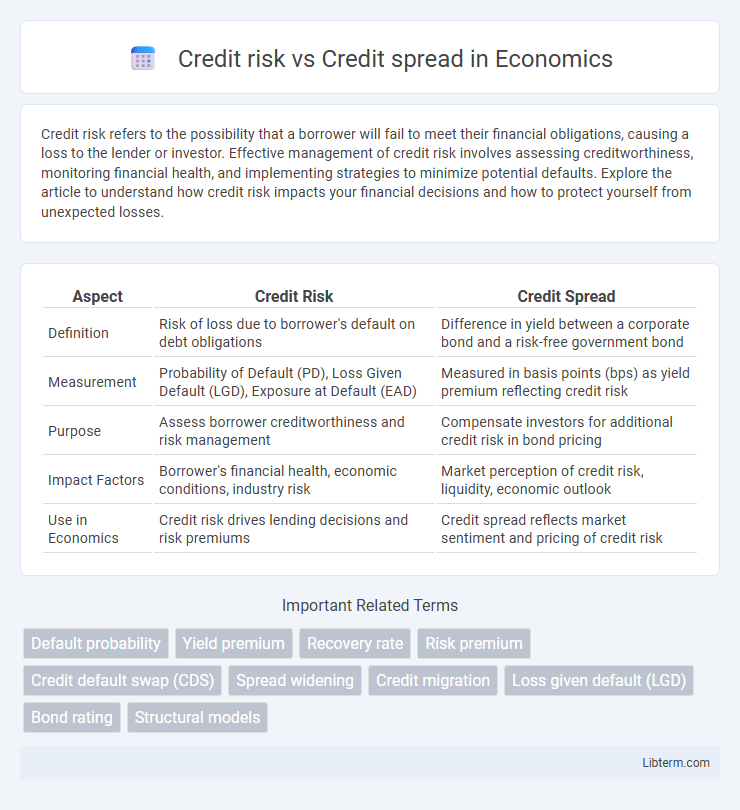

Credit risk refers to the possibility that a borrower will fail to meet their financial obligations, causing a loss to the lender or investor. Effective management of credit risk involves assessing creditworthiness, monitoring financial health, and implementing strategies to minimize potential defaults. Explore the article to understand how credit risk impacts your financial decisions and how to protect yourself from unexpected losses.

Table of Comparison

| Aspect | Credit Risk | Credit Spread |

|---|---|---|

| Definition | Risk of loss due to borrower's default on debt obligations | Difference in yield between a corporate bond and a risk-free government bond |

| Measurement | Probability of Default (PD), Loss Given Default (LGD), Exposure at Default (EAD) | Measured in basis points (bps) as yield premium reflecting credit risk |

| Purpose | Assess borrower creditworthiness and risk management | Compensate investors for additional credit risk in bond pricing |

| Impact Factors | Borrower's financial health, economic conditions, industry risk | Market perception of credit risk, liquidity, economic outlook |

| Use in Economics | Credit risk drives lending decisions and risk premiums | Credit spread reflects market sentiment and pricing of credit risk |

Introduction to Credit Risk and Credit Spread

Credit risk represents the likelihood that a borrower will default on debt obligations, causing financial loss to the lender or investor. Credit spread refers to the difference in yield between a corporate bond and a comparable government bond, acting as a market indicator of perceived credit risk. Monitoring credit spreads provides insight into changing credit risk perceptions and the overall health of debt markets.

Defining Credit Risk: Key Concepts

Credit risk refers to the possibility that a borrower will fail to meet their debt obligations, leading to financial loss for the lender. Key concepts include default probability, loss given default (LGD), and exposure at default (EAD), which collectively measure the potential impact of credit events. Understanding credit risk is essential for assessing credit spreads, which represent the additional yield investors demand to compensate for this risk.

Understanding Credit Spreads in Financial Markets

Credit spreads represent the yield difference between a corporate bond and a risk-free government bond, reflecting the compensation investors demand for bearing credit risk. These spreads fluctuate based on the borrower's creditworthiness, economic conditions, and market liquidity, serving as a key indicator of perceived default risk. Monitoring credit spreads enables investors to assess risk premium changes and make informed decisions about fixed-income investments.

Main Factors Influencing Credit Risk

Credit risk is the likelihood that a borrower will default on debt obligations, influenced primarily by factors such as borrower creditworthiness, economic conditions, and market volatility. Credit spread, the difference in yield between a corporate bond and a risk-free government bond, reflects the market's assessment of credit risk and compensation for bearing that risk. Key determinants of credit risk include issuer financial health, credit ratings, industry sector stability, and macroeconomic indicators like interest rates and unemployment levels.

Determinants of Credit Spread Fluctuations

Credit spread fluctuations are primarily influenced by changes in credit risk, liquidity conditions, and macroeconomic factors such as interest rate volatility and economic growth expectations. The credit rating of the issuer, market sentiment toward default probabilities, and industry-specific risks significantly affect the magnitude and direction of credit spread changes. Additionally, supply and demand imbalances in the bond market and shifts in investor risk appetite contribute to the dynamic behavior of credit spreads over time.

Credit Risk Assessment Methods

Credit risk assessment methods evaluate the likelihood of borrower default using quantitative models such as the Z-score model, logistic regression, and credit scoring systems, which analyze financial ratios, payment history, and market data. Credit spreads reflect the market's compensation for credit risk, and assessing credit spreads involves analyzing market-implied default probabilities and liquidity premiums. Effective credit risk assessment integrates both fundamental borrower analysis and credit spread data to optimize risk pricing and decision-making processes.

Relationship Between Credit Risk and Credit Spread

Credit risk directly influences the credit spread, as higher credit risk typically leads to wider credit spreads to compensate investors for increased default probability. Credit spreads serve as a market measure of credit risk, reflecting investor perception of issuer quality and the likelihood of default. Monitoring credit spread changes provides real-time insight into shifts in credit risk for corporate bonds and other debt instruments.

Role of Credit Ratings in Spread Analysis

Credit ratings play a pivotal role in credit spread analysis by quantifying the credit risk associated with a borrower and influencing the spread investors demand as compensation. Higher credit ratings typically result in narrower credit spreads, reflecting lower perceived default risk, while lower ratings lead to wider spreads due to increased uncertainty. Credit rating agencies provide standardized assessments that help investors compare creditworthiness across issuers, making these ratings integral to pricing debt securities and managing credit risk.

Implications for Investors and Lenders

Credit risk directly influences credit spreads, reflecting the additional yield investors demand for bearing default risk on debt instruments. Wider credit spreads indicate higher perceived credit risk, leading lenders to require greater compensation and investors to reassess portfolio risk exposure. Understanding this relationship allows both parties to better price debt, manage portfolios, and implement risk mitigation strategies effectively.

Conclusion: Managing Credit Risk and Spread Effectively

Effective management of credit risk and credit spread is crucial for minimizing potential losses in fixed-income investments. By continuously monitoring issuer creditworthiness and market conditions, investors can better anticipate spread widening linked to deteriorating credit profiles. Implementing diversified portfolios and timely hedging strategies helps stabilize returns and control exposure to adverse credit events.

Credit risk Infographic

libterm.com

libterm.com