Double-entry accounting records every financial transaction in two accounts: a debit in one and a credit in another, ensuring accuracy and balance in your bookkeeping. This system helps detect errors, improve financial reporting, and supports effective decision-making. Discover how mastering double-entry accounting can streamline your business finances by reading the full article.

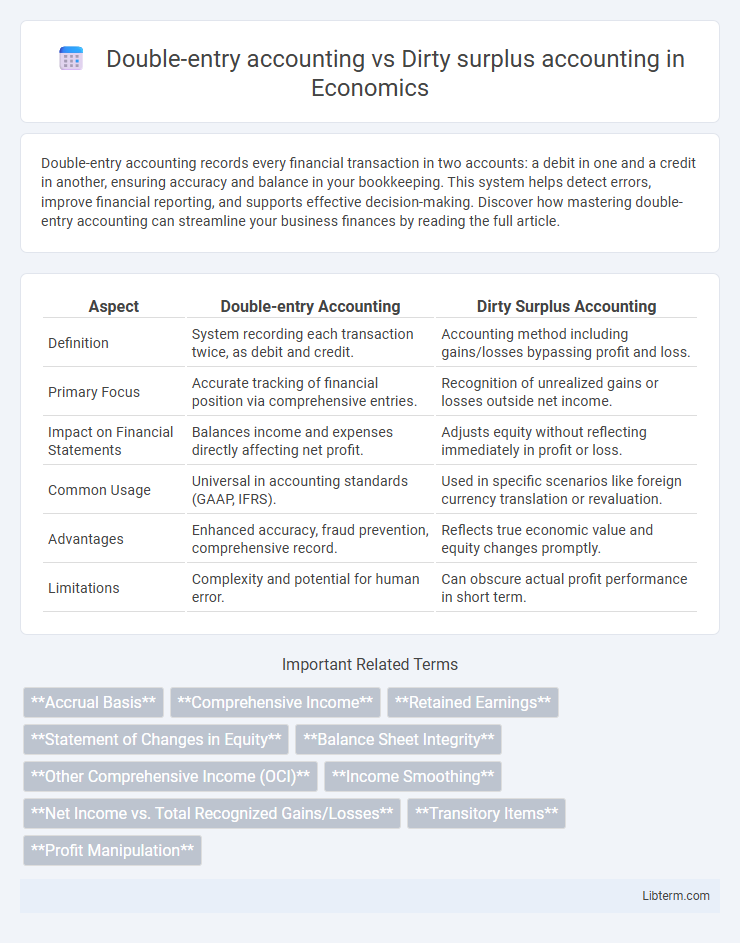

Table of Comparison

| Aspect | Double-entry Accounting | Dirty Surplus Accounting |

|---|---|---|

| Definition | System recording each transaction twice, as debit and credit. | Accounting method including gains/losses bypassing profit and loss. |

| Primary Focus | Accurate tracking of financial position via comprehensive entries. | Recognition of unrealized gains or losses outside net income. |

| Impact on Financial Statements | Balances income and expenses directly affecting net profit. | Adjusts equity without reflecting immediately in profit or loss. |

| Common Usage | Universal in accounting standards (GAAP, IFRS). | Used in specific scenarios like foreign currency translation or revaluation. |

| Advantages | Enhanced accuracy, fraud prevention, comprehensive record. | Reflects true economic value and equity changes promptly. |

| Limitations | Complexity and potential for human error. | Can obscure actual profit performance in short term. |

Introduction to Double-entry and Dirty Surplus Accounting

Double-entry accounting records financial transactions through dual entries--debits and credits--ensuring the accounting equation stays balanced and providing a clear, comprehensive view of a company's financial position. Dirty surplus accounting differs by allowing certain income and expense items to bypass the profit and loss statement, impacting equity directly and offering a more nuanced reflection of comprehensive income and other economic events. Understanding the distinction between these methods is essential for accurate financial analysis and transparent reporting.

Defining Double-entry Accounting

Double-entry accounting is a financial recording system where every transaction affects at least two ledger accounts, ensuring that debits equal credits and maintaining the accounting equation: Assets = Liabilities + Equity. This method provides a comprehensive framework for tracking financial activities, supporting accuracy and facilitating error detection in financial statements. Unlike dirty surplus accounting, which includes certain items directly in equity without affecting net income, double-entry accounting systematically records all transactions, making it the foundation for transparent and reliable financial reporting.

Understanding Dirty Surplus Accounting

Dirty surplus accounting records certain gains and losses directly in equity, bypassing the income statement, which contrasts with the double-entry system that recognizes all transactions through matching debits and credits impacting income and balance sheets. This approach challenges traditional double-entry accounting by providing a more nuanced view of comprehensive income, capturing items like unrealized gains on securities or foreign currency translation adjustments that double-entry might exclude from profit measurements. Understanding dirty surplus accounting is essential for interpreting financial statements more accurately, especially in industries where non-operational changes significantly affect shareholder equity but do not alter net income.

Historical Development and Adoption

Double-entry accounting originated in 15th-century Italy, credited to Luca Pacioli's pioneering work that established the systematic recording of debits and credits, which became the foundation for modern financial accounting. Dirty surplus accounting, emerging in the late 20th century, integrates gains and losses not recognized in net income directly into equity, reflecting a more comprehensive view of financial performance beyond traditional double-entry frameworks. Adoption of double-entry accounting is widespread globally due to its clarity and reliability, whereas dirty surplus accounting gained traction primarily in academic and specialized financial reporting contexts aimed at addressing limitations of conventional profit measurement.

Core Principles and Mechanics

Double-entry accounting records every financial transaction with equal debits and credits, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced, which enhances accuracy and error detection. Dirty surplus accounting integrates certain gains and losses directly into equity without passing through the income statement, affecting how comprehensive income is reported and potentially obscuring true profitability. Core mechanics in double-entry emphasize transaction duality and ledger balancing, while dirty surplus relies on recognizing some income components outside traditional profit and loss, impacting financial transparency and performance assessment.

Key Differences in Financial Reporting

Double-entry accounting records every transaction with equal debits and credits, ensuring the accounting equation stays balanced, while dirty surplus accounting includes certain gains and losses directly in equity without passing through the income statement. This key difference affects financial reporting by providing a more transparent and comprehensive view of financial performance and position in double-entry systems. Dirty surplus accounting may obscure true earnings, complicating the analysis of a company's profitability and financial health.

Impact on Financial Transparency and Accuracy

Double-entry accounting enhances financial transparency and accuracy by recording each transaction in two accounts, ensuring balanced books and reducing errors or omissions. Dirty surplus accounting incorporates gains and losses directly into equity without passing through the income statement, potentially obscuring true performance and reducing clarity for stakeholders. Consequently, double-entry provides a more reliable and transparent framework for financial reporting compared to the less precise recognition methods in dirty surplus accounting.

Implications for Investors and Stakeholders

Double-entry accounting provides a comprehensive and transparent financial framework by recording transactions in two accounts, enhancing accuracy and reliability for investors and stakeholders assessing a company's financial health. Dirty surplus accounting includes gains and losses not reported in net income but directly in equity, which can obscure true performance and complicate stakeholder decision-making. Investors analyzing financial statements must adjust for dirty surplus items to accurately evaluate earnings quality and the company's economic reality.

Advantages and Disadvantages of Each Method

Double-entry accounting provides a comprehensive and accurate financial record by recording every transaction in two accounts, ensuring the accounting equation remains balanced, which enhances error detection and financial transparency but can be complex and time-consuming for small businesses. Dirty surplus accounting, which bypasses the recognition of certain income and expense items through equity changes rather than profit or loss, simplifies financial statements and focuses on cash flows but may reduce transparency and obscure true financial performance. Each method offers distinct advantages: double-entry excels in thoroughness and regulatory compliance, while dirty surplus provides streamlined reporting with potential risks in misrepresenting earnings.

Choosing the Right Accounting Method for Your Business

Double-entry accounting provides a comprehensive framework by recording every transaction in two accounts, ensuring accuracy and reducing errors, which makes it ideal for businesses seeking detailed financial tracking and audit readiness. Dirty surplus accounting allows certain income and expense items to bypass the profit and loss statement and adjust equity directly, useful for companies focusing on economic performance without fluctuating profit metrics. Selecting the right method depends on your business size, regulatory requirements, and the need for transparent, detailed financial reporting versus simplified performance indicators.

Double-entry accounting Infographic

libterm.com

libterm.com