The General Equilibrium Model analyzes how supply and demand interact across multiple markets simultaneously, ensuring all markets reach a state of balance. It helps in understanding the interdependencies of economic agents and the effects of policy changes on the entire economy. Explore the rest of the article to deepen your understanding of this fundamental economic framework and its applications.

Table of Comparison

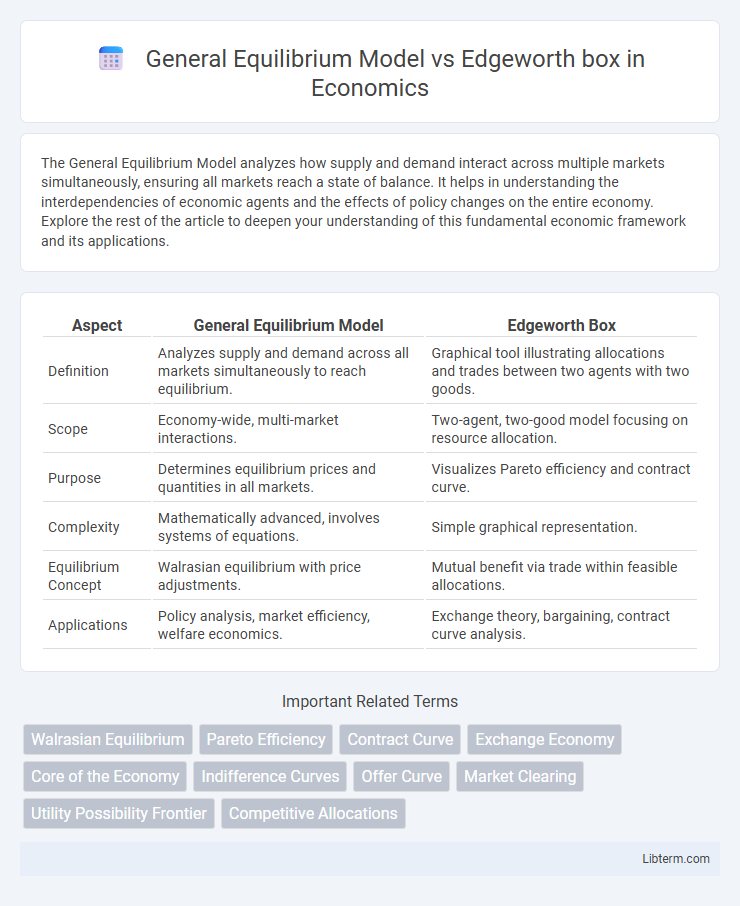

| Aspect | General Equilibrium Model | Edgeworth Box |

|---|---|---|

| Definition | Analyzes supply and demand across all markets simultaneously to reach equilibrium. | Graphical tool illustrating allocations and trades between two agents with two goods. |

| Scope | Economy-wide, multi-market interactions. | Two-agent, two-good model focusing on resource allocation. |

| Purpose | Determines equilibrium prices and quantities in all markets. | Visualizes Pareto efficiency and contract curve. |

| Complexity | Mathematically advanced, involves systems of equations. | Simple graphical representation. |

| Equilibrium Concept | Walrasian equilibrium with price adjustments. | Mutual benefit via trade within feasible allocations. |

| Applications | Policy analysis, market efficiency, welfare economics. | Exchange theory, bargaining, contract curve analysis. |

Introduction to General Equilibrium Models

General Equilibrium Models analyze the simultaneous interaction of multiple markets to determine prices and allocation of resources, providing a comprehensive framework for understanding economic equilibrium beyond partial equilibrium analysis. This approach incorporates all agents' behaviors and market-clearing conditions, capturing interdependencies among goods, factors of production, and agents' decisions. The Edgeworth box, by contrast, is a graphical tool illustrating allocation efficiency and contract curves in a two-agent, two-good exchange economy, often serving as a foundational concept for grasping core ideas in General Equilibrium Theory.

Understanding the Edgeworth Box

The Edgeworth Box is a graphical representation used to analyze the distribution of resources and trade between two agents within a fixed total endowment, highlighting feasible allocations that improve both parties' utility. In contrast, the General Equilibrium Model encompasses a broader framework incorporating multiple markets and agents, where prices adjust to achieve equilibrium across the entire economy. Understanding the Edgeworth Box aids in visualizing core concepts like Pareto optimality and voluntary exchange, which form foundational insights for the more complex General Equilibrium analysis.

Core Concepts: Efficiency and Allocation

The General Equilibrium Model analyzes the interaction of multiple markets to achieve an overall efficient allocation of resources where supply equals demand across all sectors simultaneously. The Edgeworth box focuses on the core concept of Pareto efficiency by illustrating how two agents can trade to reach an allocation where no one can be better off without making the other worse off. Both models emphasize optimal resource distribution, but the General Equilibrium Model captures economy-wide efficiency, while the Edgeworth box highlights bilateral trade efficiency and mutual gains from exchange.

Agents and Markets in General Equilibrium

The General Equilibrium Model analyzes multiple agents interacting across numerous markets simultaneously, capturing the interdependencies and equilibrium prices that clear all markets at once. Agents optimize their preferences and endowments, considering the full spectrum of goods and factor markets, leading to an equilibrium allocation of resources. In contrast, the Edgeworth box focuses on two agents and two goods, illustrating bilateral exchange and mutual gains without extending to a comprehensive market system.

Visualizing Exchange with the Edgeworth Box

The Edgeworth box offers a powerful visualization of exchange by depicting the allocations of two goods between two agents within a bounded space, clarifying the set of Pareto efficient allocations. In contrast, the General Equilibrium Model extends beyond dyadic exchanges to analyze multiple markets simultaneously, incorporating production, consumption, and price mechanisms in a broader economic context. Using the Edgeworth box, economists can intuitively visualize how agents negotiate and reach mutually beneficial trades, while the General Equilibrium framework mathematically formalizes the conditions for overall market equilibrium.

Mathematical Foundations of Both Models

General Equilibrium Models rely on systems of simultaneous equations representing supply and demand across multiple markets, using fixed-point theorems like Brouwer's or Kakutani's to prove existence of equilibrium. The Edgeworth Box utilizes geometric representation of two-agent, two-good exchange economies, emphasizing Pareto efficiency through contract curves derived from indifference curves and budget constraints. Both frameworks employ utility maximization and convexity assumptions but differ in dimensionality and mathematical tools: algebraic fixed-point methods versus graphical analysis in compact convex sets.

Comparing Assumptions and Limitations

The General Equilibrium Model assumes complete markets and perfect competition, providing a comprehensive framework for simultaneous analysis of multiple markets, while the Edgeworth box focuses on a two-agent, two-good exchange setting emphasizing voluntary trade and contract curves. The General Equilibrium Model's assumptions include perfect information and no externalities, limiting its applicability in real-world markets with frictions, whereas the Edgeworth box simplifies preferences and endowments, restricting analysis to bilateral exchanges and ignoring broader market interactions. Both models face limitations in addressing dynamic processes and market imperfections, but the General Equilibrium Model offers a broader scope despite more stringent assumptions.

Applications in Economic Theory

The General Equilibrium Model provides a comprehensive framework to analyze how supply and demand interact across multiple markets, allowing economists to understand the overall allocation of resources and efficiency in an economy. The Edgeworth box specifically illustrates the potential for mutually beneficial trade and Pareto optimality between two agents, often used to demonstrate core concepts in microeconomic theory such as contract curves and the distribution of goods. Both tools are essential in economic theory, with the General Equilibrium Model exploring broad market interactions and the Edgeworth box offering detailed insights into bilateral exchange and optimal allocations.

Advantages and Drawbacks of Each Model

The General Equilibrium Model offers a comprehensive framework for analyzing multiple markets simultaneously, capturing complex interdependencies and ensuring overall market balance, but it often relies on strong assumptions like perfect competition and may face computational challenges. The Edgeworth Box provides a clear, visual representation of two-agent exchange economies, facilitating intuitive understanding of Pareto efficiency and contract curves, yet its applicability is limited to simple two-good, two-agent contexts, restricting broader economic analysis. Both models serve distinct purposes: General Equilibrium for broad market analysis with a focus on systemic interactions, and Edgeworth Box for micro-level negotiations and trade-offs, highlighting efficiency and distribution.

Summary and Future Research Directions

The General Equilibrium Model provides a comprehensive framework for analyzing entire economies by examining the interactions and equilibrium across multiple markets simultaneously, whereas the Edgeworth box focuses specifically on the distribution and exchange of resources between two agents in a simplified, two-good model. Future research should explore integrating the granular insights of Edgeworth box bargaining solutions with multi-agent, multi-market General Equilibrium frameworks to better capture strategic behavior and market imperfections. Advancements in computational methods and behavioral economics can also enhance model realism, enabling the study of dynamic equilibria and policy impacts in more complex economic environments.

General Equilibrium Model Infographic

libterm.com

libterm.com