Neoclassical economics focuses on the determination of goods, outputs, and income distributions through supply and demand in markets with rational agents maximizing utility and firms maximizing profits. It emphasizes equilibrium, marginalism, and the efficient allocation of resources under assumptions like perfect information and competition. Explore the rest of this article to understand how neoclassical economic principles impact your financial decisions and market behavior.

Table of Comparison

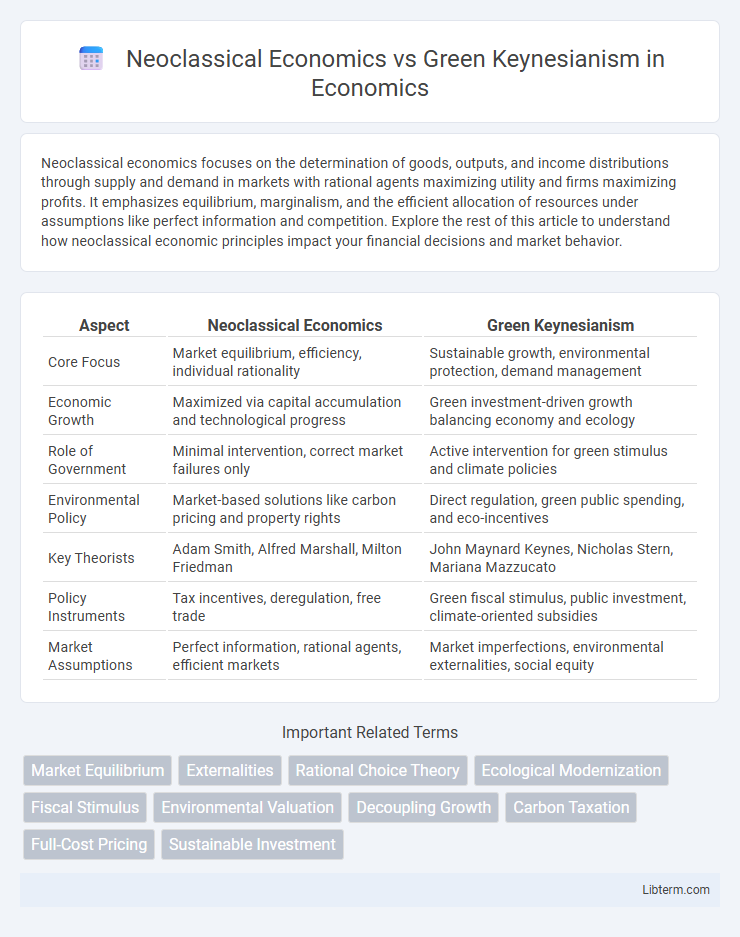

| Aspect | Neoclassical Economics | Green Keynesianism |

|---|---|---|

| Core Focus | Market equilibrium, efficiency, individual rationality | Sustainable growth, environmental protection, demand management |

| Economic Growth | Maximized via capital accumulation and technological progress | Green investment-driven growth balancing economy and ecology |

| Role of Government | Minimal intervention, correct market failures only | Active intervention for green stimulus and climate policies |

| Environmental Policy | Market-based solutions like carbon pricing and property rights | Direct regulation, green public spending, and eco-incentives |

| Key Theorists | Adam Smith, Alfred Marshall, Milton Friedman | John Maynard Keynes, Nicholas Stern, Mariana Mazzucato |

| Policy Instruments | Tax incentives, deregulation, free trade | Green fiscal stimulus, public investment, climate-oriented subsidies |

| Market Assumptions | Perfect information, rational agents, efficient markets | Market imperfections, environmental externalities, social equity |

Introduction to Neoclassical Economics and Green Keynesianism

Neoclassical economics emphasizes market equilibrium through supply and demand dynamics, relying on rational agents and price mechanisms to allocate resources efficiently. Green Keynesianism integrates environmental sustainability into Keynesian fiscal policies, advocating government intervention to stimulate green investments and drive eco-friendly economic growth. This approach challenges traditional neoclassical assumptions by prioritizing ecological limits alongside economic stability.

Historical Roots and Theoretical Foundations

Neoclassical economics emerged in the late 19th century, rooted in principles of rational choice, utility maximization, and market equilibrium established by economists like Alfred Marshall and Leon Walras. Green Keynesianism builds on John Maynard Keynes' 1930s theories of demand management but integrates environmental sustainability, emphasizing green investment and government intervention to address climate change and economic stability simultaneously. While neoclassical economics prioritizes market efficiency and individual decision-making, Green Keynesianism advances macroeconomic policies that balance growth with ecological limits and social equity.

Core Principles of Neoclassical Economics

Neoclassical economics centers on the principles of rational choice, utility maximization, and equilibrium markets, emphasizing individual decision-making and market efficiency under conditions of scarcity. It assumes that agents have perfect information, and prices adjust to balance supply and demand, leading to optimal resource allocation without external interventions. This framework contrasts with Green Keynesianism, which integrates environmental sustainability and active fiscal policies to address market failures and ecological constraints.

Fundamentals of Green Keynesianism

Green Keynesianism emphasizes the integration of environmental sustainability with economic policy, prioritizing government intervention to achieve green growth and reduce carbon emissions. Its fundamentals include large-scale public investments in renewable energy, green infrastructure, and social programs that support a just transition for displaced workers. This approach challenges neoclassical economics by addressing market failures in environmental externalities and promoting demand-driven recovery aligned with ecological limits.

Policy Approaches to Economic Growth

Neoclassical economics emphasizes market-driven growth, advocating for minimal government intervention, deregulation, and supply-side policies to enhance productivity and innovation. Green Keynesianism promotes active fiscal policies that integrate environmental sustainability with economic expansion, supporting green investments and stimulus spending to address climate change alongside growth. Policy approaches in Green Keynesianism prioritize renewable energy subsidies and carbon pricing, contrasting with Neoclassical reliance on market signals and technological advancements to drive long-term economic development.

Environmental Perspectives and Sustainability

Neoclassical Economics emphasizes market efficiency and often underestimates environmental externalities, prioritizing GDP growth without fully accounting for ecological degradation or resource depletion. Green Keynesianism integrates environmental sustainability into macroeconomic policies, promoting green investments and government intervention to achieve low-carbon development and address climate change. The latter approach aligns economic growth with ecological balance, advocating for sustainable resource use and environmental protection through fiscal measures and innovation incentives.

Treatment of Market Externalities

Neoclassical Economics addresses market externalities through mechanisms like internalizing costs via taxes or subsidies, emphasizing market efficiency and equilibrium. Green Keynesianism advocates for proactive governmental intervention to correct externalities by investing in green infrastructure and regulating pollution, prioritizing sustainable growth and environmental well-being. Both frameworks recognize externalities but differ in relying on market solutions versus policy-driven approaches for environmental challenges.

Government Intervention: Contrasts and Comparisons

Neoclassical economics advocates for minimal government intervention, emphasizing market efficiency driven by supply and demand dynamics, price signals, and rational individual behavior to achieve optimal resource allocation. In contrast, Green Keynesianism supports active government intervention through fiscal policies and public investments aimed at promoting sustainable economic growth and addressing environmental challenges. While neoclassical theory relies on market self-regulation, Green Keynesianism prioritizes strategic state involvement to correct market failures and foster green innovation.

Strengths and Critiques of Each Approach

Neoclassical economics emphasizes market efficiency and individual rationality, promoting minimal government intervention and relying on price mechanisms to allocate resources optimally, but it faces critiques for overlooking environmental externalities and social equity. Green Keynesianism integrates traditional Keynesian fiscal stimulus with sustainability goals, advocating for government-led investment in green infrastructure and renewable energy to drive economic growth and environmental protection, yet it is challenged by concerns over increased public debt and potential inefficiencies in government spending. Both approaches offer valuable insights: Neoclassical economics highlights efficient resource allocation, while Green Keynesianism stresses the importance of proactive environmental policies to address climate change and promote sustainable development.

Future Outlook: Merging Economics and Ecological Concerns

The future outlook of Neoclassical Economics versus Green Keynesianism centers on harmonizing economic growth with ecological sustainability by integrating environmental costs into market models and fiscal policies. Green Keynesianism advocates for government intervention to promote green investments and innovation, addressing climate change while supporting employment and demand. This emerging synthesis prioritizes resilience and sustainability, suggesting a paradigm shift towards inclusive growth that values natural capital alongside traditional economic metrics.

Neoclassical Economics Infographic

libterm.com

libterm.com