BRICS economies, comprising Brazil, Russia, India, China, and South Africa, are key emerging markets driving global growth through diversification and increased geopolitical influence. Next Eleven economies, identified for their high potential to become significant players, include countries like Indonesia, Mexico, and Turkey, which offer promising investment opportunities due to rapid urbanization and economic reforms. Discover how these dynamic regions shape the future of the global economy and what it means for your financial strategies.

Table of Comparison

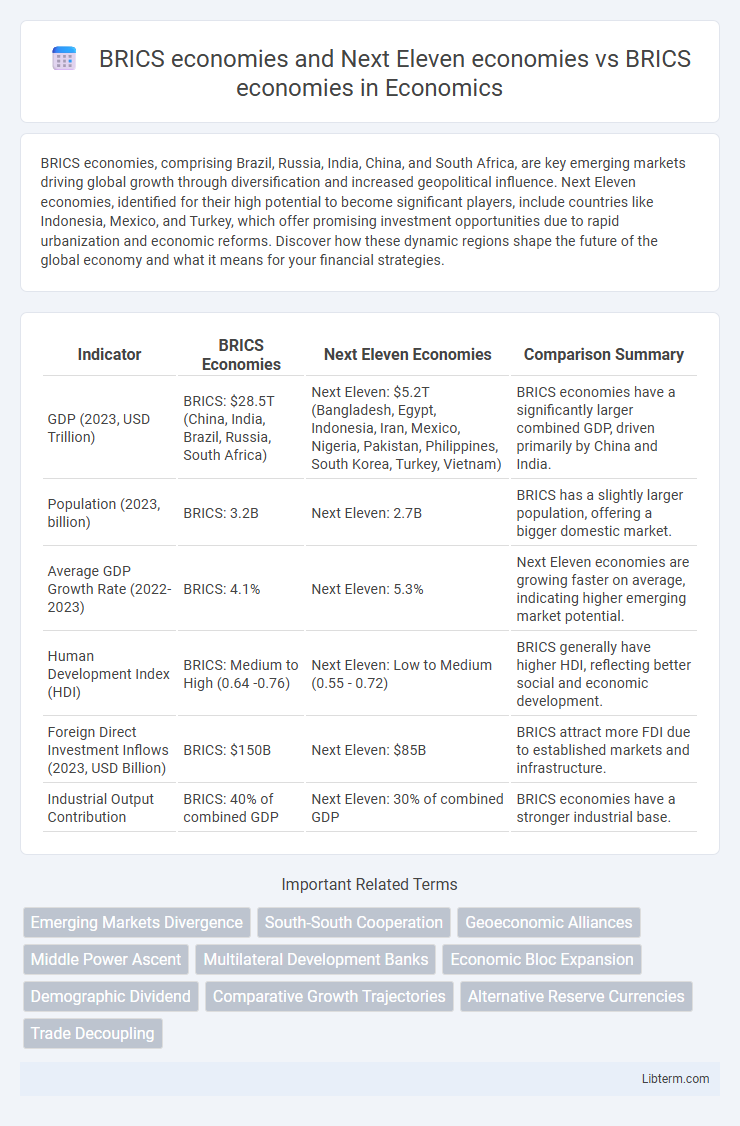

| Indicator | BRICS Economies | Next Eleven Economies | Comparison Summary |

|---|---|---|---|

| GDP (2023, USD Trillion) | BRICS: $28.5T (China, India, Brazil, Russia, South Africa) | Next Eleven: $5.2T (Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey, Vietnam) | BRICS economies have a significantly larger combined GDP, driven primarily by China and India. |

| Population (2023, billion) | BRICS: 3.2B | Next Eleven: 2.7B | BRICS has a slightly larger population, offering a bigger domestic market. |

| Average GDP Growth Rate (2022-2023) | BRICS: 4.1% | Next Eleven: 5.3% | Next Eleven economies are growing faster on average, indicating higher emerging market potential. |

| Human Development Index (HDI) | BRICS: Medium to High (0.64 -0.76) | Next Eleven: Low to Medium (0.55 - 0.72) | BRICS generally have higher HDI, reflecting better social and economic development. |

| Foreign Direct Investment Inflows (2023, USD Billion) | BRICS: $150B | Next Eleven: $85B | BRICS attract more FDI due to established markets and infrastructure. |

| Industrial Output Contribution | BRICS: 40% of combined GDP | Next Eleven: 30% of combined GDP | BRICS economies have a stronger industrial base. |

Introduction to BRICS Economies

BRICS economies--comprising Brazil, Russia, India, China, and South Africa--represent some of the fastest-growing emerging markets with significant influence in global trade, finance, and geopolitics. These countries are characterized by large populations, abundant natural resources, and rapid industrialization, contributing to their rising share in the global GDP. In comparison, the Next Eleven economies, identified by Goldman Sachs, include nations like South Korea, Indonesia, Mexico, and Nigeria, which are expected to achieve substantial economic growth but currently have smaller global economic footprints than BRICS.

Overview of Next Eleven (N-11) Economies

Next Eleven (N-11) economies, identified by Goldman Sachs, include Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, South Korea, Turkey, and Vietnam, poised for significant growth due to favorable demographics, rising urbanization, and economic reforms. These countries exhibit diverse development stages but collectively promise substantial contributions to global GDP and trade, potentially rivaling BRICS economies like Brazil, Russia, India, China, and South Africa. Key drivers for N-11 include expanding middle classes, improving infrastructure, and increasing foreign investment, which augment their roles in the shifting global economic landscape.

Economic Growth: BRICS vs. N-11

BRICS economies--comprising Brazil, Russia, India, China, and South Africa--exhibit robust economic growth driven by large domestic markets and significant natural resource endowments, with China and India leading in GDP expansion rates. Next Eleven (N-11) countries, including Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, South Korea, Turkey, and Vietnam, demonstrate high growth potential fueled by demographic dividends and increasing industrialization, yet they face varied economic volatility and structural challenges. While BRICS economies currently maintain higher aggregate GDP and investment inflows, N-11 nations are projected to sustain faster average GDP growth over the next decade, positioning them as emerging growth leaders in the global economy.

Trade and Investment Patterns

BRICS economies, consisting of Brazil, Russia, India, China, and South Africa, exhibit robust intra-group trade ties and attract significant foreign direct investment (FDI) due to their large markets and resource abundance. Next Eleven economies, including countries like Indonesia, Nigeria, and Turkey, show rapid growth potential but currently have more diversified trade partners and less concentrated FDI compared to BRICS. Trade between BRICS nations is heavily oriented toward manufacturing and natural resources, whereas Next Eleven economies often rely more on exports of raw materials and textiles, reflecting differing stages of industrialization and investment appeal.

Population and Market Potential Comparison

BRICS economies, consisting of Brazil, Russia, India, China, and South Africa, represent over 40% of the world's population and command significant market potential through their combined GDP exceeding $20 trillion. Next Eleven economies, including countries such as Indonesia, Nigeria, and Mexico, have a rapidly growing population base projected to surpass 1.7 billion by 2050, indicating substantial future consumer markets and labor force expansion. While BRICS currently dominates in market size and economic influence, Next Eleven nations offer higher demographic growth rates, signaling emerging opportunities for long-term investment and development.

Infrastructure and Development Challenges

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, face significant infrastructure gaps, particularly in transportation, energy, and urban development, limiting their growth despite sizable investments. Next Eleven (N-11) economies, identified for their potential to become major markets, often encounter more acute development challenges, including limited access to quality infrastructure, financing constraints, and weaker institutional frameworks compared to BRICS. Addressing these disparities requires targeted policies to enhance infrastructure efficiency and upgrade development capacities in both groups, with a focus on sustainable urbanization, digital connectivity, and energy access.

Political Influence on Global Stage

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, exert significant political influence on the global stage through strategic alliances, voting power in international organizations, and coordination in diplomatic initiatives. Next Eleven economies, including countries like Indonesia, Mexico, and Turkey, show emerging political clout but lag behind BRICS due to less cohesive representation and limited impact on global governance structures. BRICS' established political networks and consolidated economic strength enable stronger leverage in shaping international policies compared to the more fragmented and developing Next Eleven group.

Innovation and Technology Trends

BRICS economies, including Brazil, Russia, India, China, and South Africa, showcase significant advancements in innovation and technology with strong investments in AI, fintech, and green technologies. Next Eleven economies such as Indonesia, South Korea, and Turkey, while emerging, demonstrate rapid growth in digital infrastructure, startup ecosystems, and technology adoption rates, often outpacing BRICS in areas like mobile technology penetration and e-commerce innovation. Comparative analysis reveals BRICS lead in large-scale industrial innovation, whereas Next Eleven economies excel in agile technological adoption and digital entrepreneurial ventures.

Future Prospects: BRICS vs. N-11

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, are projected to maintain robust growth due to large markets, diverse natural resources, and increasing technological advancements. Next Eleven (N-11) countries, including nations like Nigeria, Pakistan, and Mexico, exhibit high potential for rapid economic expansion driven by demographic dividends and improving infrastructure but face challenges like political instability and weaker institutional frameworks. Future prospects for BRICS remain strong with established global influence, while N-11 economies could emerge as key players if they enhance governance, investment climates, and human capital development.

Conclusion and Strategic Implications

BRICS economies, comprising Brazil, Russia, India, China, and South Africa, continue to dominate global economic growth due to their large populations, abundant natural resources, and increasing industrial capabilities. Next Eleven economies, identified for their potential to join the ranks of major emerging markets, such as Bangladesh, Mexico, and Vietnam, offer diversified investment opportunities and rapid growth trajectories but lack the consolidated economic influence of BRICS. Strategically, integrating BRICS' established market power with the Next Eleven's dynamic growth can optimize global economic partnerships and enhance long-term development prospects for investors and policymakers.

BRICS economies and Next Eleven economies Infographic

libterm.com

libterm.com