The multiplier effect refers to the phenomenon where an initial injection of spending leads to a greater overall increase in economic activity. This happens because one person's spending becomes another person's income, creating a chain reaction of increased consumption and investment. Discover how understanding the multiplier effect can help you grasp the complexities of economic growth in the full article.

Table of Comparison

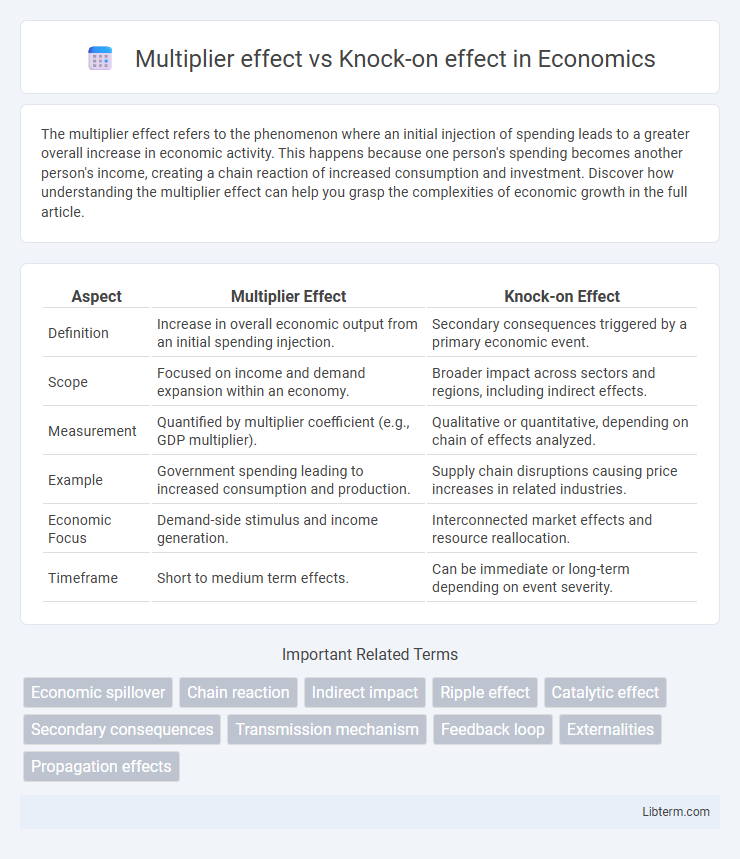

| Aspect | Multiplier Effect | Knock-on Effect |

|---|---|---|

| Definition | Increase in overall economic output from an initial spending injection. | Secondary consequences triggered by a primary economic event. |

| Scope | Focused on income and demand expansion within an economy. | Broader impact across sectors and regions, including indirect effects. |

| Measurement | Quantified by multiplier coefficient (e.g., GDP multiplier). | Qualitative or quantitative, depending on chain of effects analyzed. |

| Example | Government spending leading to increased consumption and production. | Supply chain disruptions causing price increases in related industries. |

| Economic Focus | Demand-side stimulus and income generation. | Interconnected market effects and resource reallocation. |

| Timeframe | Short to medium term effects. | Can be immediate or long-term depending on event severity. |

Introduction to Multiplier Effect and Knock-on Effect

The multiplier effect refers to the process where an initial injection of spending leads to a greater overall increase in economic output, as the initial expenditure circulates through various sectors. The knock-on effect describes how one event or action triggers a chain of related impacts across different industries or parts of the economy, amplifying the initial influence. Both concepts illustrate the propagation of economic changes but differ in scope, with the multiplier effect emphasizing amplified financial growth and the knock-on effect highlighting interconnected consequences.

Definitions: Understanding Core Concepts

The multiplier effect refers to the process where an initial injection of spending leads to a greater overall increase in national income due to successive rounds of re-spending. The knock-on effect describes the indirect consequences of an economic event, where changes in one industry or sector trigger ripple effects across related businesses and supply chains. Both concepts highlight how economic activities extend beyond their immediate impact, but the multiplier effect emphasizes cumulative income generation while the knock-on effect focuses on interconnected sectoral influences.

Differences Between Multiplier Effect and Knock-on Effect

The multiplier effect refers to the proportional increase in overall economic output resulting from an initial injection of spending, causing a chain reaction of increased consumption and investment. In contrast, the knock-on effect describes a series of indirect or secondary impacts arising from a primary event, often affecting related industries or sectors beyond the original activity. While the multiplier effect quantifies economic expansion through spending rounds, the knock-on effect emphasizes the broader ripple impact across interconnected markets or regions.

Economic Importance of the Multiplier Effect

The multiplier effect amplifies the initial spending impact in an economy by generating additional income and consumption, leading to a chain reaction of increased economic activity. This phenomenon is crucial for economic growth, as it fosters higher employment, boosts production, and enhances overall demand across various sectors. Unlike the knock-on effect, which refers broadly to secondary consequences, the multiplier effect specifically quantifies the economic expansion resulting from initial expenditures.

Real-world Examples of the Knock-on Effect

The knock-on effect refers to a chain reaction where an initial event triggers subsequent impacts across multiple sectors. For example, a disruption in semiconductor production can delay automobile manufacturing, causing reduced sales and layoffs in dealerships worldwide. Similarly, a natural disaster damaging key infrastructure leads to widespread supply chain interruptions, affecting industries from retail to food services.

Factors Influencing the Multiplier Effect

Factors influencing the multiplier effect include the marginal propensity to consume, the level of savings, and the degree of openness in an economy, which determines how much income is spent domestically versus imported. The knock-on effect differs by emphasizing sequential impacts across industries but is less focused on aggregate demand changes. Understanding these elements helps distinguish how initial spending amplifies economic output through varied channels and timeframes.

Short-term vs Long-term Impacts

The multiplier effect generates immediate economic gains by increasing income and consumption through initial spending, leading to short-term boosts in employment and production. The knock-on effect unfolds over the long term, as initial changes trigger secondary and tertiary impacts across interconnected sectors, fostering sustained growth and structural shifts in the economy. Short-term multiplier impacts emphasize rapid output expansion, while long-term knock-on effects drive innovation, investment, and systemic transformation.

Applications in Policy and Business

The multiplier effect quantifies how initial spending generates increased aggregate economic activity, crucial for policymakers designing fiscal stimulus programs to maximize economic growth. The knock-on effect illustrates the ripple impacts across sectors and supply chains, informing businesses about interdependencies and risk management in strategic planning. Both effects help optimize resource allocation and assess the broader implications of economic decisions in policy and corporate environments.

Measuring Multiplier and Knock-on Effects

Measuring multiplier effects involves quantifying the total economic impact generated by an initial injection of spending, typically using input-output models or Keynesian fiscal multipliers to estimate changes in output, income, and employment. Knock-on effects are assessed by tracking subsequent rounds of indirect and induced impacts within supply chains or related industries, often analyzed through detailed economic impact analysis and network tracing techniques. Accurate measurement requires distinguishing direct, indirect, and induced effects to reflect the full scope of economic ripple effects throughout different sectors.

Conclusion: Choosing the Right Perspective

Choosing the right perspective between the multiplier effect and the knock-on effect depends on the specific economic context and analytical goals. The multiplier effect quantifies the total increase in economic output resulting from an initial spending injection, highlighting the amplification in aggregate demand. The knock-on effect emphasizes the indirect, sequential impacts across related industries or sectors, useful for understanding supply chain dynamics and broader economic interdependencies.

Multiplier effect Infographic

libterm.com

libterm.com