A managed float is an exchange rate system where a country's currency value is primarily determined by the foreign exchange market but with occasional government intervention to stabilize or influence the rate. Central banks may buy or sell their currency to prevent excessive volatility and maintain economic stability. Discover how this approach impacts your financial decisions and international trade by reading the full article.

Table of Comparison

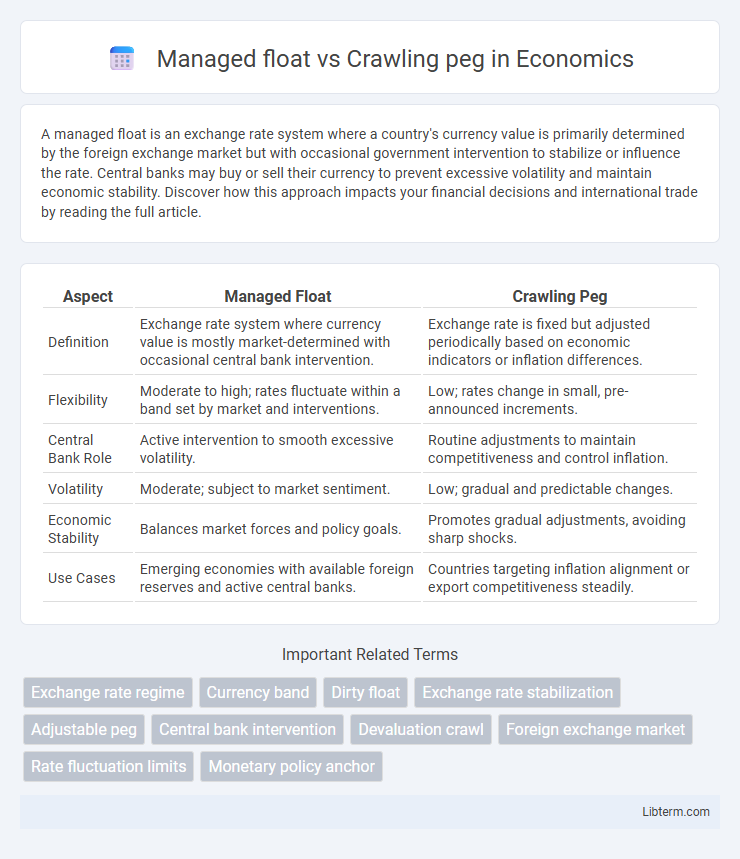

| Aspect | Managed Float | Crawling Peg |

|---|---|---|

| Definition | Exchange rate system where currency value is mostly market-determined with occasional central bank intervention. | Exchange rate is fixed but adjusted periodically based on economic indicators or inflation differences. |

| Flexibility | Moderate to high; rates fluctuate within a band set by market and interventions. | Low; rates change in small, pre-announced increments. |

| Central Bank Role | Active intervention to smooth excessive volatility. | Routine adjustments to maintain competitiveness and control inflation. |

| Volatility | Moderate; subject to market sentiment. | Low; gradual and predictable changes. |

| Economic Stability | Balances market forces and policy goals. | Promotes gradual adjustments, avoiding sharp shocks. |

| Use Cases | Emerging economies with available foreign reserves and active central banks. | Countries targeting inflation alignment or export competitiveness steadily. |

Introduction to Exchange Rate Regimes

Managed float exchange rate regimes allow currencies to fluctuate according to market forces with occasional central bank intervention to stabilize volatility. Crawling peg systems adjust the exchange rate at predetermined intervals or in response to specific indicators, providing a controlled and gradual alignment with economic fundamentals. Both regimes aim to balance exchange rate stability and flexibility to support trade competitiveness and inflation control.

Overview of Managed Float System

The managed float system, also known as a dirty float, allows currency exchange rates to fluctuate in response to market forces while central banks intervene occasionally to stabilize or steer the currency value within a desired range. Unlike the crawling peg, where the exchange rate is adjusted at a predetermined rate or intervals, the managed float provides greater flexibility to respond to economic conditions and external shocks. This hybrid approach balances market-driven currency movements with controlled interventions to prevent excessive volatility.

Understanding the Crawling Peg Mechanism

The crawling peg mechanism involves a currency exchange rate that is adjusted periodically at a predetermined or market-driven rate to avoid large fluctuations and maintain stability. Unlike a managed float, where currency value fluctuates within a controlled range influenced by market forces and occasional interventions, the crawling peg offers a transparent and systematic approach to incremental devaluation or revaluation. This method helps countries maintain competitiveness in international trade while managing inflationary pressures through predictable and gradual exchange rate adjustments.

Key Differences Between Managed Float and Crawling Peg

Managed float exchange rates fluctuate within a predetermined range set by the central bank, allowing for market-driven adjustments while the authority intervenes to prevent excessive volatility. Crawling peg systems adjust exchange rates incrementally at fixed intervals or in response to specific indicators, maintaining more predictable and gradual currency movements. The key difference lies in the managed float's flexible band system versus the crawling peg's systematic, rule-based periodic adjustments aimed at reducing shocks in foreign exchange markets.

Advantages of Managed Float

Managed float offers greater flexibility in exchange rate adjustments, allowing central banks to intervene selectively to stabilize currency values without committing to fixed targets. This system accommodates market-driven fluctuations while reducing volatility compared to free-floating regimes, thereby enhancing economic stability. It enables policymakers to respond swiftly to external shocks, promoting smoother trade and investment flows.

Benefits of Crawling Peg System

The crawling peg system offers enhanced exchange rate stability by allowing gradual and predictable adjustments, which helps reduce market uncertainty and inflationary pressures. This system facilitates better alignment with economic fundamentals and improves trade competitiveness by avoiding sudden currency shocks. It provides a controlled framework for monetary policy, balancing flexibility and stability compared to the managed float.

Risks and Challenges in Both Approaches

Managed float systems face risks such as increased market speculation and potential loss of monetary policy autonomy due to frequent interventions by central banks. Crawling peg regimes encounter challenges including exchange rate misalignment and vulnerability to sudden capital outflows as adjustments may lag behind economic fundamentals. Both approaches risk creating uncertainty for investors and traders, complicating effective forecasting and long-term planning.

Real-World Examples and Case Studies

The managed float system employed by India since 1994 allows the rupee to fluctuate within a controlled range, balancing market forces with central bank interventions to maintain stability amid volatile capital flows. In contrast, Chile's crawling peg mechanism, used extensively during the 1990s, adjusted the peso's fixed exchange rate incrementally to counter inflationary pressures and competitive imbalances, providing a predictable yet flexible framework for trade and investment. Both systems highlight strategies for emerging economies to manage exchange rates while preserving monetary policy autonomy and fostering economic growth.

Factors Influencing Regime Selection

Factors influencing the selection between managed float and crawling peg exchange rate regimes include economic stability, inflation rates, and capital flow volatility. Managed floats offer flexibility to adjust currency values in response to market forces, preferred by economies with moderate volatility and effective monetary policy frameworks. Crawling pegs suit countries aiming to control gradual currency depreciation while maintaining trade stability, especially where inflation rates are high or there is a need for predictable exchange rate adjustments.

Conclusion: Choosing the Right Exchange Rate Policy

Selecting the appropriate exchange rate policy depends on a country's economic stability and external vulnerabilities. Managed float systems offer flexibility to adjust currency values in response to market conditions, benefiting economies with moderate volatility. Crawling peg mechanisms provide gradual adjustments to maintain competitiveness and control inflation, ideal for countries seeking incremental stability without abrupt shifts.

Managed float Infographic

libterm.com

libterm.com