Nominal return represents the percentage increase in money invested without adjusting for inflation or taxes, providing a straightforward measure of investment growth. It reflects the gross return earned over a period, which is crucial for comparing different investment options before considering purchasing power changes. Explore the rest of the article to understand how nominal return impacts your investment decisions and its relation to real return.

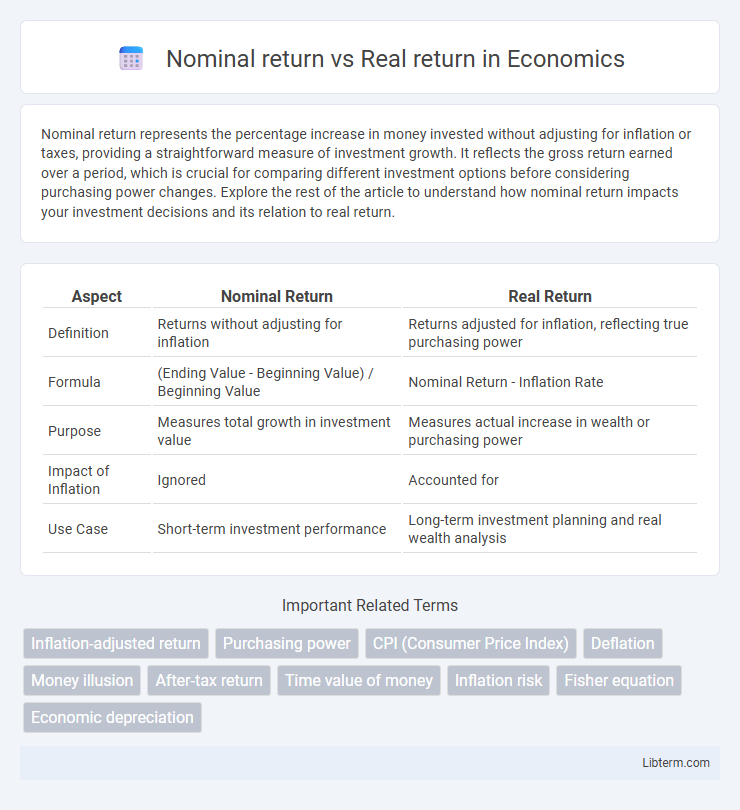

Table of Comparison

| Aspect | Nominal Return | Real Return |

|---|---|---|

| Definition | Returns without adjusting for inflation | Returns adjusted for inflation, reflecting true purchasing power |

| Formula | (Ending Value - Beginning Value) / Beginning Value | Nominal Return - Inflation Rate |

| Purpose | Measures total growth in investment value | Measures actual increase in wealth or purchasing power |

| Impact of Inflation | Ignored | Accounted for |

| Use Case | Short-term investment performance | Long-term investment planning and real wealth analysis |

Understanding Nominal Return

Nominal return represents the percentage increase in an investment's value without adjusting for inflation, reflecting the raw financial gain over a specific period. It is calculated by dividing the difference between the ending and beginning value of the investment by the initial investment amount. Investors rely on nominal return to assess gross performance, but it may overstate true profitability when inflation rates are high.

What is Real Return?

Real return measures the actual purchasing power gained from an investment, adjusting the nominal return for inflation to reflect true growth. It provides a more accurate assessment of investment performance by accounting for changes in the cost of living over time. Investors rely on real return to evaluate how much their wealth increases after eroding effects of inflation are considered.

Key Differences Between Nominal and Real Return

Nominal return refers to the percentage increase in an investment's value without adjusting for inflation, while real return accounts for inflation, providing a more accurate measure of purchasing power gains. The key difference lies in how inflation impacts the actual earnings, with real return reflecting the true growth of an investment by subtracting inflation from the nominal return rate. Investors rely on real return to assess investment performance over time, ensuring that the gain surpasses the erosion of value caused by rising prices.

The Impact of Inflation on Investment Returns

Nominal return represents the percentage increase in money earned from an investment without adjusting for inflation, while real return accounts for inflation's effect by reflecting the actual purchasing power gained. Inflation reduces the value of nominal returns by eroding the investor's ability to buy goods and services, thereby diminishing the real return on investments. Understanding the distinction between nominal and real returns is critical for assessing investment performance and making informed financial decisions in an inflationary environment.

Why Real Return Matters for Investors

Real return matters for investors because it reflects the true increase in purchasing power after adjusting for inflation, providing an accurate measure of investment performance. Nominal return can be misleading as it does not account for changes in price levels, potentially overstating actual gains. Understanding real return helps investors make informed decisions about the growth and sustainability of their wealth over time.

Calculating Nominal and Real Return

Nominal return is calculated by dividing the investment's ending value minus the initial value by the initial value, without adjusting for inflation. Real return adjusts the nominal return by subtracting the inflation rate to reflect the true purchasing power gain or loss. Investors use the formula Real Return = ((1 + Nominal Return) / (1 + Inflation Rate)) - 1 to accurately measure investment performance.

Examples: Nominal vs Real Return in Practice

An investment with a nominal return of 8% in a year with 3% inflation results in a real return of approximately 4.85%. For instance, if you invest $1,000 and earn $80 nominally, the purchasing power of that return decreases after accounting for inflation, leaving you effectively with $48.50 in real gains. This practical comparison highlights the importance of considering inflation to understand the actual growth of your investment.

Common Misconceptions About Return Calculations

Nominal return represents the percentage increase in an investment's value without adjusting for inflation, often leading to an overestimation of actual gains. Real return accounts for inflation, providing a more accurate measure of purchasing power and true investment performance. A common misconception is equating nominal return with real profitability, overlooking the erosive effect of inflation on investment returns.

Strategies to Maximize Real Return

Maximizing real return involves focusing on investment strategies that outperform inflation, such as diversifying portfolios with assets like stocks, real estate, and inflation-protected securities (TIPS). Active portfolio management, including regularly rebalancing and seeking opportunities in high-growth sectors, helps preserve purchasing power by ensuring returns exceed consumer price index (CPI) increases. Tax-efficient investing and minimizing fees further enhance real returns by reducing the erosion of gains from taxes and expenses.

Conclusion: Choosing Between Nominal and Real Return

Choosing between nominal and real return depends on the investment goals and inflation expectations. Real return provides a more accurate measure of purchasing power by adjusting nominal return for inflation, making it essential for long-term financial planning. Investors seeking to preserve or grow wealth should prioritize real return to better assess investment performance in terms of true economic gain.

Nominal return Infographic

libterm.com

libterm.com