the impact of money supply on inflation and output, fundamentally differing from RBC's real shocks approach based on productivity changes and market clearing assumptions.

Core Principles of Monetarism

Monetarism centers on the core principle that changes in the money supply are the primary driver of economic fluctuations and inflation, emphasizing the importance of stable monetary growth to achieve long-term economic stability. It asserts that markets are generally efficient and that government intervention should be minimal, advocating for a predetermined monetary rule rather than discretionary fiscal policies. Monetarists argue that variations in aggregate demand caused by monetary shocks lead to short-term fluctuations, contrasting sharply with Real Business Cycle theory, which attributes economic cycles to real shocks like technology changes without emphasizing monetary factors.

Fundamental Assumptions of Real Business Cycle Models

Real Business Cycle (RBC) models assume that economic fluctuations result primarily from real shocks, such as changes in technology or productivity, rather than monetary disturbances. These models emphasize intertemporal optimization by rational agents who respond optimally to changes in external conditions, with labor supply and capital accumulation as key drivers. The fundamental assumption is that markets clear continuously, and business cycles reflect efficient responses to real economic changes rather than market failures or monetary policy effects.

Role of Money and Monetary Policy

Monetarism emphasizes the crucial role of money supply in influencing economic activity and advocates for steady monetary growth to control inflation and stabilize output. In contrast, Real Business Cycle (RBC) theory downplays the role of money, attributing economic fluctuations primarily to real shocks such as technology changes, and regards monetary policy as largely ineffective in altering real output. Monetarists argue that active monetary policy can smooth business cycles, whereas RBC proponents assert that monetary interventions have limited impact on real economic variables.

Explanation of Economic Fluctuations: Monetarist Perspective

Monetarists explain economic fluctuations primarily as the result of variations in the money supply, emphasizing that unstable monetary policy leads to changes in aggregate demand and subsequently impacts output and employment. They argue that slow adjustments in prices and wages cause temporary deviations from full employment when the money supply shifts unexpectedly. Monetarist models prioritize controlling the growth rate of money to stabilize the economy and minimize cyclical volatility.

Real Shocks and Business Cycle Dynamics

Real Business Cycle (RBC) theory emphasizes real shocks such as technology changes, productivity fluctuations, and resource availability as primary drivers of business cycle dynamics, highlighting their role in causing variations in output and employment. Monetarism prioritizes nominal factors like money supply changes and inflation, viewing business cycles largely as consequences of monetary policy disturbances rather than real shocks. The RBC framework models economic fluctuations as efficient responses to real shocks, whereas monetarist perspectives stress the destabilizing effects of monetary policy on economic stability.

Policy Implications: Contrasting Monetarist and RBC Approaches

Monetarism emphasizes controlling the money supply to stabilize inflation and influence economic output, advocating for consistent monetary policy rules to reduce uncertainty and prevent inflationary or deflationary spirals. Real Business Cycle (RBC) theory argues that economic fluctuations result from real shocks, such as technology changes, suggesting that government intervention is often ineffective or counterproductive since the economy is best left to self-correct through market mechanisms. Policy implications diverge as Monetarists support active monetary policies to smooth cycles, while RBC proponents favor minimal state interference and emphasize supply-side reforms for long-term growth.

Critiques and Contemporary Relevance

Monetarism, championed by Milton Friedman, faces critiques for oversimplifying the relationship between money supply and economic output, ignoring real shocks and price rigidities. Real Business Cycle (RBC) theory, which attributes fluctuations to technology shocks and market clearing, is criticized for neglecting monetary factors and downplaying demand-side issues, limiting its policy applicability. Despite critiques, Monetarism influences central bank strategies emphasizing inflation control, while RBC models underpin modern macroeconomic frameworks incorporating microfoundations and real shocks analysis.

Monetarism Infographic

libterm.com

libterm.com